Economists spend a lot of time talking about comparative advantage: France has just the right climate and land to make great wine, for example. In the Industrial Revolution England had good quality coal in just the right place. Germany has a lot of good industrial workers and craftsmen.

Most comparative advantage, however, is cost advantage. If it’s cheaper and you can produce it for less, it’s hard to compete against you.

Absolute advantage is different. Absolute advantage is when you are the only one who sells something other people want or need. For most of the 20th century if you wanted commercial airplanes you could only get them from the US or Europe or Canada (until Canada’s aviation industry was mostly destroyed in the 50s under threat from the President of the US.) Cars were available from the West and the USSR, then from Japan and Korea. Most advanced medicines were made only by the West, though India came on strong for a lot of generics towards the end of the century.

Absolute advantage is far superior to comparative advantage: you can charge much more.

This is the second article on the West’s situation via China. If you haven, read the first “You can’t run industrial policy or a war economy under neoliberalism.”

Absolute advantage can be created. The rise of England didn’t start with the Industrial Revolution, it started when England banned exports of wool to the Netherlands. Be clear, English weavers sucked in comparison, but it didn’t matter. England produced most of the wool, and if you wanted woolens, you had no choice but to buy them England, inferior thought they were at the start, or do without.

This sort of policy used to be fairly standard. When I was young Canada would not export raw logs or raw salmon, for example, but by the 80s we had begun to do so. African nations have recently started insisting on doing primary processing in country: refine the ore or hydrocarbons, tin the fish, and so on. It’s not the same as advanced manufacturing, but it captures more of the value. If you have a resource there is more demand than supply for, you can insist. Perhaps tinning or smoking fish in the US or Mexico saved ten cents a can, but so what, before fish farming there was never enough salmon.

The problem with absolute advantage, though, is it makes you lazy. When you’re competing on comparative advantage, you have to drive down costs or increase quality, or ideally both. People don’t have to buy your goods, so they have to be better or cheaper.

Now the problem is that for about two centuries the West has had absolute advantage. For most intents and purposes everything we made had absolute advantage outside the West. We had better weapons, machines, clothes, medicines, transport. Everything.

Japan was the first non-Western nation to catch up, but an island nation without significant resources, it couldn’t compete and was conquered and made into a satrapy. South Korea was given the same treatment, and allowed to industrialize, as was Taiwan.

I was a young adult when Japan roared in the 80s, but Japan was never a serious threat, simply because it didn’t have enough population. It was never going to unseat the US or Europe, only claim its place in the (still) Western system.

China is a different matter. The reason China is eating the West’s lunch is that it has overcome most of our absolute advantage and is now competing with us on comparative advantage: Chinese goods are cheaper and in some cases, like EVs, Chinese goods are better. This often isn’t a small difference: you can buy an EV in China for 14K, and it’s a decent car.

Further, China has a massive domestic market. Oh, incomes are still not as high in the West, but the population makes up for it, and Chinese industries mostly aren’t oligopolies or monopolies. In 2019 there were over 500 EV companies. As of 2023 there were still about a hundred. The competition was fierce. There is nothing like it in the west, where car companies are essentially an oligopoly, and don’t truly compete on either price or quality.

China moved up the technological chain. They actually practice competitive market capitalism much more than we do: their markets are closer to “free” than any western country’s. They have effective subsidies due to the exchange rate and direct government intervention, of course, but that’s not the key issue any more (though it was for a long time), it’s that they are genuinely better at manufacturing than we are, and more responsive to what buyers actually want.

Many nations in the West used to have competitive internal markets, with a myriad of companies competing, but under neoliberalism, and to be fair to a certain extent under Bretton Woods liberalism, they were replaced by oligopolies. The problem with real competition is that you might lose. Fake competition is far safer, and offers far better returns for the ownership and executive classes.

Until, of course, you run into companies which are used to real competition, and they eat your lunch and you scream to the government for tariffs and trade war.

Mind you tariffs aren’t a bad idea, but if they are to work, Western companies must actually become competitive again and they don’t want to do that, it’s too much like work. Nor, as I’ve noted before, is it easy for them to do. Internal rent in the West is very high, and thus so is the cost of living. If they’re involved in a trade war, they have to sell to their own citizens, but the only way they know to reduce prices is to crush wages and if they do that, well, the internal market isn’t what it needs to be. (This is what FDR and Keynes realized, which is why New Deal and post-war capitalism emphasized having wages rising faster than inflation. It created a robust market.)

Offshoring anything another country doesn’t already know how to make is stupid, because when you offshore the locals learn how to make what you offshore and eventually they make it themselves for themselves and compete with you. “Friendshoring” can’t work, it can only crate new competitors with lower costs.

The days of the West’s absolute advantage are over. We threw it away for a few decades of high profits funneled to elites, and now we must learn to compete on comparative advantage again, something we mostly don’t have and aren’t used to being necessary.

It’s the bed we made and we have to lie in.

You get what you support. If you like my writing, please SUBSCRIBE OR DONATE

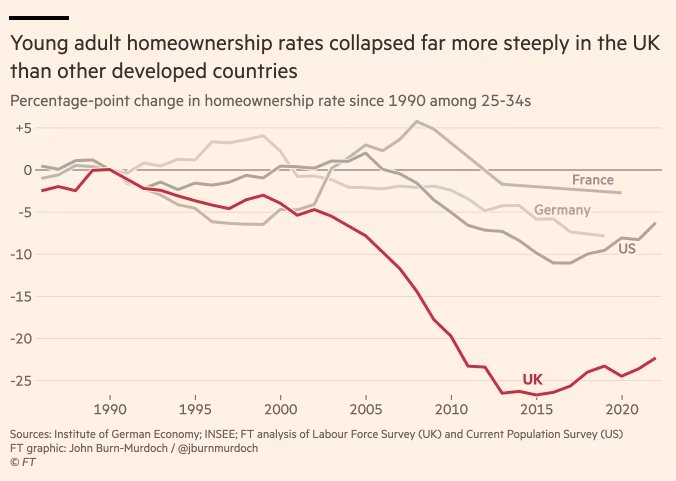

Ouch. I mean, it’s not like the situation is good in the US, is it?

Ouch. I mean, it’s not like the situation is good in the US, is it?

As for Biden, his claims to success are based on statistics that only a toddler or an economist would believe reflect reality, leaving aside the fact that he’s overseeing the loss of the US dollar as the primary trade currency, which will hurt the US worse than an Israeli shoving a red hot metal rod up a Palestinian civilian’s ass.

As for Biden, his claims to success are based on statistics that only a toddler or an economist would believe reflect reality, leaving aside the fact that he’s overseeing the loss of the US dollar as the primary trade currency, which will hurt the US worse than an Israeli shoving a red hot metal rod up a Palestinian civilian’s ass.