Only someone ignorant, stupid or on the payroll could deny climate change before 2023, but this is the year where to remain in denial you have to be 5-sigma stupid or on the payroll.

So, boys and girls, let’s look at some of the highlights of what will be one of the coldest years of the rest of your life.

Let’s start with Antarctic sea ice extent. Remember, this is during WINTER.

Yesterday, Antarctic sea ice extent hit a new record statistical low of -6.65σ below the 1991-2020 mean. About a 1-in-70B chance w/o climate change.

This is not a graph of extent or anomaly. It is a graph of standard deviations — a measure of how abnormal the year's data is. pic.twitter.com/CvnYLde9iD

— Prof. Eliot Jacobson (@EliotJacobson) July 29, 2023

For years I’ve said that marine inundation (sea level rises) would happen before most people expect it. And I’ll be right.

Next, we have more winter fun. 35 degrees celcius in Chile.

The winter heat wave has kicked off in South America.

Extraordinary heat in Chilean highlands of Atacama:35.0 Tranque Lautaro 1135m

34.5 Altar de la Virgen 1385m

32.0 Iglesia Colorada 1687mIn Argentina near 25C in Patagonia and >30C in Cordoba.

This is just the appetizer… pic.twitter.com/M2zwnOJUG2— Extreme Temperatures Around The World (@extremetemps) July 29, 2023

Well, that seems… bad.

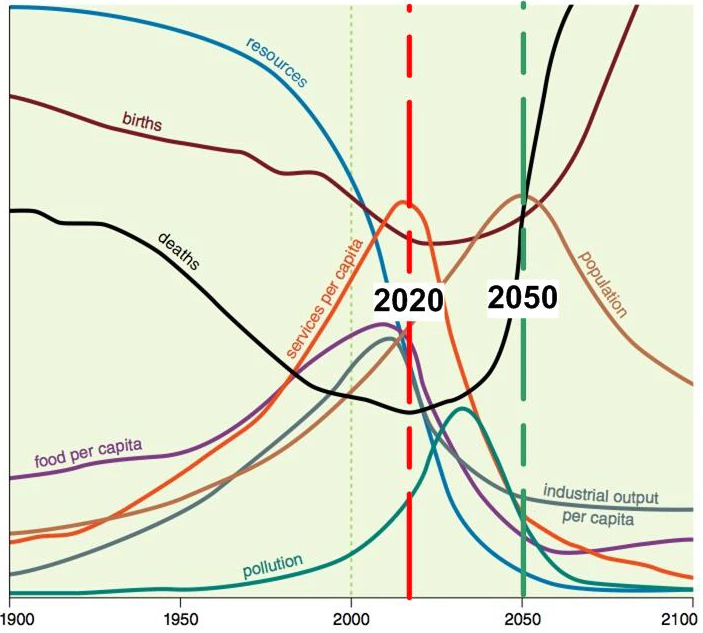

Now for the lovely long-term view:

What’s super about the aboe graph, is that I’ll lay you 4:1 it is over-optimistic. By a lot.

What’s super about the aboe graph, is that I’ll lay you 4:1 it is over-optimistic. By a lot.

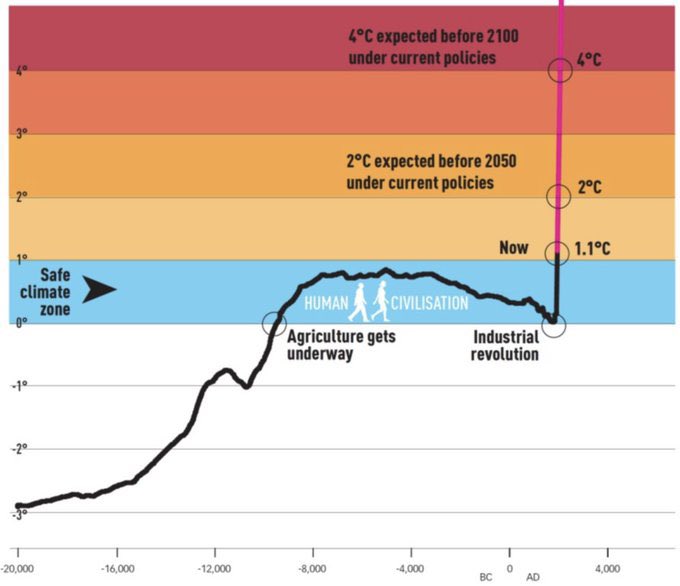

There’s a vast amount of delusion about how bad global warming will be. People talk about 1.5 C, or 2 C, or 3 C.

How about +10C as the equilibrium? This is from a pre-print, but it’s not unreasonable:

Equilibrium global warming for today’s GHG level is 10°C for our central estimate

Now, the guys who made the above estimate are on the gloom side and as they themselves say, blackballed, but everyone who’s been paying attention knows that essentially everything has been coming in sooner and worse than expected. Are you going to bet on the consensus forecasts made for politicians that have consistently under-estimated climate change?

Yeah.

Next we have Farmer’s Insurance leaving Florida. The time when home owners insurance won’t be available anywhere unless the government underwrites it is withing sight.

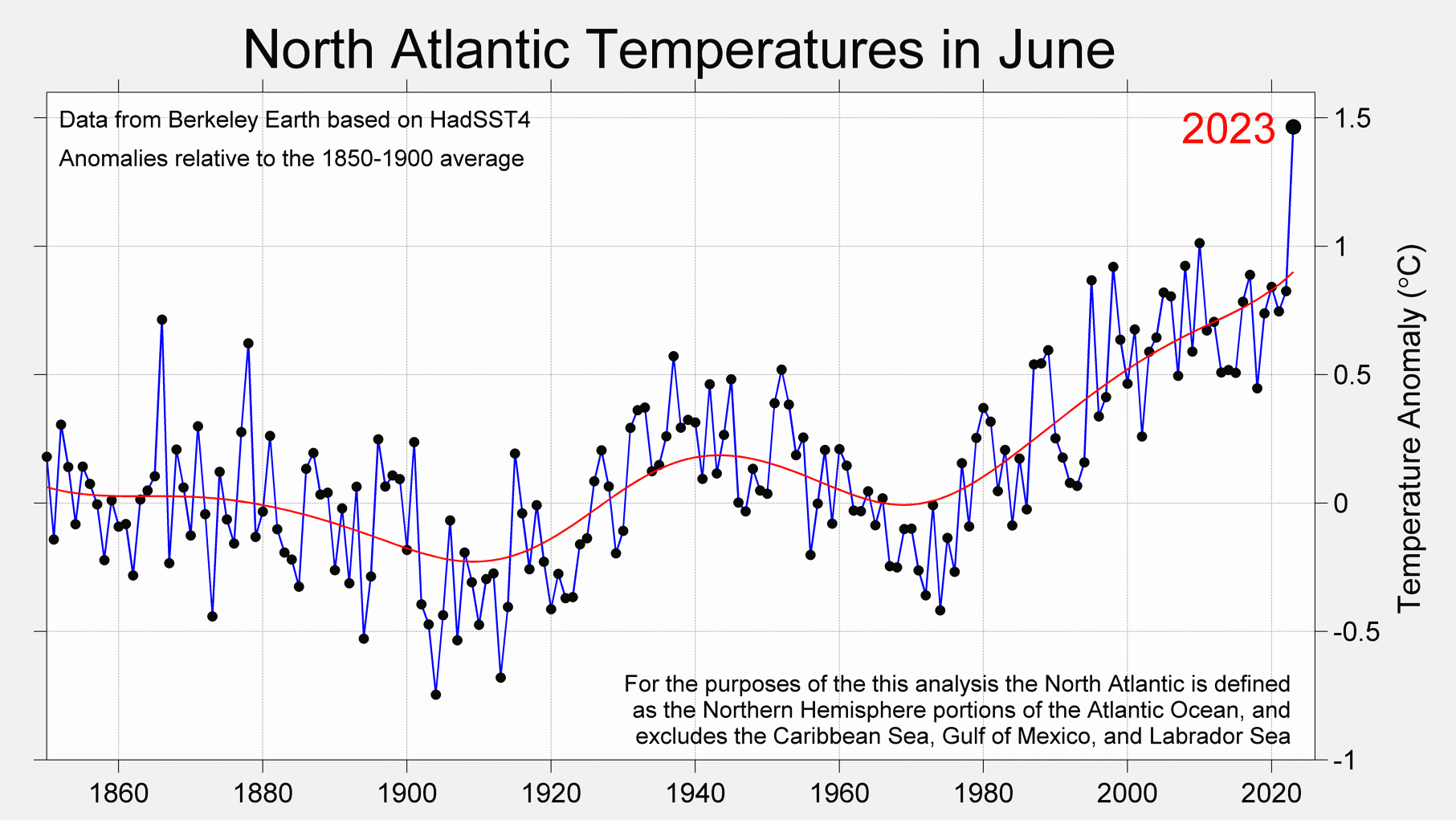

Ocean water is warming up. In the more tropical areas it’s destroying coral, but it’s damn impressive in the north, too:

Spain, July 7th.

Extraordinary heat event forecast next week for Spain. Widespread 43C-45C with 47C (116.6F) in numerous places currently being forecast. Records will fall. The heat will approach Spain's all-time record of 47.4C set in 2021. Brutal, deadly heat pic.twitter.com/XRgwPvv7HD

— Nate Bear (@NateB_Panic) July 7, 2023

My guess is that most of the Mediterranean area will not be inhabitable during the summer in ten to twenty years. If you don’t have air conditioning, you will die.

Then there’s the whole “jellyfish future”:

Oxygen levels in the world’s oceans have already dropped more than 2 per cent between 1960 and 2010, and they are expected to decline up to seven per cent below the 1960 level over the next century. Some patches are worse than others — the top of the northeast Pacific has lost more than 15 per cent of its oxygen. According to the Intergovernmental Panel on Climate Change’s 2019 special report on the oceans, from 1970 to 2010, the volume of “oxygen minimum zones” in the global oceans — where big fish can’t thrive but jellyfish can — increased by between three and eight per cent.

I for one welcome the ocean’s new Jellyfish overlords.

We’ll talk more about the implications of all this soon, including the implications for you personally.

This is a donor supported site, so if you value the writing, please DONATE or SUBSCRIBE