Starbucks sells expensive sugared drinks, and some of them have coffee in them. It’s been very profitable and despite some declines, remains so. The CEO was paid about $96 million last year. He was brought in to “turn Starbucks around”, and his main moves have been towards returning Starbucks to its roots as a “third place”, which is to say, somewhere other than work or home where people spend time.

Starbucks sells expensive sugared drinks, and some of them have coffee in them. It’s been very profitable and despite some declines, remains so. The CEO was paid about $96 million last year. He was brought in to “turn Starbucks around”, and his main moves have been towards returning Starbucks to its roots as a “third place”, which is to say, somewhere other than work or home where people spend time.

That’s a good idea, actually, because if all Starbucks sells is expensive drinks, which most people pick up, then it’s a lousy value proposition for consumers, especially for the mass of consumers who are seeing a lot of inflation and effectively decreasing wages. The average drink at Starbucks probably comes in around $5 and it’s easy to spend $7, and that’s just on the drink.

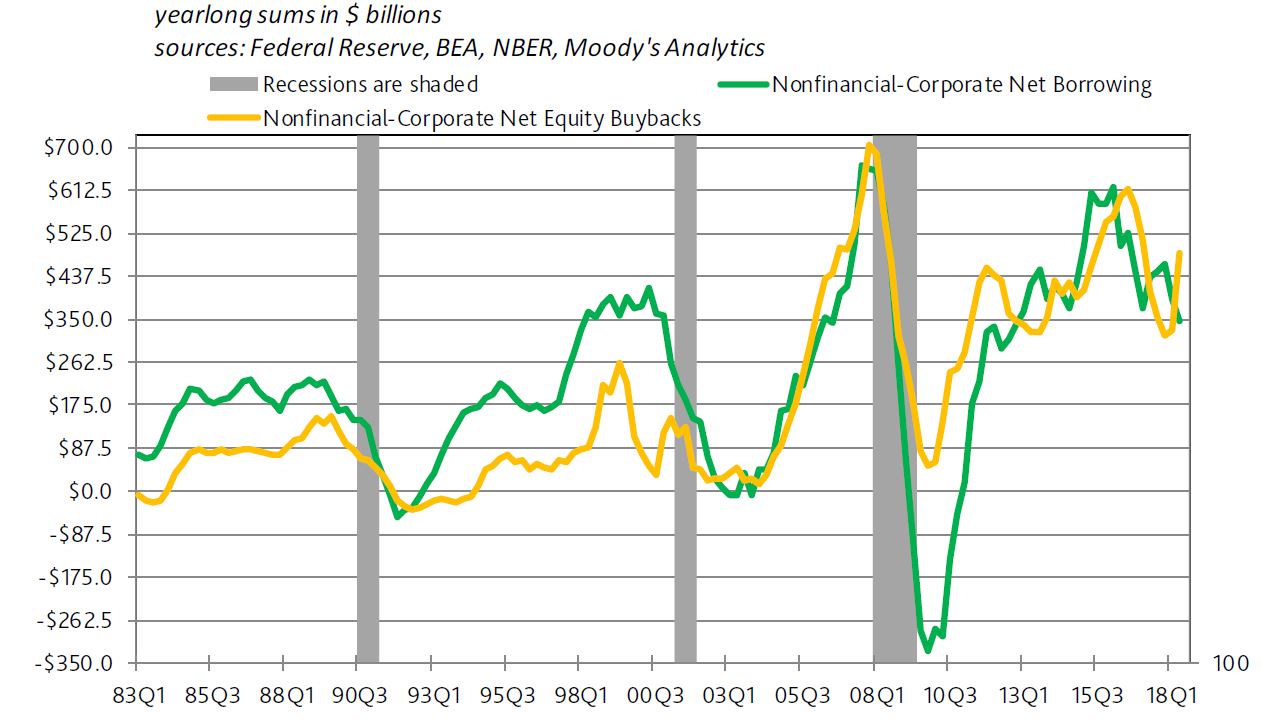

Now here’s the issue: American companies are most interested in profits. They want to make large net profits and pay their executives well, which they do by giving them stock options and in most cases juicing share prices by spending massive amounts on stock buybacks.

American companies are in the business of making whoever controls them rich. Sometimes they’re willing to make a long play and compete for market share, but generally ONLY if they think there’s a possibility of achieving a monopoly or oligopoly position. So there was tons of money for Uber & Lyft, because investors knew that in the end, they’d be able to reap monopoly profits, which they now are.

But in markets where there doesn’t seem to be that possibility, corporations are much less willing to compete aggressively for market share by beating the competitor on price. They prefer to compete in other ways: the third place, for example, or a product that is perceived as better and effectively “price clump”. If an upstart tries to break into an established industry they may briefly drop prices to keep them out, but that’s as far as they’ll go.

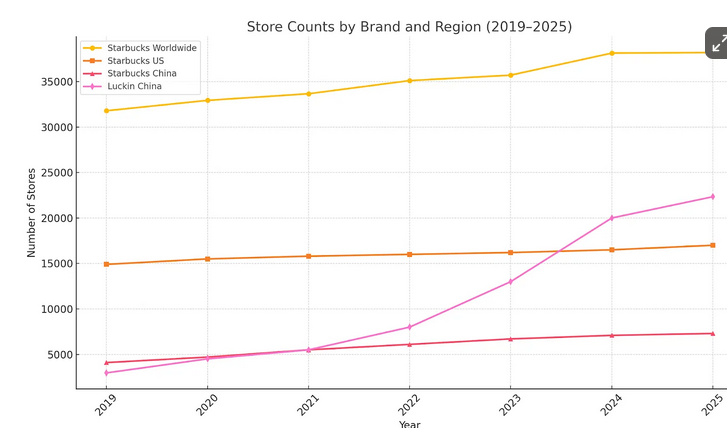

Now here’s the problem, Chinese companies compete aggressively for market share based on price. Starbucks used to be the #1 player in the Chinese coffee house market. Then they had their coffee drunk by an upstart named Luckin. Luckin is opening about 10x as many stores as Starbucks. It has 16,000 stores to Starbucks 7,000, and its drinks, which include fancy ones, are about 30% cheaper. Starbucks definitely makes more per store, but Luckin makes more gross. There’s no “third place” about Luckin, they’re kiosks, you order your drink, usually thru your phone (which offers constant discounts) and pick it up.

Because they have massive scale, their unit costs are low, and they benefit from the usual “no one can beat the Chinese at scale” advantage. (Though Starbucks could have done the same, they just wanted to be a more luxury brand and get the extra profits.)

Now Luckin has come to America. The drinks are cheaper and Starbucks does a lot of pick up business. If you’re just going to pick up a drink, why not go to the cheaper alternative, assuming the drinks are about as good? And unlike China, American consumers are squeezed big time. (China’s 2nd and 3rd tier city consumers are doing well, Beijing and Shanghai consumers are currently under pressure from the housing bubble being smashed, but should recover in the next year or two.)

For now Starbucks has more stores worldwide than Luckin. But their unit costs are higher even now. If Luckin keeps expanding, and especially expanding in the US and S.E. Asia, Luckin’s unit costs are likely to keep decreasing.

It’s hard to see how this doesn’t end badly for Starbucks, unless they get Congress or Trump to intervene. There’s momentum with Starbucks: people are used to going there and keep doing so. But if there’s something cheaper, that’s about as good?

If they compete on price, they lose a lot of their profit margins and investors are already squealing about the minor drops they’ve recently experienced. If they don’t compete on price, Americans who are price sensitive and don’t need “the third place” move to them, and they lose massive amounts of volume. There’s certainly a niche and a fairly large one for “buy a drink and stay at the coffee shop to enjoy it”, and I suspect it’s pretty profitable, but it’s smaller than what Starbucks is right now, and what’s to stop Luckin, after it wins the price sensitive customers from opening “Luckin Luxury Cafes” or somesuch, offering actual premium drinks and comfy chairs and tables and laptop charging, and using their unit cost advantage to out compete the “third place” Starbucks?

This is a specific case of a general rule: Chinese companies want scale and compete on price. They’re like American businesses in the 50s and 60s. They offer value and they aren’t trying to maximize profits by maximizing prices, because they’re used to an economy which has actual price competition.

I used to spend a lot of time in Starbucks, because they had stores in book shops, and I’d buy a coffee and read books for a few hours every day. I’d still be interested in that sort of thing and I have some emotional fondness for Starbucks because of what are, for me, good memories.

But it’s hard to be sanguine about their future. The third place stuff is fine, but if they want to survive, they’d better start competing on price while they still have a size advantage.

Most US companies are in a far worse situation: they’re already smaller than their Chinese equivalents. They can’t compete on price, it’s not possible, because they don’t have scale economies and can’t get them. As China catches up in quality and in many industries surpasses, they’re toast unless protected from Chinese competition, usually by law, geography or trade barriers. Businesses which aren’t, however, are about to experience what other countries experiences when Coke and McDonalds, in the 80s and 90s, came to town, or manufacturers experienced in the 50s and 60s before the rise of Japan.

Developing countries, with lower costs, have an ironic advantage when it comes to survival of many businesses. But high profit, high cost countries like America and most European ones?

Toast.

***

I appreciate everyone who donates or subscribes to keep this site (and Ian) running. Readership is up over 40% this year, and I’m very grateful. If you want to help the blog, please share the articles you like and if you can afford it, and like the content, please Subscribe or donate.