Sanders-021507-18335- 0004

All right, let’s get this out of the way: It’s better than the status quo.

But most credit card interest rates are about 20 percent or so, so this is about a five percent decrease.

Twenty percent is already insane. Given that banks have access to money, right now, at a little over 2.5 percent or so and have had it at less than one percent for most of the last ten years, it’s crazy low and would still leave them with a profit of 12.5 percent or so (minus administrative expenses).

That’s way more profit than anyone should earn for just lending money. Heck, it’s way more profit than almost anyone should earn for anything. Healthy economies have profit rates at no more than 5 percent or so, with profits for lending money less than those for actually doing things, a lot less.

So the interest rate cap for credit cards should be linked to the cost of the bank’s borrowing. Feeling generous to banks? Put it at four percent more than the Fed Funds rate. Remember that credit cards also charge merchant fees, which is how they make money off people who always pay their bills in free.

And any legislative act must count fees as part of the interest. Fees + interest charges are the actual interest rate of a card.

Lending money is the best business in the world to be in. Banks and other lenders, as the MMT people like to point out, don’t actually borrow money then lend it out, they create it out of thin air.

Any fool who can’t make a profit with the ability to create money out of thin air and lend it at four percent more than Fed Funds, shouldn’t be in the business–especially when they’re getting a fee for every purchase on the card.

When it’s easier to make money by lending than by doing, as well (which it is now, and has been for about 40 years) you don’t get as much actual new work, companies and innovation, because it’s safer and easier to just lend.

So being generous to banks and shadow banks is a recipe for economic stagnation. It also tends to push money towards the rich, because they are, after all, the people who can lend money (and borrow it cheap).

So, good first step on the part of AOC and Sanders, and it may be all they think it is possible to pass (much like the $15 minimum wage is inadequate and should have automatic yearly increases, but is still a good start), but it’s not enough. Not even close to enough.

The results of the work I do, like this article, are free, but food isn’t, so if you value my work, please DONATE or SUBSCRIBE.

Bruce Wilder

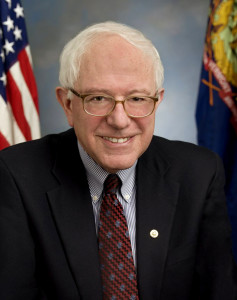

With Sanders, simply getting the idea that this is what politics can be about across is critical.

Of course, it starts a conversation about what the ceiling should be. Good conversation to be having.

Mike Barry

And it’s a (yes, modest) move in the right direction.

StewartM

The problem with our capitalist society is that handing the reins to the financial sector inevitably creates an economy where you make more money by lending or manipulating money than you make by doing real things–creating good and delivering real services. So I agree, you want to throttle profits in this sector, and discourage non-productive work, to force people into the harder task of creating better mousetraps.

Rd

“That’s way more profit than anyone should earn for just lending money”

isn’t that the result of socializing the losses and privatizing the profits? do they call that Capimunism? or some such thing?

These are just small pressure valves, like the universal payment plan, by the rubber barons of our time. keeps the folks HOPING. None of these people(sanders, et al) would do anything worthwhile, even if they wanted to. The establishment is way to powerful. The only other group with even more power, are all the ordinary folks. However, as long as they are divided/sleep, they will be ruled.

There are very many serious issues (ie environment) that should have been addressed yester year. However, the most significant issue are;

#1Reform the media – without it, this place is more like a banana republic, and most people will remain mis-informed, at best. And nothing else will ever get resolved.

#2 Bring back the draft,

#3 War tax.

These issues have the potential to wake up the people, otherwise, folks are sound sleep, and nothing will move enough masses to create any real change, for any other issue. The establishment, knows how to manipulate. And American people are no exception to the rest of human societies of the past, who prospered at some point, and then eventually fell sleep.

To wake up the public, need to start with #2 and 3. When folks are involved in “defending” the nation, they will wake up fast. Then #1 would be easier to accomplish. Just look at the Nixon era, the last liberal pres this country had, and all three issues were in play.

StewartM

Also, another consequence of handing the economy to the banksters is that they have a self-interest in starving incomes. Their ideal world is that everyone should have to come to them to borrow money for anything; higher wages mean that people need to borrow money less and need them less. Given this, is the wage decline of the past forty years a coincidence?

Ché Pasa

A hard cap on interest rates for credit means more restrictions on access to credit, no matter what the cap is. This may or may not be considered a good thing.

Right now, whole categories of people are unable to get credit and most of those who can get credit pay way too much interest, and contrary-wise they are paid nothing or next to nothing on bank deposits and savings. Many pay fees just to have a bank account at all.

It’s a wildly out of balance system. I don’t know that a hard cap on interest charged rebalances the system by itself. Many other reforms would be necessary.

Americans borrow as much as they do due to generations of flat or declining incomes. The cost of living continues to rise while incomes don’t. With relatively easy credit (albeit at a high cost) some of the gap can be made up for a while.

Raising income would have the effect of reducing need for credit, no? But then how do you ensure the finance sector and CEOs and such the amount of revenue they believe is their due?

It’s a mystery, isn’t it?

450.org

I agree, much of what AOC & Bernie & the so-called “Progressives” are proffering is too little, too late to include the Green New Deal. Wall Street is the money lenders and the money lenders must be eliminated if we are to strike at the root of the problem.

Capping interest rates isn’t striking at the root. It’s a bandaid, at best. The money lenders are clever and will find ways around any legislation if there is ever any regulating legislation (I highly doubt there ever will be) with teeth that gets passed into law.

Total interest is the result of two variables — time (length of loan term) and rate. There’s the principle too, of course, and let’s not pretend principle values (prices) aren’t at least partly determined by the availability of credit. The money lenders will merely increase the loan term in the event of capped rates. Hell, they’re already doing this. Car loans are now resembling mini mortgages. In ten years, at this rate of loan term lengthening, there will be 15 year car loans especially when you factor in the push towards ridiculously expensive electric vehicles. With compound interest, the total interest due & paid over the life of a 15 year loan versus a 5 year loan is smotheringly substantial.

Remember #OccupyWallStreet? I do, but apparently most people don’t as though it never happened. It’s as though it was the last gasp and because it was so utterly & miserably feckless and misdirected we now have Donald Trump at 1600 and in future we will have much much worse than Trump who has been effectively neutered & neutralized by those surrounding him who have allegedly saved him from himself and saved us from him if the Mueller Report is to be believed. That’s the one positive of the Mueller Report and no one talks about it. The Mueller Report is an official document that reveals the POTUS is only as powerful and effective as his/her handlers will allow him/her to be. Before the Mueller Report, this was always a secret hidden in plain sight for those who have eyes they use to see. Now, it’s no longer a secret. The Muller Report has officially announced the POTUS is a puppet on a string regardless of party.

Bill H

The discussion so far, in the post and comments, has omitted the factor of risk. Interest rates on high risk loans are higher than on loans which are more likely to be repaid.

450.org

Ah, yes, of course, risk. Because it makes total sense to charge a risky prospect 25% interest thus ensuring they could never and would never pay back the loan. It’s a contradiction. Charging exorbitant interest rates for risky prospects only serves as a self-fulfilling prophecy. The exorbitant rate ensures failure to repay thus it drastically increases the risk.

Donald Trump has always found a way to ride tsunami of debt despite being a failed business man many times over. Trump has lived like royalty his entire life on the dime of lenders. He will never pay back his debt and those who lend to him know it. His rate should be 100% and yet it’s not.

StewartM

Bill H.

The serfs having higher incomes means greater savings by them and reduces the risk factor. But no, the Masters of the Universe do not want this, even that would mitigate their risk. They’d rather starve wages so that the serfs have to come to them to borrow the money to buy groceries–they can deal with the risk.

The FDR economy–let alone a true socialist economy–is what creates the “ownership society”. What has happened under our increasingly pure capitalism is that the peons own NOTHING. Oh, they may buy a home, but they’re really maintaining it for the bank; then when the get old and sick they will have to get a reverse mortgage to give the home back to the bank–so it’s always the bank’s house. Likewise, instead of being able to save the money for car repairs and home repairs, they are now encouraged to buy insurance for it, because they can’t possibly save enough on their diminishing wages. Computers which they used to be able to fix themselves, and which could last for a decade, are being pushed aside in order to buy closed phones (software and hardware) which will have to be replaced every few years (and if you don’t, Apple will start slowing yours down!!). The Masters encourage people to lease rather than own cars, which is the expensive way to drive. And so forth.

Guest

It goes both ways. If you are too risky to be a profitable borrower at 15%, you shouldn’t be borrowing, you’re just digging yourself deeper. Such people may need a lot of things but access to credit isn’t one of them. If you want to help them then GIVE them help, don’t LEND it, that’s just stingy and not helpful at all.

And anyone lending to you at those rates is exploiting you, and more than likely they will leave some other idiot holding the bag when the borrower defaults, bundling loans and hiding the risk from investors, or cashing out and leaving the taxpayers to bail out the lender.

Also, if we had healthy wages, we’d ave a lot more inflation, which isn’t necessarily a bad thing depending on the cause, and 15% might not seem as absurdly high as it is now. It wasn’t that long ago that 6% mortgage rates were considered pretty good.

A better idea would be to cap the rate at CPI + X%.

StewartM

Guest:

Also, if we had healthy wages, we’d ave a lot more inflation

Not necessarily, if people are engaged in useful work. It is true that higher wages mean lower profits, and fewer people living off unearned income, but that’s a good thing, not bad. For Lincoln was right, it is labor, not sitting on your rear end trading securities, that creates wealth, so more people working means more wealth created. If the amount of wealth created keeps up with wages, prices stay stable.

The problem is our economy now has large swaths of people getting highly rewarded for doing nothing economically useful; and in the financial sector, doing so by adding money to the money supply, which is inflationary. There are countries with lower unemployment rates than ours which have no higher or even lower inflation.

450.org

The prosperity trap. “More wealth created” equals more growth equals more wasteful depletion of natural resources equals more pollution equals destruction of the habitat that enables and nurtures all life on the planet. Humanity has borrowed so much from and of the future, there is no future for humanity on this planet or any planet. When it’s all said and done, we will have been but a flash in the cosmic pan. If you blinked, you missed us on the cosmic scale.

StewartM

For better or worse, 450.org shows the lack of concern of the ‘hippie’ left for the poor of which I spoke of in the ‘hippes vs hard-hats’ war from the 1960s–and those poor includes a good many in the US and developed countries.

In fact, income equality is better for the environment too, even within the US.

https://grist.org/politics/inequality-isnt-just-bad-for-the-economy-its-toxic-for-the-environment/

Hugh

For background, in 1978, the Supreme Court held in Marquette National Bank of Minneapolis v First of Omaha Service Corporation that nationally chartered banks could charge nationally interest rates which were allowed in the state in which they were domiciled. This led banks to move to states which allowed high interest rates.

In 1980, Marquette was extended by Congress to more categories: savings banks, installment plans, and loan companies in the Depository Institutions Deregulation and Monetary Control Act.

In 1996, Marquette was extended again in Smiley v Citibank to remove state limits on credit card fees.

A post office bank would be one way to eliminate or minimize bank fees. We could also re-institute anti-usury laws, and make bankruptcies easier for ordinary Americans. Important to remember that it was Biden who championed screwing many of us by making bankruptcy harder on student and medical debt, all to the benefit of banks.

As others have noted, Trump is a poster child of a bad credit risk who nevertheless always has had access to credit. A much larger example of this occurred following the 2008 financial meltdown. Banks which had engaged in the biggest financial frauds in human history got trillions from the Fed at zero percent interest. They used this money to juice the real estate markets to cover up what would otherwise have been worthless loans and collateral. They used it to juice stock markets to increase their own market valuations. And they could, actually were required, to deposit some of it back at the Fed for which the Fed paid them billions in interest. All this violated what Bagehot, who literally wrote the book (Lombard Street) on financial crises, had laid out. His rule was in a financial crisis you make credit available, but at punitive rates. This forces the really bad actors to go belly up, and administers a costly lesson to other participants to avoid similar behavior in the future. None of this was done. In fact, the exact opposite.

No one knows what the 2008 financial meltdown really cost. The Fed only released data on its emergency programs. Rule of thumb decreases in GDP start at one year lost or around $18 trillion. As I say, start. If Bush/Paulson and Obama/Geithner had chosen to bail out ordinary Americans, instead of the rich and the banks, they could have underwritten all the suspect mortgages for about $5 trillion, or actually less since many of these were still performing.

450.org

Stewart, the answer to climate change and the destruction of the biosphere isn’t a pony for everyone versus billions of ponies for a few. It’s no ponies for anyone. It’s crafting an economy based on contraction to a steady state and certainly equality should be at the center of that balanced equation.

Look what the extension of credit has done to a college education. It’s cheapened the quality of said education whilst exponentially increasing the cost of that cheapened education by making it effectively mandatory that everyone must have a college education if they want to survive in the “modern” economy. Easily-obtained student loans have made debt slaves of students before they ever receive their diplomas let alone a job that may never come and certainly not a job that will help them pay back that money any time soon.

As a result of easy credit, the cost of a college education has skyrocketed to the point we now have a student loan bubble just as we have a car loan bubble. We abound in various credit bubbles competing with one another as to which one will have the largest bang when it finally bursts.

Granting a free college education to EVERYONE only serves to further increase the cost of an education and as we all know, nothing is truly free. Someone is paying for it and when you throw government money at anything without proper accounting for it, it will be wasted and grifted. Colleges will spend the money on redundant administration and unnecessary buildings as they have been doing for the past two decades at least, amidst the student loan bubble.

Everyone doesn’t need to have a college education. Some people, many people even, are not college material. This doesn’t mean they’re any less worthy or equal, it just means their strengths lay elsewhere.

This is all rendered moot though if we don’t address the root of the issue as it relates to our environment and the root is growth and Wall Street is the enabler and defender of growth. Growth is what ails us. Arguing for and demanding the redistribution of that growth more equally does not change the very basic and pertinent fact that growth is the root of the problem and if we are to solve the problem and ameliorate at least some of its inevitable destructive implications, we must accept this most basic fact, otherwise we’re just burying our collective heads in the sand and avoiding accountability and responsibility.

Fyi, I’m not a hippie. My hair is actually rather short. But I do have a beard.

Please, everyone, I implore you to read this article. It’s the best analysis on the topic I’ve ever encountered. AOC & Bernie and the “Progressives” need to, or needed to, use this as the cornerstone of their Green New Deal. A Green New Deal or any Green Deal that does not address this is dead in the water and will be largely feckless.

Exponential Economist Meets Finite Physicist

Here’s the epilogue but please read the article and all the articles at that link related to our unsustainable & destructive growth economy.

Bill H

It’s interesting how much of the discussion revolves around a basic principle that people and/or companies that lend money do not deserve to get that money back. A loan should be “forgiven” because the borrower did not get the job he/she expected to get, for instance, and the lender should just accept the loss of the money that was lent.

If that is the case, why should they lend it?

@450.org

“Because it makes total sense to charge a risky prospect 25% interest thus ensuring…”

Interest serves two purposes – profit and buffer against risk. What the latter means is that the interest received from people who do pay loans is not pure profit. It also serves to offset loss of money lent to people who don’t pay loans. The more high risk people to whom you lend, the higher the interest needs to be to provide that offset.

Willy

There’s normal business risk and profit, and then there is loan sharking and price gouging. What does a society do when the needle get buried in the red, “legally”?

Of late, corporations and industry sectors have come to dominate national politics via their crony lobby networks, increasingly making rule of law work only in their favor. As is said here often, in America, that bastion of competitive capitalism, this has gotten so bad they’re no longer a truly competitive capitalism. This doesn’t even meet Milton Friedman’s ruthless business standards.

Ian Welsh

When you make a loan, you make a bet on whether the person who takes the loan can pay back. It’s that simple.

Lose the bet, lose the money.

Going bankrupt, even when bankruptcy laws are generous, like they are for business bankruptcies, isn’t pleasant.

I used to work in an underwriting department. One of the things the underwriters checked was whether or not the purchaser could reasonably afford to make payments. If they were applying for more than we thought they could pay back, we declined them (or told them to ask for less.)

Both borrowers and lenders have responsibilities.

But, as is understood in business bankruptcy, if someone really can’t pay, lenders need to take their goddamn losses.

And choose who to lend to better next time. People who lend to Donald Trump, for example, deserve to lose their money.

bruce wilder

@ Bill H

And, the higher the interest rate you charge, the harder it is for the people you lend to, to pay off the loan. There is a sweet spot there for payday lenders, credit cards, student loan servicers and others to charge enough interest that the lender never loses, but the borrower is reduced to straitened circumstances and is able to escape debt only rarely and after paying a large multiple of the original loan.

Financialization can create an ecosystem that drives up the cost of services that people need to borrow in order to access. Student loans were a model for this. It has been extended in the U.S. to dentistry and veterinary services.

A ceiling on interest is a simple, bright-line legal remedy for usury. It cuts off a lot of predatory lending.

I agree with Ian though: an effective ceiling in a low-inflation or deflationary environment could be and should be much lower.

The effect of a ceiling on interest rates is to place a greater burden of responsibility on lenders to actively ascertain the credit-worthiness of potential borrowers. In a healthy financial system, this kind of due diligence and policing of fraud is a socially valuable function of the banking system.

It could noted that a ceiling on interest rates is not sufficient to create a fair or efficient financial system. The ascertaining of credit-risk is not an economic function that scales well. The use of algorithms and “credit scores” in place of human judgment enables enormous concentration of power and wealth in giant institutions that are incubators for criminal tax evasion and fraud, institutions that are designed to force the state to bail them out and defer prosecution of financial crime.

Giant bank holding companies have been very effective at unbanking the poor, forcing them to turn to payday lenders and the like, while buying off the more comfortable classes with free services and promises of “cash back” from using their credit cards.

different clue

If such a bill could be passed into law over Presidential Veto, that would show that such a thing is possible. If it became clear that such a law didn’t solve any problems, people would at least be emboldened to believe that the right laws done the right way could solve problems. They would at least be heartened to try.

So a victory on this one would be an important morale-building excercise for the political mortal combat to the death to come over this and other problems.

By the way, if the Biden Creature somehow gets itself elected President, it will veto any and every such law. The Biden Creature’s Prime Directive was always backing banks and credit card companies against their target populations.

I don’t worry about that, though. If Election 2020 pits Trashy Trump against Catfood Joe; Trashy will win 40 states.