Sanders-021507-18335- 0004

All right, let’s get this out of the way: It’s better than the status quo.

But most credit card interest rates are about 20 percent or so, so this is about a five percent decrease.

Twenty percent is already insane. Given that banks have access to money, right now, at a little over 2.5 percent or so and have had it at less than one percent for most of the last ten years, it’s crazy low and would still leave them with a profit of 12.5 percent or so (minus administrative expenses).

That’s way more profit than anyone should earn for just lending money. Heck, it’s way more profit than almost anyone should earn for anything. Healthy economies have profit rates at no more than 5 percent or so, with profits for lending money less than those for actually doing things, a lot less.

So the interest rate cap for credit cards should be linked to the cost of the bank’s borrowing. Feeling generous to banks? Put it at four percent more than the Fed Funds rate. Remember that credit cards also charge merchant fees, which is how they make money off people who always pay their bills in free.

And any legislative act must count fees as part of the interest. Fees + interest charges are the actual interest rate of a card.

Lending money is the best business in the world to be in. Banks and other lenders, as the MMT people like to point out, don’t actually borrow money then lend it out, they create it out of thin air.

Any fool who can’t make a profit with the ability to create money out of thin air and lend it at four percent more than Fed Funds, shouldn’t be in the business–especially when they’re getting a fee for every purchase on the card.

When it’s easier to make money by lending than by doing, as well (which it is now, and has been for about 40 years) you don’t get as much actual new work, companies and innovation, because it’s safer and easier to just lend.

So being generous to banks and shadow banks is a recipe for economic stagnation. It also tends to push money towards the rich, because they are, after all, the people who can lend money (and borrow it cheap).

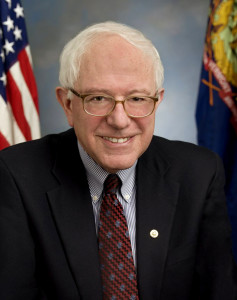

So, good first step on the part of AOC and Sanders, and it may be all they think it is possible to pass (much like the $15 minimum wage is inadequate and should have automatic yearly increases, but is still a good start), but it’s not enough. Not even close to enough.

The results of the work I do, like this article, are free, but food isn’t, so if you value my work, please DONATE or SUBSCRIBE.