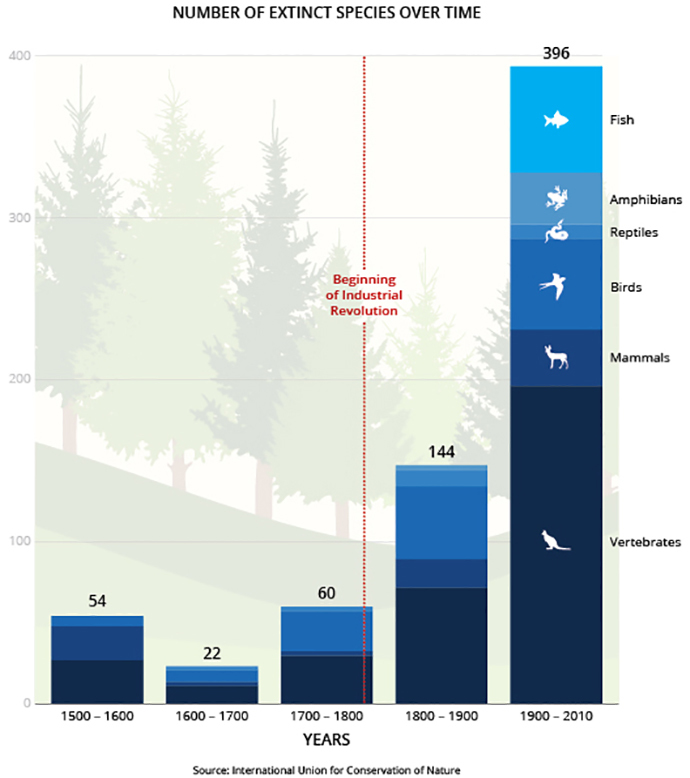

So, a very conservative study on the rate of species going extinct has come up with the following:

One hundred and fourteen times faster than the normal background rate.

“If it is allowed to continue, life would take many millions of years to recover, and our species itself would likely disappear early on,” lead author Gerardo Ceballos of the Universidad Autonoma de Mexico said…

Cheerful.

This is the point where a sane species would be in a controlled panic.

Which brings us to Laudato Si. The obvious issue with Luadato Si is Pope Francis sticking to current church doctrine against birth control. It is incontrovertible that every person has a carrying load for the planet.

But Francis makes a great number of good points, starting with the fact that we are vastly wasteful. It is not that we have necessarily surpassed the Earth’s carrying capacity in theory (only in fact). Half the food in America, for example, is wasted. Suburbs are vastly wasteful. Lawns are idiocy. Most of our buildings use far more energy than they need to. Improved agricultural methods can produce up to ten times as much produce on the same amount of land, for less water. Urban indoor agriculture using LEDs is showing great promise. Centralized manufacturing, which requires concentrated power which cannot yet be provided by renewables could be decentralized even with out current tech, and within fifteen years or so we could radically decentralize it.

And so on. There are more good ideas than one could possibly list. These ideas would allow us to support our current population on much less land and allow the environment to renew itself. We could massively reduce carbon output at the same time, stop overfishing the seas, and everyone would still be fed, have a place to live, and so on. Yes, most suburbs would be a thing of the past, but the question of “suburbs” vs. “human survival” shouldn’t be a hard one.

All of this would probably not be enough.

Yeah, sorry.

We’ve left it too late. The issue is the carbon and other hothouse gases already in the environment. They are so high that we will see release of methane from the arctic, both land and sea. This has already begun. It will continue. Even entirely stopping carbon tomorrow (which is impossible) likely wouldn’t be enough. Cutting carbon by half would definitely not be enough.

We needed to be acting back in the 1980s when climate change science first became overwhelmingly likely to be true.

We didn’t. An alien species studying our extinction, should it come to that, will only be able to conclude we did it to ourselves.

What I’m seeing is that we are on the wrong side of a self-reinforcing cycle.

We’re going to need geo-engineering. It’s messy and we’ll probably screw it up, but we don’t have much choice left.

Because there is a chance that even doing everything right, we’ll still go extinct (especially if we bork the oxygen cycle, a non-zero possibility), we need to be crashing biospheres. We’ve never made biospheres work before; we cannot create artificial environments cut off from the world which work. We need to.

That understanding will be very useful in any scenario–from cleanup of major, but not catastrophic, environmental damage, to triage on a crashing ecosystem, to saving a breeding population in a world which no longer supports humans.

A sane humanity, who self-governed in ways that made sense, and which was concerned with the welfare of their children, would have headed off most of this. A not-completely-insane humanity who had failed to take action before would now be making this the highest world priority.

We are doing neither.

Instead, our best and brightest are figuring out the best possible ways to serve ads, creating the most impressive mass-surveillance system the world has ever seen, and playing leveraged financial games which are resulting in austerity for much of the world. Destroying the human resources which we should be using to save ourselves (and so many other species, who have done nothing to “deserve” their extinction).

One can argue, and many will, that this is entirely the fault of our rulers. Maybe, maybe not, but it won’t matter when we’re all dead, and I’m not seeing widespread revolts because of mismanagement. And hey, if worse comes to worst, and enclaves are set up to save a small breeding population, remember, it’s the “leaders” who did most of the damage who will get into them.

You won’t. Your children won’t. You live or die with saving the Earth.

Probably you die.

But, then, most people probably figure they’ll die before the environmental collapse gets them. If they’re at least middle-aged, they’ll probably win that bet.

Their kids won’t. Too bad for them. Loved them enough to do everything except save their lives from a completely predictable threat.

If you enjoyed this article, and want me to write more, please DONATE or SUBSCRIBE.