Ok. Enough.

I’ve been walking people through what’s happening, what it means, etc. in Greece now for a while, with an able assist from Mandos and commenters.

Let’s cut the crap. Merkel has come back and said that Germany will not allow debt reduction and insists on austerity—and harsh austerity, worse than the last offer. She is backed by most EU members and the European Central Bank, which has put the screws into Greece so hard that imports are piling up on docks because Greece can’t pay for them.

ENOUGH.

Syriza needs to get its act together. The Euro is a stupid idea, and it always was. It cannot work absent central fiscal policy (aka, national governments reduced to de-facto provinces). It does not allow governments the ability to devalue their currency when they need to increase exports, to print money, and so on.

It cannot work. It never could, as designed. It was always a stupid idea. (And yes, I opposed it from the beginning.)

Oh, it could be fudged. They could forgive Greece’s debt (but then would have been expected to forgive a bunch of other countries some of their debt), and money could be funneled to Greece in various ways and so on. But that can’t be done because of neo-liberal doctrine, which insists that debts are sacred and that creditors must never lose money, which is ludicrous and a direct violation of how capitalism works. People who make bad loans MUST lose their money. Without that, it isn’t capitalism and the virtues of capitalism don’t work.

This is not in question. This distribution of money to people who know how to make a profit and not lose it (and thus make “Productive” use of it), is about three-quarters of the pragmatic argument for capitalism.

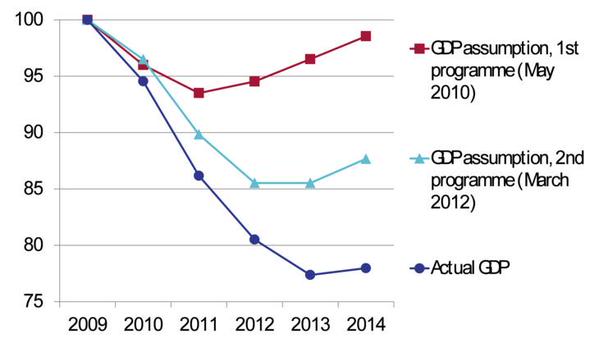

Austerity is beyond stupid: In order to fix the economy, you reduce gross expenditures and expect that tax incomes will increase faster than deficits and the economy will grow as a result. It is so dribblingly inane on its own merits that anyone who believes it either hasn’t spent three seconds thinking, is an ideologue incapable of thought, or is on the take, expecting that the benefits of austerity will flow to them.

The Euro is moronic as implemented. Austerity does not do what it is sold to do. And neoliberalism does only one thing more effectively than other forms of capitalism (those which actually work): It transfers money to the rich faster.

Syriza needs to leave the Euro. They are not going to get a good deal, or even a mediocre deal from Europe. They will be better off leaving the Euro. If they do so, they should simply repudiate all debts.

Yes, all of them. Once they leave the Euro, Europe and the neoliberal order will go all out to crush them. It does not matter what they do, they will be target number one.

They should then cut a deal with Russia for oil and a pipeline, and align solidly with Russia and China, asking for aid from those two countries.

They should cease any attempts to stop refugees from flooding out of Greece into the rest of Europe. Heck, put them on buses and ship them to the border.

They should nationalize the distribution of food grown in Greece. Greece grows enough food; just start delivering it to every household. Saddam did this effectively, Greece can too.

That takes care of oil and food (Greece has plenty of refinery capacity).

Medicine is the next issue; Greece will have to arrange to get the meds it needs through Russia and China.

There are other details, but mainly Greece should do everything it can short of leaving the EU (not the Euro, the EU) or going to war to make Europe’s life miserable. Why? Because then they have something to negotiate with.

There are those who will say this escalating, blah, blah, blah.

Yes, it is. The path of capitulation, down which even Syriza was plodding (the deals they were willing to sign were terrible and would have kept Greece in depression for the foreseeable future) did not work. It is time for Greeks take their own future in their hands and be bold.

“Europe” doesn’t want them. Fuck Europe. A Europe which has turned its back on the foremost modern Greek virtue, Democracy, is not a Europe worth bothering with. Greece and the Greeks should regard themselves as what is left of the true Europe (along with Iceland), sneer down their noses at the barbarian Eurpeans and embrace and trust themselves.

Why? Well, because frankly, they don’t have anyone else.

The current world order is breaking up anyway. Russia, China, and various other nations hate how it is run, and they are moving to destroy the credit/banking gridlock which is the real power of the West. Yes, it would be nice if Greece didn’t have to be one of the first into the breach. But, at this point, every other option is worse.

As for the European leaders insisting on this course of events, and they are insisting, they will be seen as those who destroyed the Euro. Their treatment of Greece is a clear lesson to everyone else in Europe that the Euro does not and cannot work. The moment a country gets into serious trouble (and that time will always come), Europe is not flexible enough to do what needs to be done. The current pols, who are complicit in the crimes of austerity and neoliberalism cannot run against Europe, but they will be replaced, in time, by those who will.

Greece’s situation has been a completely unnecessary mistake and a crime. The amount of money involved is trivial. Simply following basic, capitalist ideology (lenders lose their money if they lend to people who can’t repay) would have solved the situation five years ago. If they’d behaved like slightly decent and competent technocrats, they could have easily solved the crisis and bailed out private investors in any number of ways, while still allowing the Euro and mild austerity to continue.

The leaders of Europe are idiots, as well as being ethical monsters who have impoverished and killed many for an ideology whose sole purpose is to make a small proportion of the population very, very, very rich. This will be seen as the moment when those leaders broke the Euro. Combine this with the US abusing its stranglehold on the financial transfer system to starve countries out, and stupidity like Iraq, and they’ve hastened an end to the American/Western hegemonic period–decades earlier than smart, human policies would have achieved.

A finance system exists, socially, only to direct money to where it is needed to create more social good. It has no purpose otherwise. It is not an end in itself. Money that is not a useful commodity (a.k.a. food) is not a store of value and never was. It is a fiction used to allow feedback in the system and to act as a distribution mechanism for goods and services based on perceived social utility (a.k.a. people who have more money are assumed to have more social utility).

A society which understands NONE of these points will vastly mis-allocate its productive resources, as, currently, ours is doing. That mis-allocation will, in time, lead to collapse or another disaster (in the much larger picture here, much of the world is now in both a pre-revolutionary state and a pre-war state, though most people won’t believe either until they’re dying).

I have spent my entire life watching these people burn down the house to generate heat and call themselves geniuses. Neoliberalism “works” because it bribes just enough people to maintain enough of a constituency, while piling money into the hands of a very few people who will do anything to keep it going because that’s how they became filthy rich, and virtually any system which cared about the common good would take their money and power away from them.

Neoliberalism works only in the sense that it creates the circumstances for its own continuation. But it is a locust ideology: It cannot last long in historical terms and it will not. That doesn’t mean it will be replaced by something better, the world has often seen centuries to millenia go by with most of the world ruled by nobles, kings, and despots and the majority of populations peasants, serfs, and slaves.

But, be clear: It will end. Be clear: Greece, whether they buckle or fight, is making its end come closer. And be clear: That end will almost certainly result in hundreds of millions to billions of death in war, revolution, famine, and so on.

None of this was necessary. But some people wanted to be really, really rich and many other people were willing to make corrupt deals that cut out most of society from any gains. Most of those people will be dead before the shit hits the fan in any way that would effect them, safe in their core nations. But not all will be dead.

I hope that Juncker, Merkel, and Draghi, among others, live very long lives. Sincerely. I hope they live to be a hundred, with their minds sharp. I hope this devoutly.

Meanwhile, all the stupid options having been exhausted, having a mandate from the population, and with the EU saying “lie down after taking your cup off so we can gather in a circle around you and kick you,” let us hope Syriza does what needs to be done. (They might also wish to just reinstate Varoufakis as Finance Minister. There is no deal to be had, and they’re going to need a competent technocrat to do what needs to be done.)

If you enjoyed this article, and want me to write more, please DONATE or SUBSCRIBE.