There’s been a lot of hysteria over the ballooning US deficit lately. Is it worth worrying about? Let’s learn how you can tell for yourself, rather than relying on others to tell you.

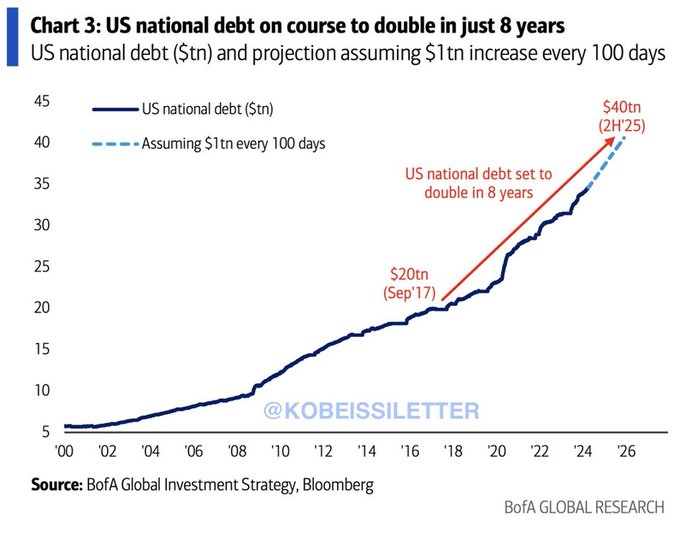

This is the sort of chart which is going around:

Scary, eh?

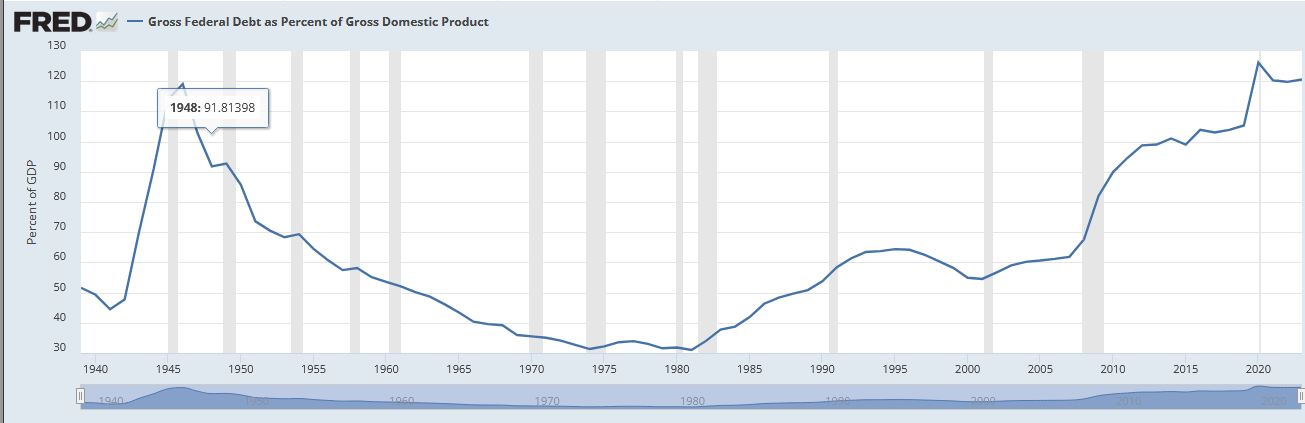

So, here’s the debt long term, as a percentage of GDP:

Still pretty scary. US debt it is running higher than WWII debt.

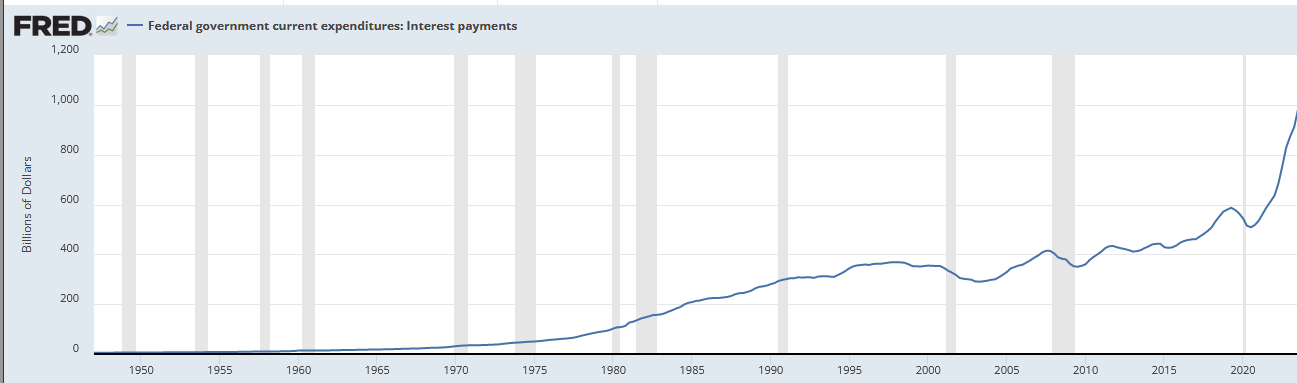

In the short run, most of this is caused by interest payments:

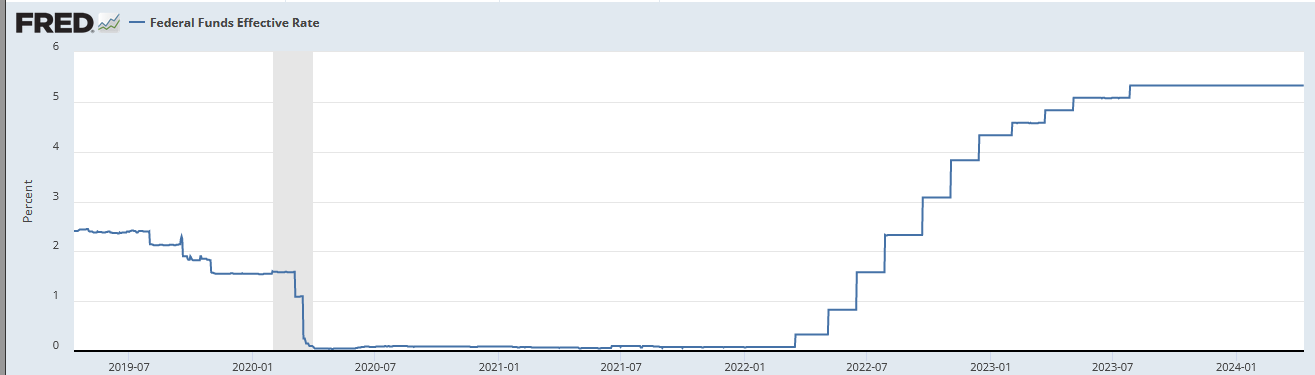

So, what changed? Prime.

If you take a look at these charts you’ll see the rise in rate of increase is mostly due to interest.

Now, when governments who can print money default, it is because people don’t want their money, or the money can’t buy what what they need. US debt is entirely in US dollars. Treasury can mint as many bonds as it likes, and the Federal Reserve can buy them. It is impossible for the US federal government to run out of money, per se.

Rule: Debt is a problem for a government with the power of the printing press when money can’t buy what is needed.

Regular readers will know I am fond of Keynes maxim: “Anything we can do, we can afford.”

The corollary is “Anything we can’t do, we can’t afford.”

It doesn’t matter how much money you have. You can’t build a nuclear bomb in 1900. You can’t build a nuclear bomb if you are Nicaragua. For ages no one but the US and Europe could, effectively, build commercial airliners. You can’t buy what you can’t produce.

In 1945 the US debt did not matter. The US was half the world’s economy, and everything it needed to produce, including oil, it produced itself. It also had the power of taxation: the top marginal rate was 94%.

Rule 2: Money can’t buy what you need when you can’t produce it and those who can produce it won’t sell it to you.

Right now the US cannot produce much of what it needs. It does have a food surplus and can survive on its own domestic food production and it has a surplus of petrochemicals BUT much of the goods it genuinely needs, like basic electronics and production equipment are no longer made in America.

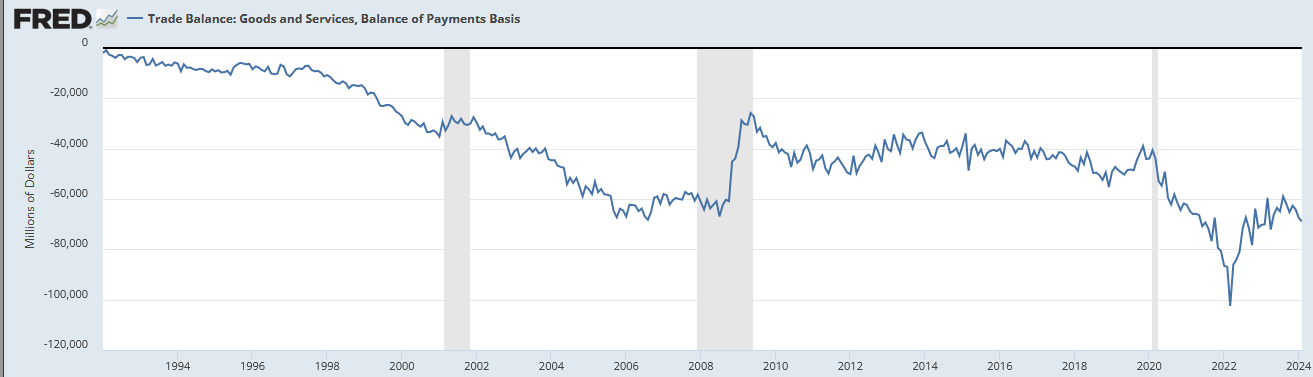

Let’s look at three charts. First the trade deficit in goods and services:

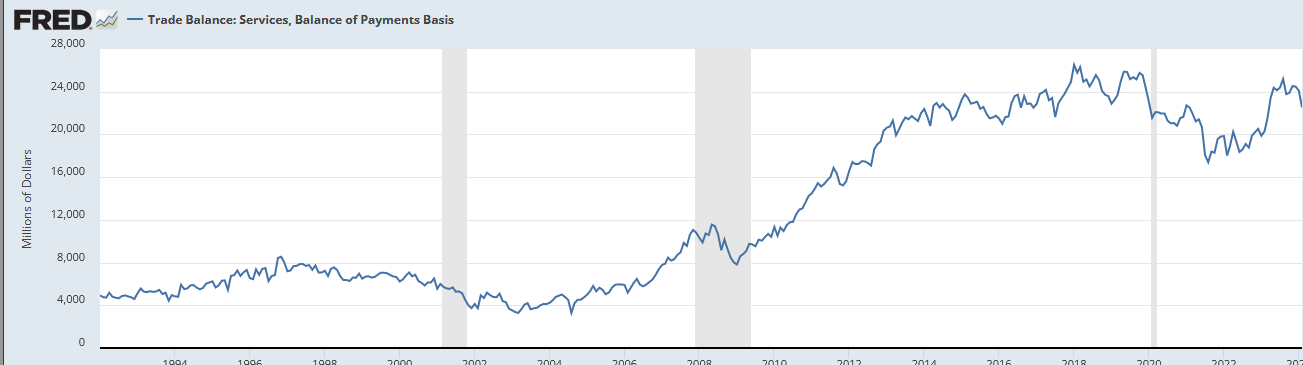

Now, let’s look at the trade balance in services:

So, the US has a trade surplus in services. Crap like intellectual property and management consulting. Stuff people can do without if they must or can ignore if they choose.

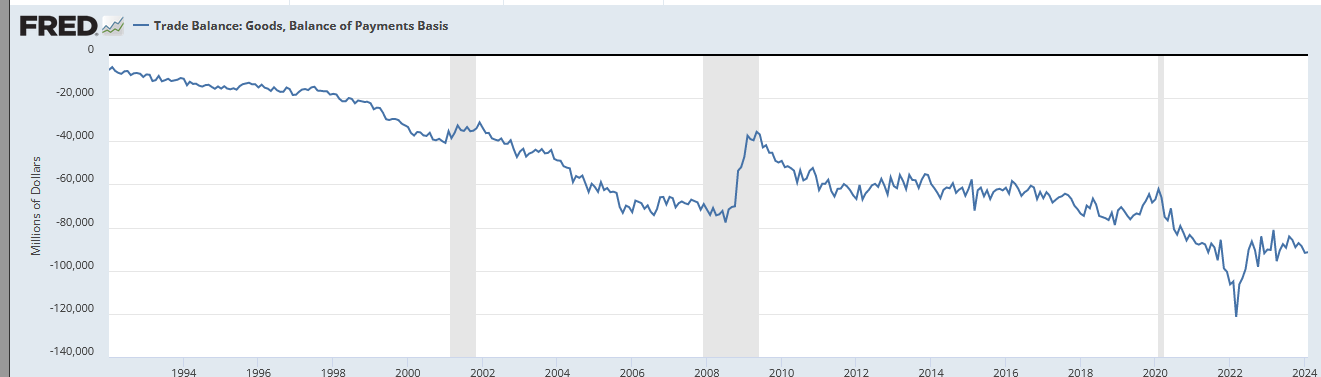

Now, trade balance in goods:

The trade balance in goods is what the US doesn’t make itself that it wants or needs. Some of it is crap: you don’t need summer vegetables in the winter. Nice to have, but not needed. But a lot of it is important: those basic electronic and mechanical goods, including production goods which the US no longer makes and in many cases no longer knows how to make.

The overall trade balance doesn’t look so bad, but it is made to look way better than it is by the US trade surplus in services, which are far less important than goods.

When the US can’t make or buy what it needs using US dollars the deficit matters.

That means the key point is when other countries stop taking US dollars as default. When the dollar is no longer the medium of trade. Right now almost everything can be bought in dollars, which the US can print. If and when that changes, the US is up shit creek without a paddle.

But there is another set of issues: domestic ability to pay.

Specifically, when you can’t pay the enforcer class. Cops and military and judges and prosecutors and prison guards and all that security crap.

America is a vastly unequal society, seething with latent unrest. If the people who protect the status quo won’t fire, then the government and the peace is at great risk. We say this during the January 6th insurrection: most of the capital cops were not willing to fire. This was an ideological issue: they were sympathetic to right wing protesters, just as cops tend to protect Nazis and beat down socialists and blacks.

But it can also become a financial issue. You can print as much as you want, but if people can’t buy what they need with it, it’s worthless. See Weimar Germany hyper-inflation. Or you can refuse to pay, because part of the ruling coalition wants too much of the money and won’t give it to others. Most of the policing in the country is local: it is financed by states and municipalities which do not have the power of the printing press and which do not have a great deal of effective taxation ability: people and business can leave the state or the municipality, in addition to the normal elite capture rule.

When the Bolsheviks took over Russia, most of the enforcer class was not being paid, or couldn’t buy what they needed with the money they were being paid. So when push came to shove, they didn’t fight for the government, and many (especially the navy), switched sides.

Likewise, as Lenin observed, ordinary people are genuinely willing to violently revolt when the risk of doing so is less than the risk of not doing so.

The key question, then, is inflation. Unfortunately, in the US and the West in general, actual inflation is impossible to tell thru official stats. You have to judge buy your own grocery bill; your own fuel bill and your own expenses, and those of people you know. Do you and others have excess money to spend?

Inflation spikes when there isn’t enough to go around. It’s that simple. If a country can’t produce what it needs or wants, and others start raising their prices or refusing to sell, inflation becomes a problem.

Even without inflation, decreasing surplus income is a problem. This is why inequality matters: if a large chunk of the population can’t buy what they need, well, Lenin’s maxim comes into play.

China is at risk of deflation (not significant risk, yet, but that’s their danger.) The US and Europe and the Anglosphere are at risk of inflation.

That inflation will happen when others won’t or can’t sell us what we need and we can’t make it or grow it or mine it.

It is at that point where the US deficit will matter.

If you want to know when the US deficit will matter, it’s simple: when China and other countries stop using dollars as the default trade currency. That process is early yet, but underway. It used to be unthinkable to sell oil in anything but dollars: did not happen. Now it does. China and Russia, China and India, and Iran and everyone now trade without dollars. African countries are in the midst of throwing out French and American military bases and do the majority of their trade with China, not America or Europe. They are increasingly trading with Russia, as well, and relying on it for military aid.

Everything those countries need except for some medicine they can get from Russia and China: food, goods, and fuel. China gives them better debt terms and doesn’t interfere in most countries internal politics nearly as much as America does.

This is the actual threat: the West not being able produce what it needs and other countries no longer willing to accept dollars. Track this by watching actual inflation, and observing the process of global de-dollarization.

The deficit and the debt don’t matter much, yet.

But they will.

You get what you support. If you like my writing, please SUBSCRIBE OR DONATE

bruce wilder

Very good. Clear.

The size of the debt and the magnitude of interest payments and the fiscal (in)capacity to tax economic rents are also factors in the upward redistribution of wealth and income and contribute to financialization.

Jorge

Excellent post.

We are seeing degradation of the police numbers in big cities and expensive suburbs- here in the SF Bay Area many more affluent towns cannot hire enough officers to cover their patrols. Rents are too high, other cost of living items same. Gas under $5/gallon here is a rare occurrence in the past few years.

Jorge

Another way to put it is that the US dollar is backed by soft & hard power, and we are throwing it away by mishandling Ukraine, Israel, Russia and China.

david lamy

“Designed in California by Apple just not sold there or any other U.S. state”

Is this the coming logo imprinted on Apple products?

I think it is highly likely that design moves to Asia within a decade.

Oakchair

Once upon a time Iraq was looking stop trading in US dollars and switch to Euros. Then Bush committed war crimes and invaded the country. America was treated as liberators, liberating the US dollar in its rightful place as king. It only killed millions of people, created ISIS and cost several trillions of dollars but perhaps the oligarchs see that as a victory.

Even Bush understands the Iraq war was a psychopathic war crime because when he was attacking Putin the Satin for Ukraine he couldn’t stop calling it Iraq.

But Bush texts his daughter quotes from the Bible daily so Americans think he is a decent guy. That is the level of moral and intellectual heft the populace has. Forget it at your own peril.

Daniel Lynch

Ian said “This is the actual threat: the West not being able produce what it needs .”

That’s a huge issue. But for the most part, the U.S. produces plenty of food, yet there has been significant food inflation because much of the food industry is controlled by large corporations that have semi-monopolistic pricing power.

They’re not making any more land, so land is sort of a monopoly, and there has been housing inflation despite a mostly adequate supply (by most metrics, like houses per capita or square foot per capita, there’s no supply problem). Michael Hudson has talked extensively about how the unregulated finance sector has goosed house prices. Because of economic inequality, the affluent own 2nd homes and ridiculously large homes while the poor can’t afford a home.

In the U.S., with its dependence on automobile transportation, the price of a new vehicle is simply out of reach for many working class Americans. My newest vehicle is 25 years old while my “old” vehicle is 48 years old. I repair them and keep them on the road. We can debate why new cars cost so much but the bottom line is that we have made a political choice to rely on automobile transportation rather than public transportation or bicycles.

Then there is health care inflation in the U.S.. The shortage of doctors is a deliberate political policy. If Cuba can produce enough doctors, why can’t the U.S.? Health care is the exact opposite of a well informed, competitive market yet the U.S. allows providers to charge whatever they can get away with (and even Medicare prices are excessively high due to lobbying by the health care industry). All this is a deliberate policy choice, because it’s what the affluent want.

In short, a lot of inflation in the U.S. right now is due to gangster capitalism.

different clue

@Oakchair,

The oligarchs got most of that several trillion dollars so for them it was a victory. Also, a victory for the fracking industry, because part of the point of the Iraq war was to stop Iraq from being able to sell oil in order to raise oil prices enough to make “frack baby frack” pay all over America itself. I didn’t invent that theory. Greg Palast did, and rolled it out in his book Armed Madhouse.

Those individuals and hopefully entire families and even whole little regions who can prepare to survivalize now while the debt and defict don’t matter much should prepare for survivalizing now so that they will be ready to survivalize and survive once the debt and deficit do matter. Food will get you through times of no money better than money will get you through times of no food.

RJ

The US may have a domestic surplus of food, but I would guess that the supply chains that support that surplus all extend overseas. Trucks, tractors, specialized equipment, etc. Industrial food production requires an industrial base.

Carborundum

I’m not sure one can say that things are being driven primarily by interest rates, at least not directly in terms of their impact on current expenditures. The timing just looks off for that – interest rates don’t spike until after the 2019/2020 inflection point; when one looks at the actuals, it’s only 2022 and 2023 that are affected.

From a current expenditures standpoint, it looks to me like it’s a combination of increased transfer payments and a jump in subsidies (not sure of what specifically is being subsidized here) in 2020 and 2021 with interest rates becoming important in 2022 and 2023 and appearing to be largely responsible for why things aren’t settling down to pre-pandemic norms.

What I’m not sure about is when one looks beyond a current expenditures standpoint. Gross debt includes the value of the government’s financial and non-financial assets (i.e., it isn’t just the accumulated deficit). If that is significantly affected by interest rates, then it may indeed mean that interest rates are the primary driver, but intuitively I’m not sure I would view that the same way as I would rate impacts on the accumulated deficit.

JBird4049

The elites just do not want to increase the income of the bottom 90% in anyway,

but hoard most of the money. Add the increasing monopolization of the essentials of food and housing as well as medical care and utilities, which allows a relative few to steal more than any extra money from the bottom of the population.

It seems silly to complain about the debt or of printing money when most of the money does not go to the people who need it to buy the necessities for living. If nothing else, pumping that money into the bottom half would allow small businesses to exist (and partially recreate the old economy of forty years ago). But even something as useful and well supported as an expansion of the child tax credit can’t happen.

Yes, I know that the trading needed by the United States for what it does not make is slowly becoming in danger because of the gradual dedollarization along with the growing debt. It still does not seem relevant to those who don’t have the money, which is most Americans. If the trade imbalance being caused by the deindustrialization becomes both well known and accepted as the cause of suffering in the future, I suspect that efforts at confiscation of wealth will occur. It might be a bloody effort, but if people start dying from the lack of imports, it will happen.

But I think that the deindustrialization of the country and the deskilling of the nation is perceived by some people as a benefit to them, which pushes them to keep the processes going. Perhaps because the destruction of all those businesses also destroys the tax base of both the states and local municipalities, which forces them to get loans, issue bonds, and finally sell off parts of the community’s infrastructure to investors. This means nothing will be allowed to change until it comes apart.

bruce wilder

it is easy to get distracted from the simple reality that the vast debt is held as assets by persons, financial and corporate, and used as wealth and a hedge to support deep financialization of the economy and extension of predatory forms of capitalism. the rise in interest rates powers a massive shift toward further acceleration of upward transfers of income using the state’s fiscal capacity.