Let’s put an end to this nonsense:

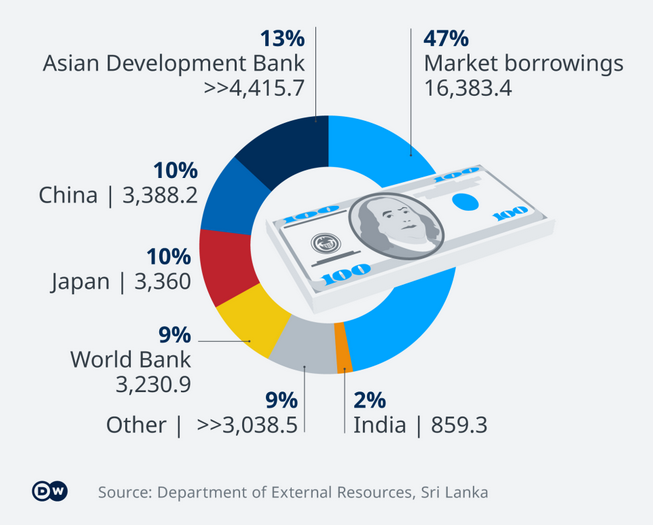

The Asian Development Banks is essentially a US proxy and the World Bank is mostly controlled by the US. Market borrowings are almost entirely from Western sources.

The article goes into more detail:

Sri Lankan President Gotabaya Rajapaksa, who spent a significant part of his life working in the United States, entered office in 2019 and immediately imposed a series of neoliberal economic policies, which included cutting taxes on corporations.

These neoliberal policies decreased government revenue. And the precarious economic situation was only exacerbated by the impact of the Covid-19 pandemic.

Facing an out-of-control 39.1% inflation rate in May, the Sri Lankan government did a 180 and suddenly raised taxes again, further contributing to popular discontent, which broke out in a social explosion in July.

Seems that cutting revenues makes you more likely to default on your debts and does not magically improve the economy. And when you do it just before a pandemic, well maybe it doesn’t work out well.

From Reuters, about that tax increase too late.

An increase in Value Added Tax (VAT) to 12% from 8% with immediate effect is among the key tax increases announced on Tuesday, which is expected to boost government revenues by 65 billion Sri Lankan rupees ($180.56 million).

Other measures, including increasing corporate income tax to 30% from 24% from October, will earn an additional 52 billion rupees for the exchequer.

Withholding tax on employment income has been made mandatory and exemptions for individual taxpayers have been reduced, the statement said.

So, the biggest chunk of it was a regressive VAT tax increase.

I’m not an expert on Sri Lanka, but the third world debt trap, which started primarily in the 1970s was based on the idea that you could borrow money and use that money to buy development. The play was to spend the money to turn to exports the West wanted (cash crops, minerals, etc…), which you had a “comparative advantage” in. Problem is that everyone was getting the same advice, so the supply of cash crops and minerals increased in multiple countries and the price crashed. Worse, to grow cash crops you had to get your subsistence farmers off the land. They went into slums, and you now had to feed them, which meant you had to import food.

In Sri Lanka’s case tea, spices and coconuts are key exports. You can only eat one of those three. When Covid happened the market collapsed, incomes were already down, debt load was high and … BOOM. According to the figures Sri Lanka is a net “agri” exporter, but it exports mostly non food agri items and can’t feed its own population.

(Rule #1: if your country can’t feed its own population, you are always vulnerable to outside forces.)

So, anyway, Sri Lanka spent generations servicing debt by selling the developed world luxury agri-goods, but the prices of those weren’t that high, and they didn’t get a developed economy out of their loans, but still had to pay the loans while unable to feed their own population. Pretty normal story, sadly. (Egypt is the saddest, from the cornucopia of the world to a food importer. The Aswan dam should never have been built, losing the Nile’s annual flood was too high a price to pay for its electricity.)

Now, the media is constantly full of stories about the Chinese Debt Trap. They’re bullshit.

African countries owe three times more debt to Western banks, asset managers and oil traders than to China, and are charged double the interest, according to a study released on Monday by British campaign charity Debt Justice.

This is entirely consistent with what I have discovered every time I’ve looked into the issue. It is not that there have never been corrupt high interest Chinese loans, but generally speaking, Chinese terms are far better than Western ones.

The reasons are twofold:

- China wants resources. In exchange they are willing to build infrastructure for cheap in countries who will sell them those resources. If you want hospitals and schools or even an entire city as well, they’re happy to build that for you too. This seem similar to Western policies from the 70s but is different in important respects: the West wanted the resources and they wanted to make lots of money off the loans and they wanted to gain control of economic policy in developing countries so they could institute neoliberal policies like getting rid of food subsidies.

- China has just spent decades developing its own country. While the job isn’t done, it has slowed down and China found itself with a lot of extra development ability: companies and workers specialized in building infrastructure: from ports and airports and railways, to everything a city needs, including sewage and power. They want to keep that industry running, and not have to get rid of millions of employees and have firms downsize and go bankrupt. So those firms, and often workers now develop countries all around the world. As long as they make some profit, that’s good enough for China. It doesn’t have to be high, especially, again, as they’re getting resources in exchange.

The “developing” world is a mess because of the West, not China. It is our policies which made it nearly impossible for most nations to develop. Those policies were designed to make our coporations and banks rich and to weaken the ability of poorer countries to resist us. They were exactly the opposite of what is required to develop a country, which is almost always done behind trade barriers and by moving UP the value added chain, not by selling raw materials and crops. This is how the US did it, Britain did it and almost every country in Europe did it. It is how Japan and Taiwan and Korea did it.

We sold countries like Sri Lanka advice that was bad for them and good for us, and which put them into a debt trap we refused to let them get out of by pretending that debt default was unthinkable and debts sacrosanct and by hurting any country which tried to default brutally.

This isn’t the historical norm. Previously third world countries defaulted all the time, and they soon floated new debt and yes, investors loaned to them anyway.

People who loan money should not be protected that much from default. Some protection is reasonable, but when a person or country is bankrupt, they should be able to default. Doing so keeps lenders honest: they either don’t lend, or they accept the risks, and they have incentives to keep debt reasonable, since if they don’t, they will be hurt.

When we made it so that default was virtually unthinkable, we changed the incentives (so beloved by economism believer) in ways that made it make sense for investors to lend money which was to be used in ways which crippled entire countries, indeed continents and made it impossible for countries to change course and pursue strategies which would actually allow them to develop.

That’s the story of most of the developing world.

And if you need to borrow money as a third world nation? Borrow it from China, not the West, if they’ll lend to you. As for the IMF, their job is to keep the payments going and keep countries in the debt trap so they can never develop and never have policies independent of the US and the West.