Practically every day I read an economist like Paul Krugman or Brad DeLong talking about how the economy is the best ever, but ordinary people just don’t get it, and must be idiots influenced by propaganda.

Someone’s an idiot on this subject, but it’s not ordinary people.

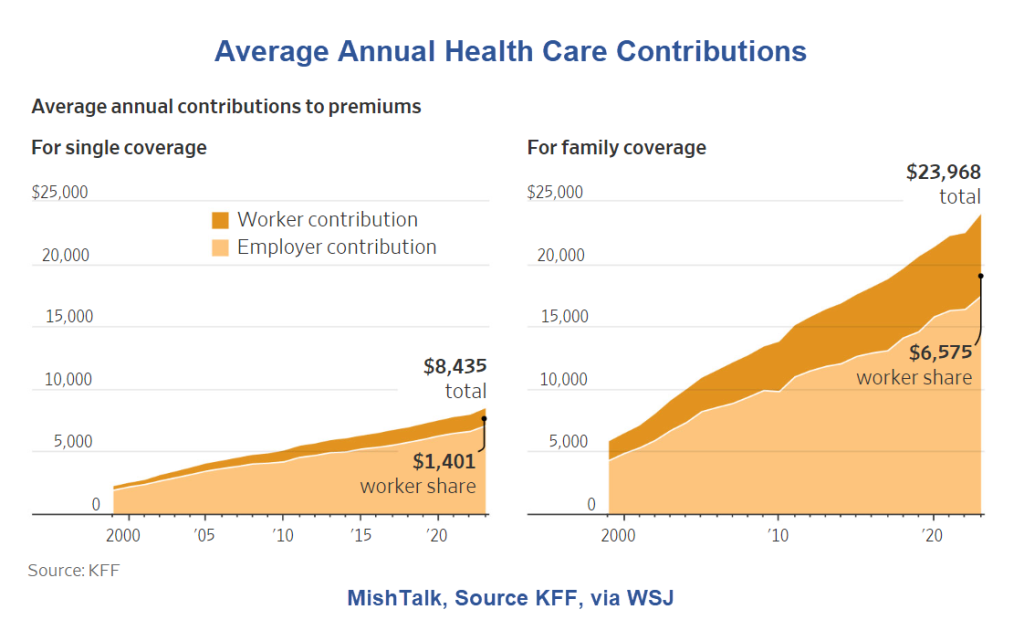

Mish Shedlock had a good article on medical inflation. Here’s two charts from his article. First, costs:

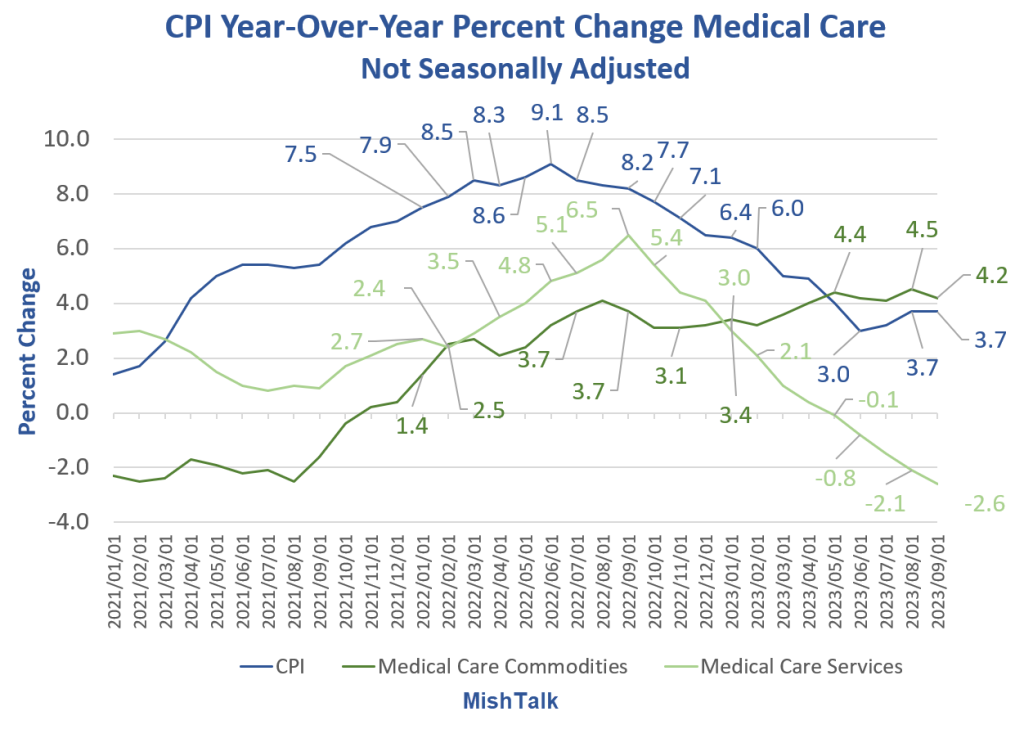

Second, CPI for medical:

You might be noticing a—slight disconnect. The cost of medical care services (which is what you care about as a patient) are dropping, according to the Bureau Of Labor Services (BLS).

Mish has the extended explanation, and you should read his whole post.

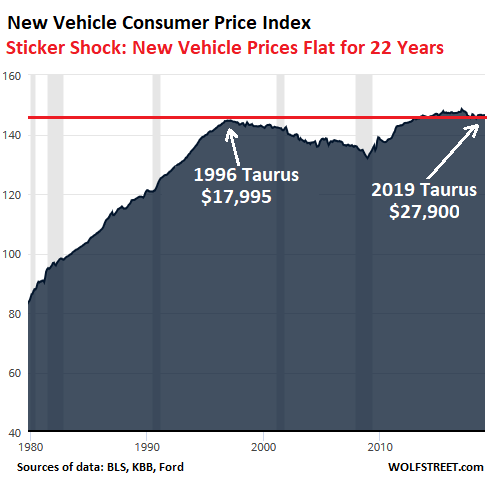

Now, back in 2020 I wrote an article on how inflation statistics are bullshit. One example was automobile costs. Here’s the chart from that.

Yeah. right.

The inflation statistics, at the this point, are complete bullshit. Absolutely worthless in entire categories.

When it comes to how good people feel two things matter: how many people have a job, and how much money they’re making. When economists look at wages, they look at “inflation adjusted wages.”

How much your money buys. So, since the inflation numbers are garbage, the inflation adjusted wages are garbage.

A long time ago Stirling Newberry gave me a rule of thumb, which is that people are fooled in generalities but not in specifics. Which is to say, people know what hurts or feels good in their own lives, though may be completely clueless about the generalities. But when you take a survey asking people how the economy is doing, what you’re really asking is “how does it feel for you and people you know.” The answer is “shitty.”

I’ve personally seen, in Toronto, Canada, foodprices increase at least two-thirds. If I buy the shopping basket I bought for $30 in 2020, it now costs me about $50. A lot of things have doubled in price. Rent is way up for most people.

And when I talk to other people, no matter where in the US or Canada they’re from, I hear the same thing. So I’ve never believed the BS talk about the “best economy ever.”

Back in the 90s, there was a rather good book titled, “Economists are bad for your health.” Economists are clueless. North of 99% of them missed the 2000’s housing and financial bubble, for example. The advice they give on how to run economies is almost always not just bad, but terrible, at least for 96% or so of the population.

The most important requirement to understanding the world is accurate perception. Truth, if you will. If you don’t know the truth, you’re going to draw the wrong conclusions. Economists believe BLS stats, so they’re full of it. Add to that the fact that Economics as a discipline is mostly wrong about almost everything macro, and economists are out to lunch in a very dangerous way.

(Note that I predicted the financial crisis, publicly, in advance and spent years before that writing about the bubbles. All the necessary information was available, if you didn’t think nonsense like markets being self-regulating and housing prices always going up. A correspondent once did a search to find out how many people predicted the crash in advance. He found 39. Where were all the economists, who are supposed to understand the, well, economy?)

Anyway, ordinary people are right. Their wages haven’t increased enough to make up for the increases in key prices. You can skip on a lot of things, but not food and shelter, and skipping on medical services is bad too. As for autos, well, most people need them or they can’t get to work or go shopping.

We have late imperial disconnect: the elites live in a world where everything is great, while ordinary people live in the real world, and it sucks.

Donors and subscribers make it possible for me to write, so if you value my writing, please DONATE or SUBSCRIBE