Stumbled across this recently:

- China aims to become custodian of foreign sovereign gold reserves to strengthen its standing in the global bullion market, according to people familiar with the matter.

- The People’s Bank of China is using the Shanghai Gold Exchange to court central banks in friendly countries to buy bullion and store it within the country’s borders.

- The move would enhance Beijing’s role in the global financial system, furthering its goal of establishing a world that’s less dependent on the dollar and Western centers.

Remember when the US stole Venezuela’s gold? Remember when the West “froze” Russia’s reserves, including gold?

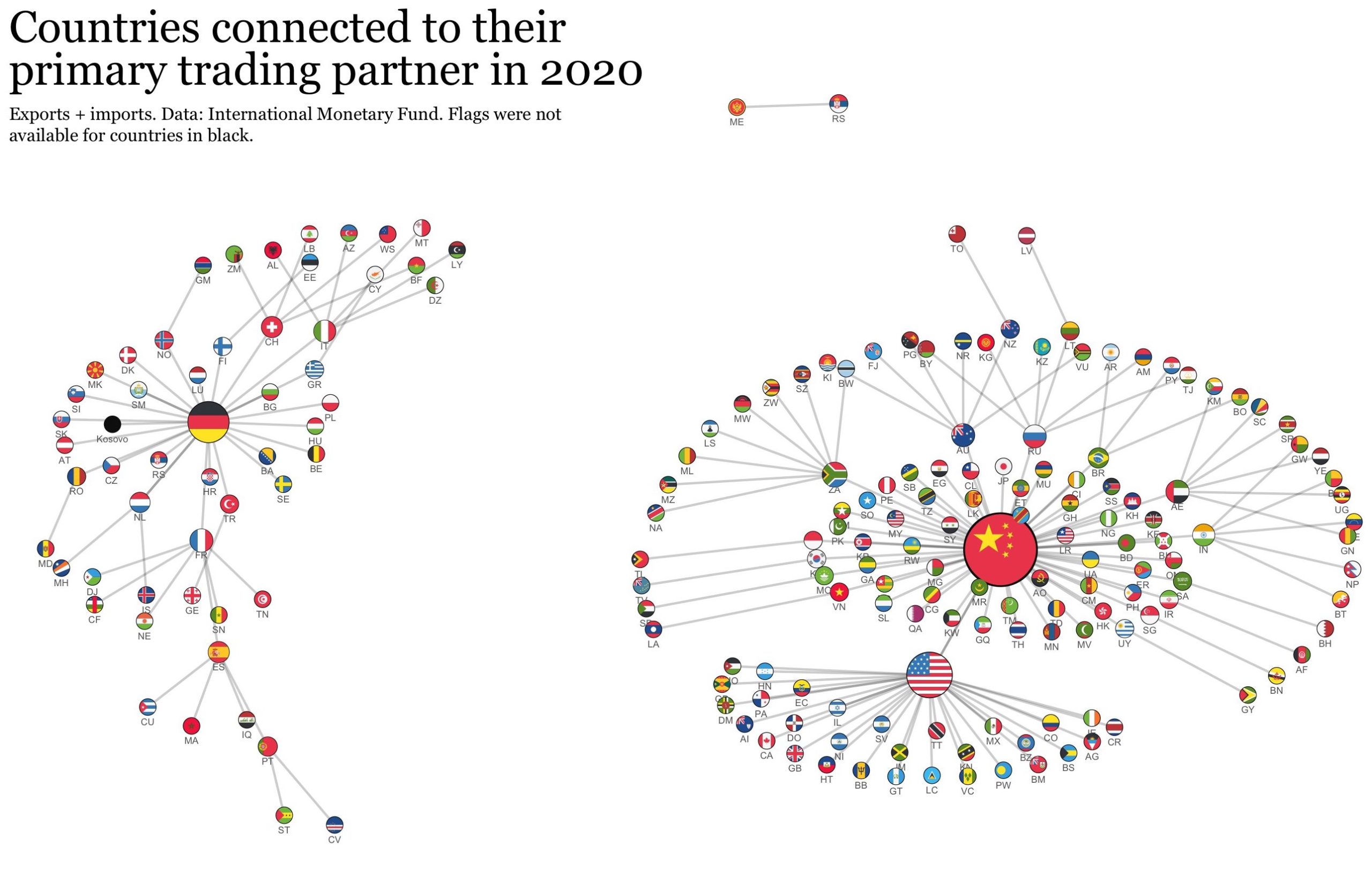

Actions have consequences. Since most countries do more trade with China than with the US, let alone the laughable UK, and since China appears a lot less likely to steal one’s reserves, this rather makes sense.

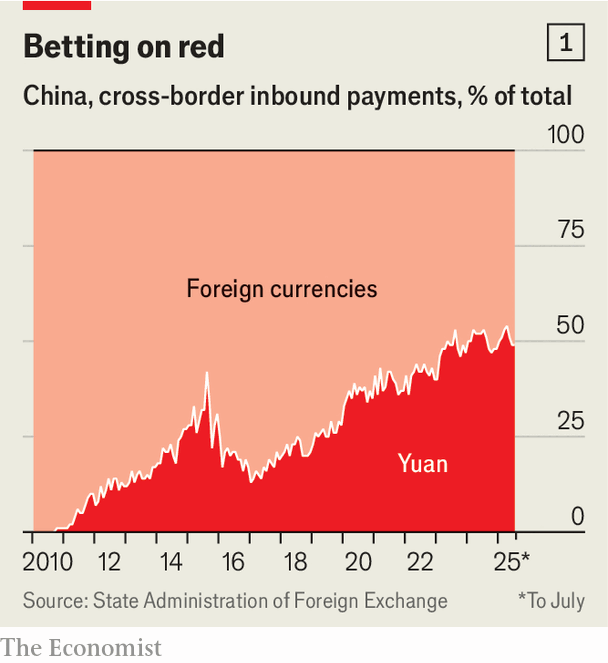

China does almost half of its trade now in Yuan, and the the remaining is often in local currencies. (The Russians pay in rubles, for example.)

When you add in the trade flows, and bear in mind this is 5 years old and today China has overtaken in more countries…

Well, why exactly would you use US dollars for trade, or use New York or London as your primary foreign banking center? You’d be a fool if you did so, if you’re outside of the West+allies (Japan, South Korea, Taiwan.)’

The US stock market is also VASTLY over-valued. There hasn’t been a proper market correction which was allowed to stick in generations. The idea that US public companies are worth more than China’s public companies is ludicrous. As the actual world economy is now centered on China, not America, this will become unsustainable, because the US dollar is going to copy what happened to the UK pound over the 20th century, and the US will no longer have currency seignorage: if other countries don’t want it, the US can’t just print it without massive and crippling inflation.

This means the eternal rising market created by Greenspan and treated as sacred by every President and Federal Reserve Chairman is in its last gasp. No matter how much they will wish to prop it up, they won’t be able to without crippling side-effects beyond what can be papered over by printing more money and giving it to rich people. (All of this before the fact the stock market is currently an AI circle jerk, with companies buying NVidia chips for AI and NVidia then investing in those companies. When AI turns out to be an ordinary tech, useful for some things but not revolutionary, BOOM.)

Meanwhile:

Iran supplied its first advanced gas turbine to Russia

Iranian firm MAPNA marks first international sale of high-tech, showing independence under Western sanctions

Provides alternative to the aging German Siemens units & offers higher efficiency pic.twitter.com/LfW8WMrRFt

— RT (@RT_com) September 22, 2025

This is a big deal. This is what GE and Siemens sell. Now there are Japanese and Korean and Chinese suppliers, but this a key technology. And Iran can make it now. GE has the largest installed base, followed by Siemens (German), but why court sanctions risk and repair parts being cut off?

When the Ukraine war started, Siemens withdrew from Russia, and refused to maintain already sold turbines.

Woops.

Again, core tech that used to be controlled by the “North” is spreading across the world. Hell, the Houthis are making their own farm combines!

And it’s China where the future is happening, including the Jetsons future:

🇨🇳 BREAKING: China’s “low-altitude economy” is taking off — with eVTOL flying cars, delivery drones, and passenger-grade aerial vehicles already licensed for commercial use in cities like Guangzhou and Hefei. Beijing wants Chinese firms to dominate this new industry.

Source: The… pic.twitter.com/5X69PZfgJR

— Defence Index (@Defence_Index) September 22, 2025

The US isn’t even on this technology, let alone moving to scale. Let me remind you of the rule of Industrial dominance:

When there is a dominant industrial power (Britain to 1860, America from 1920 to 1965) you have to be ahead in tech to compete, because the dominant power can always scale cheaper than you.

This is an industry where the US and Europe aren’t even on the playfield. Worse (or better), it’s the sort of industry that, in wartime, can easily be converted to military production.

We’ll end with one more chart:

Which nation’s ports trade the most goods?

Facts matter. pic.twitter.com/8YLbgexlr6

— Jason Smith – 上官杰文 (@ShangguanJiewen) September 20, 2025

It’s over. It’s all over. The West is sinking into industrial and technological second place and it’s a second place that is long way behind first place. Further, massive US research cuts and a monomaniacal obsession with one tech (so called “AI”) indicate that the US isn’t serious about catching up, but has accepted its decline, whatever the political rhetoric may be.

This leads to the end of the American Empire, to vassals pulling away, and to a massive and sustained loss of standard of living, just as it did in the UK. Combined with ecological issues, I expect the American experiences of decline to be faster and worse.

***

I appreciate everyone who donates or subscribes to keep this site (and Ian) running. Readership is up over 40% this year, and I’m very grateful. If you want to help the blog, please share the articles you like and if you can afford it, and like the content, please Subscribe or donate.

Feral Finster

Every dollar of US debt has a willing buyer.

https://qz.com/us-treasuries-government-bonds-hedge-funds

Moreover, the US plan is simple – if they cannot win by honest competition, smash up the competitors’ stuff. China in particular is easy to choke off.

Ian Welsh

Oh, the UK and Japan bought US bonds and China has its lowest level since 2009.

The UK found bond buyers for a long time into its decline too.

No, China is not easy to choke off any more and as soon as all the ex-Euro oil is redirected to them thru the new pipeline, that will be even more true.

The US can’t even maintain its fleet without buying parts from China.

different clue

That statement about the dollar . . . ” if other countries don’t want it, the US can’t just print it without massive and crippling inflation. ” . . . is going to get a lot of MMT cargo cultists very very mad.

Failed Scholar

Good. Literally the best news I’ve heard all week.

mago

I second Failed Scholar.

The Heretic

If the US prints dollars to pay for products and services produced within its own borders, then the inflationary impact is dependant on the level of utilization of the economy, and the pricing power of companies (and oligarchs) relative to the buying power of thr US government ( non-market maneuvers by oligarchs, including paying off decision makers to overpay for products, threatenijg them with Epstein level of embarrassments, and lack of honest competitors, does constitute part of the calculus of pricing power in facour of the oligarchs). But there is a limit to the inflation, as long as credit policies are controlled, so that the real consumption is not turbocharged via incurring debts(consummer debt) and asset prices are not speculated ever higher via debt financed speculation.

The conditions for hyperinflation only exist as per thr condtions of Weimar Germany… the country must make payments in a foreign currency, the country (for whatever reason including environmental degradtion) loses real resources and manufacturing capacity and skills, political instability (long term civil unrest, or worse, civil war), reckless printing of currency to pay for necessary goods and services.

The US still has some useful and valuable in country manufactured products and services, but the tech bro loving orange wrecking ball will have unpredictable consequences on the governance and health of the country.

Mel

The other way to tell the story of the eager U.S. bond buyers is to say that there are lots of people, businesses, governments, whatever who have lots of $US, but can’t think of anything useful to do with them. By buying bonds, if in a year they do think of something useful,, they’ll have some 5% more $US to spend. If not, they’ll buy bonds again, I guess.

Bob

China picks up the baton in the race to destroy the natural world. Whoopee.

The fall of the American empire is welcome.

Hail the new empire.

Like & Subscribe

I’m with Bob. It’s a pyrrhic victory at best. Human is toast. Nature screwed the pooch when it produced humans — the seeds to its own annihilation.

Also, do you really think the turd blossoms running the show in America are just going to up and say, “oh shit, you’re right, we’re toast, you win, oh well, that’s the way the cookie crumbles”? Do you think the turd blossoms will just disable all the nukes and go quietly into the long night? Just as Russia has?

I submit that a collapsing or collapsed America will ensure humans are toast much quicker than if China proceeds to gobble up the earth and spit out poison like Pac Man. A collapsed America will be likened to a rabid dog — one you can’t put down without perishing yourself.

Feral Finster

For once, L&S gets it.

Those of us opposed to the Washington Consensus have a bad habit of declaring premature victory, of accepting mortal victories in lieu of the real kind, and when they do on occasion notch up a win, letting their enemies off easy, presumably out of a need to appear to be “nice”.

Feral Finster

@Mel: if holders of USD thought that the dollar was a losing bet, they would be buying hard assets (real estate) with those dollars while they still had purchasing power, not buying more dollar assets that don’t mature for a while yet.

Forecasting Intelligence

Agree, up to a point.

The Trump team are effectively giving up on the global empire and withdrawing to the Americas – see https://www.politico.com/news/2025/09/05/pentagon-national-defense-strategy-china-homeland-western-hemisphere-00546310

Which is a strategy that can work and salvage some of their lingering global power (e.g. military and currency).

elkern

(semi-OT; related to OP but not to its central point)

MAPNA looks like a fine example of smartly targeted Gov’t Industrial Policy. Iran has the core ingredients of a strong Metals sector – Mines, Energy, and Education – so that was smart choice for an industrial sector to target for investment, and it looks like it’s working quite well.

I worked for a company which produced parts for industrial turbines like those pictured above. It’s complex work, requiring close attention to both Product and Process Engineering (Design + production process control). Engineers are the core of the Company, but MBAs view them as expendable labor.

Bonus (for Iran): Gas Turbines are a lot like Jet Engines, only running the opposite way. Jet: spin shaft, push air backwards, push jet forward. Turbine: fluid (steam/water/etc) spins shaft, shaft spins Generator, makes electricity. So investing in Gas Turbines creates the infrastructure for producing your own Air Force.

Mel

@Feral Finster: “they would be buying hard assets (real estate) with those dollars while they still had purchasing power”

Well, to buy hard assets, they would have to find somebody who’s selling hard assets. If few people can find a good use for US$, sellers might be rare. That would mean the purchasing power is not what it was. Wolf Richter’s blog is writing about the way real estate prices have started a downward slide.

The FED’s primary dealers will always sell Treasuries at some price.

Plus, if somebody buys hard assets, it’s best they want hard assets. I remember when the price of oil went negative. Traders only wanted to trade oil contracts, but the market froze, and they wound up owning all this oil, and nowhere to put it.