If you look up whether governments can “just print more money,” what you’ll find at most sites is the answer, “No, because it only increases the amount of money, not the amount of economic activity.”

This is not true, and it’s not true in a number of ways.

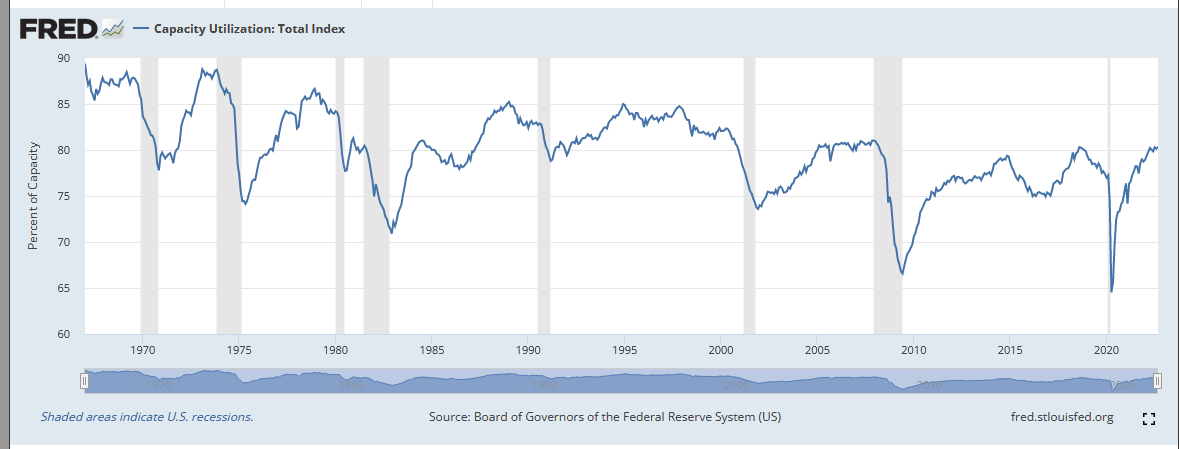

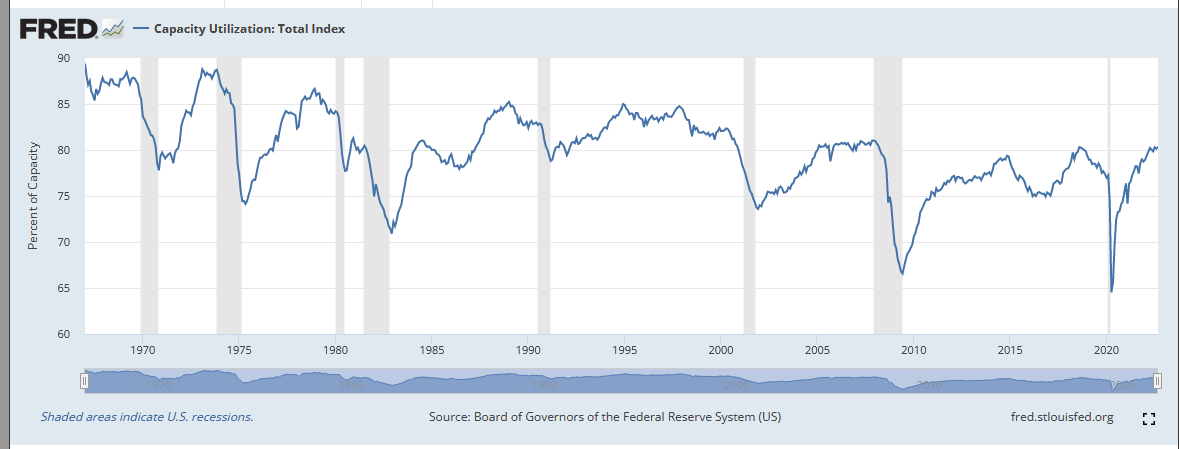

If there is under-utilization of capacity, you can print. Here’s US capacity:

The US has been running substantially under capacity for a long time.

But, you say, there was a lot of money printing (private and public, most money is created by banks, brokerages, and so on), and capacity utilization didn’t go up. In fact, it went down.

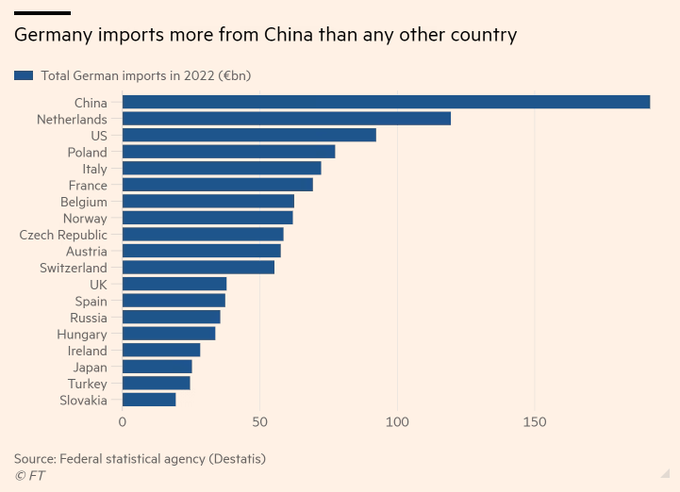

Well, yes, because the money went to other countries like China, where it increased capacity vastly, or it went into assets (the housing bubble, stock bubbles, and so on), or it bought private jets and yachts and so on.

Which is to say, it’s not just about money creation; it’s about who gets the money. Since virtually all the money creation of the past 40+ years has gone to rich people, capacity has been created for what they want. And because it was cheaper and more profitable to build capacity overseas, that’s where the money created went.

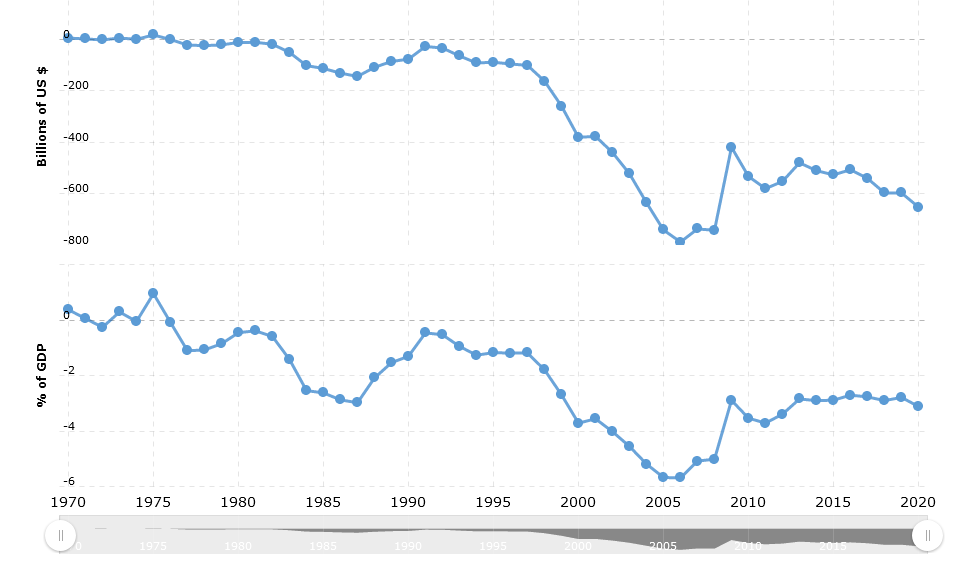

In addition, there’s the fact that the US dollar is used to buy oil and is the general medium of exchange in most foreign trade. It’s also the “gold” currency, in that during crises it tends to go up, so people want to hold a store of it against bad times.

All of these factors are contingent. If oil was not sold primarily in dollars, or trade settled in dollars, for example, there’d be a lot less demand for dollars. If the trade regime didn’t allow for vast imports and exports, but the world was more autarchic, then building new industry overseas wouldn’t make any sense, and so on.

This is to say, nothing is eternal. The dollar’s position is a historical artifact, based on specific circumstances which did not, and will not, always exist.

Remember, there was a time when the center of the world economy was Britain (chart from Mike Todd).

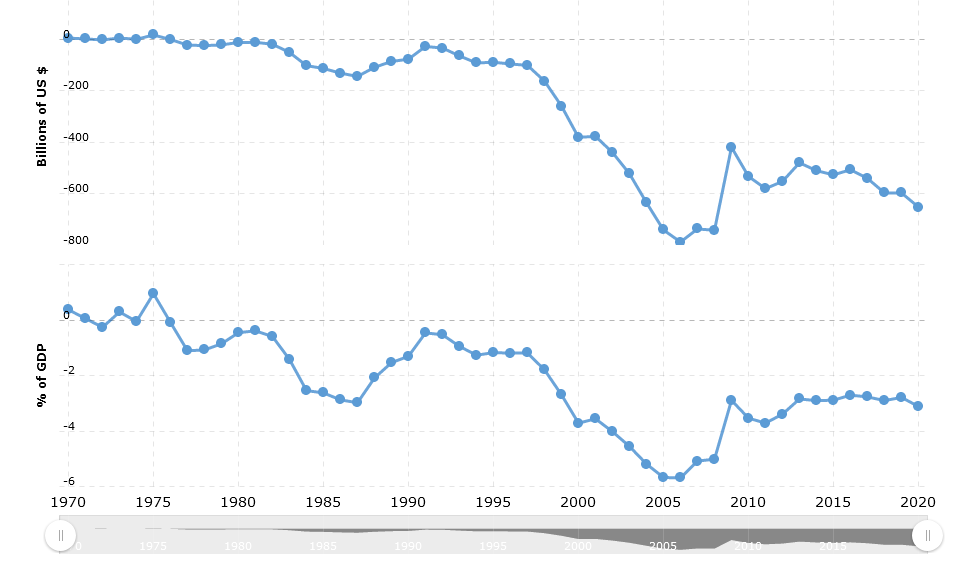

What you see in that chart (and it’s going to keep getting worse) is the switch from London to New York; from the pound to the dollar, because the pound wasn’t the primary international currency any more AND (and this is important) the UK kept de-industrializing so there was less and less relative demand for its products, though the City of London retained an important financial role, which kept the pound higher than the economic situation of Britain would otherwise have allowed.

Developing countries, as a rule, cannot run the printing the press because people only want enough of their currency to buy whatever goods and services they produce. In addition, because most Third World countries have vast import requirements (more so as time has gone on), and their agricultural bases have been destroyed, printing money causes inflation very fast. It’s not just an internal matter, more money chasing goods, it’s that people try and use the new money to buy goods produced externally, and their exchange rate collapses.

When the US prints money, a lot of it goes into other countries reserves and the reserves of people and companies. It pools, as it were, uselessly, and to the extent that it is “more money chasing the same goods,” its effect is spread over most of the world and not just internally.

Once this was true of the British pound.

The original conception of comparative advantage was based on the assumption (true at the time) that money mostly pooled inside countries and could not be used to create production in other countries. If Britain produced less widgets because French widgets were cheaper, the money freed up in Britain would go to produce something in which they had a comparative advantage, say woolens, instead of fleeing overseas. (See Ricardo’s Caveat for the long form of why comparative advantage doesn’t work with free capital flows.)

Now, you can also print money if you give it to the useless classes, i.e., the rich. In that case, it drives bubbles (see the SPX chart above or art prices) or creates niche markets, like yachts and private jets. It doesn’t drive general inflation, it only drives inflation for what useless people want.

Unfortunately, that inflation does eventually cause various crises, but for a time, it seems “free” — you make the rich much richer without causing widespread inflation.

What matters, then, is who you give the money to, and what they spend it on. Volcker crushed wages because, in addition to wanting to make useless people richer, he didn’t want ordinary people to have more money because they would spend it on things which lead to buying more oil, and given oil prices at the time, that would lead to more inflation. He needed to smash oil prices, and he did so by smashing wages to smash oil demand.

If you print money and give it to ordinary people, and it just leads to them buying more stuff from overseas, it won’t move that capacity utilization number you see in the chart at the top very much.

But this isn’t to say that printing money doesn’t “work.” It does work. It always does something. Someone benefits. If you print a bunch of money, and make sure it goes to ordinary people in your country, and that your country increases utilization and/or increases how much it produces, then it can produce a general wave of prosperity. After all, when wages rise higher than the cost of goods and services, that’s prosperity, but companies don’t like that unless they’re still making more money because they’re selling more overall.

(That last sentence, by the way, is the secret of the post-war good era. Meditate upon it.)

You lose the power of the printing press when no one wants your currency because you can’t produce enough, or increase production, AND it isn’t necessary for other things (like international trade).

This goes in stages. Britain, outside of the EU and with less and less industry, and with less reason to send money to the City of London, is in danger of losing the power of the printing press in the way Third World countries do. “There’s no reason to buy any more of this than however much you need to buy their goods.”

At that point, you need to figure out how to re-industrialize and under a free trade order like the neoliberal one, that’s hard. Every time you try, money floods out of your country instead of increasing activity inside of it.

As for the US, it’s in an extraordinarily privileged position, but as China and the BRICS move to conduct more and more trade without dollars, and as trust in the US to run the international monetary system drops and drops due to repeated sanctions and thefts of reserves, that privilege will decline, and the US will find more and more that if it wants goods from another country, it will need to provide not dollars (though they may still be exchanged), but actual goods and services itself.

If you can’t pay with goods and services, you pay by selling your patrimony — companies, land, resources, etc.

The power of the printing press is great, but it can be used for ill and good. It can create real economic growth and widespread prosperity under the right conditions, conditions which are partially under a country’s control. But if you become too weak or poor, you can lose even the theoretical ability to create those conditions. There is essentially nothing most African countries can do to restore enough sovereignty to allow them to use the printing press for good, and if you’re a relatively rich country which does still have the freedom of the printing press, there is always the temptation to use it foolishly or venally, as the US mostly has in recent generations.

Money is a social creation. So is how we run the economy. It can be made to work for everyone, for a few people, or as a machine of impoverishment. The choice, on aggregate, is ours.

DONATE OR SUBSCRIBE