Many years ago now, I wrote a post called “There Was a Class War and the Rich Won.”

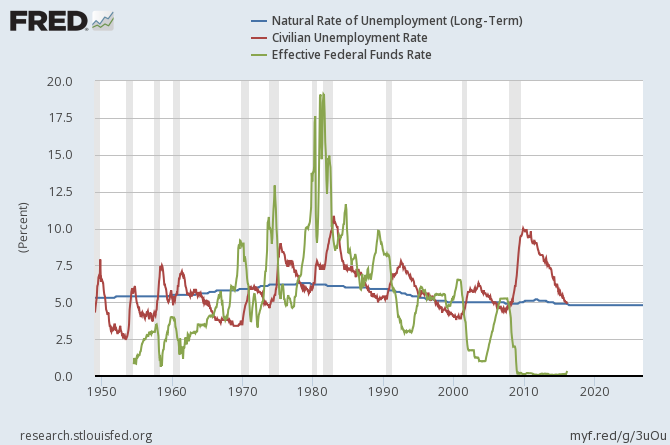

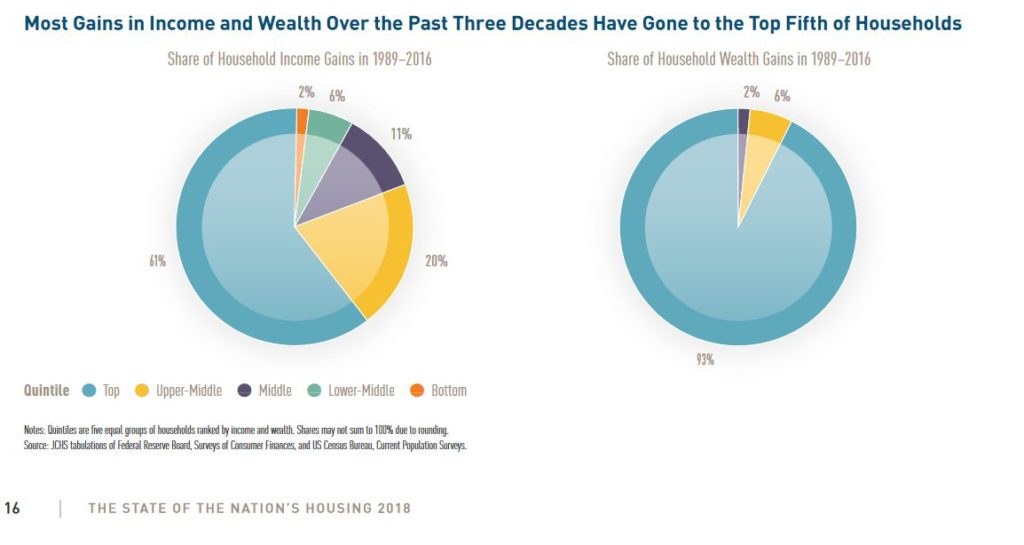

Ironically, after the financial meltdown of 07/8, and thanks to Bush, Obama, Bernanke, and Geithner both bailing the rich out and immunizing them from their crimes, that victory has accelerated. This chart, from Harvard, tells the story of the last 30 years.

What this chart doesn’t show is that the those gains went primarily to the top one percent, and in the top one percent to the top 0.1 percent and in the top 0.1 percent to the top .01 percent.

What happened was a vast centralization of wealth, and therefore of power. This power was used to buy the government: the presidency (Obama acted in the interests of the rich in every important way–so has every President since Carter); congress and definitely the courts, both of which have, ruled, time and time again, in favor of capital and for large and larger concentrations of wealth and power, culminating with “Citizens United,” which classified money as speech and sharply limited government’s power to regulate money in elections. This legislation was the crowning glory of the rich’s victory in the class war.

One of the problems with capitalism is that its benefits rest largely on having competitive (free) markets. But the first thing capitalists do when they “win” the markets is take their profits and use them to buy government so that they can end free markets (our markets are nowhere near competitive or free). Free markets, to anyone who has won, are a threat.

You can see this in the march of so-called “intellectual property.” There is no such thing in anything close to a state of nature: Intellectual property is entirely the product of government. Ideas are free, in nature, and can be used by anyone, and one person using an idea doesn’t mean someone else can’t use it. There is no natural property of ideas.

But we have extended intellectual property well beyond the life, even, of creators. Walt Disney is dead, long dead, and Donald Duck and Mickey Mouse are still the intellectual property of a company.

Competitive markets require that other people be able to compete. They must be able you use your technology, your ideas, etc… to bring down the price of goods. If you want to keep charging a premium, you have to keep coming up with new ideas. But when key technologies and ideas are locked behind patents and copyrights forever, this isn’t possible. (I can’t see any argument for most patents beneficially owned by companies to last more than five years, and even that is questionable. There is an argument for longer copyrights, if they are beneficially owned by individuals, but even in such cases, not long beyond the life of the copyright owner.)

All of this is putting aside other vast barriers to entry and laws and subsidies which benefit incumbents and which push hard towards monopolization.

So we don’t have free markets, and we do have vastly rich rich, and those rich own the government, without question (the events of 2007/2008 proved it).

Capitalism without free markets doesn’t provide most of the benefits of capitalism, and democracy which has been captured by oligarchy doesn’t provide most of the benefits of democracy.

And so both are being discredited, and fascism rises and non-market alternatives become more and more popular. You see it in Corbyn, you see it in the challenge to so-called free trade epitomized by Trump, and you see it in the fact that, for most young Americans, socialism is no longer a four-letter word.

Corbyn’s program includes a vast swathe of straight up de-privatization. It includes rent-controls and a program for the government to just build housing. It isn’t radical from a 60s point of view, but to a neoliberal capitalist, it is terror indeed. And if Corbyn was elected by just those under 40, he’d win in a landslide.

The days of our form of capitalism are nearly over. It is done, and that it is done is concealed by an overhang of older people in the developed world. What will replace it remains to be seen: there are alternatives on the right and left, and the right-wing alternatives are pretty ugly.

But that neoliberal capitalism is nearly done, that is obvious.

The results of the work I do, like this article, are free, but food isn’t, so if you value my work, please DONATE or SUBSCRIBE.

This is vastly disappointing, even though, after the appointment of Bolton to the White House, it is not all that surprising.

This is vastly disappointing, even though, after the appointment of Bolton to the White House, it is not all that surprising.