China from Deng (82) on, had two main plays.

The first play was a standard mercantalist export driven developing state. Low costs were used to create low cost goods primarily for overseas consumption. Foreign currency was plowed back into capital machinery acquisition. Foreign partners were given good deals and the decision makers become rich, but to play one had to give up intellectual property.

This is the standard industrialization sequences, followed by almost everyone, including Britain, Germany, the United States, Japan and South Korea.

It generally requires an already industrialized sponsor (Britain was an obvious exception to this, but the Dutch provided a similar service pre-industrialization.) For China that sponsor, from Deng on, was the United States: the US took the goods, sold the capital machinery, made profits and was generally pretty happy about the deal (just as Britain was while it sold its patrimony to the US for temporary profits.)

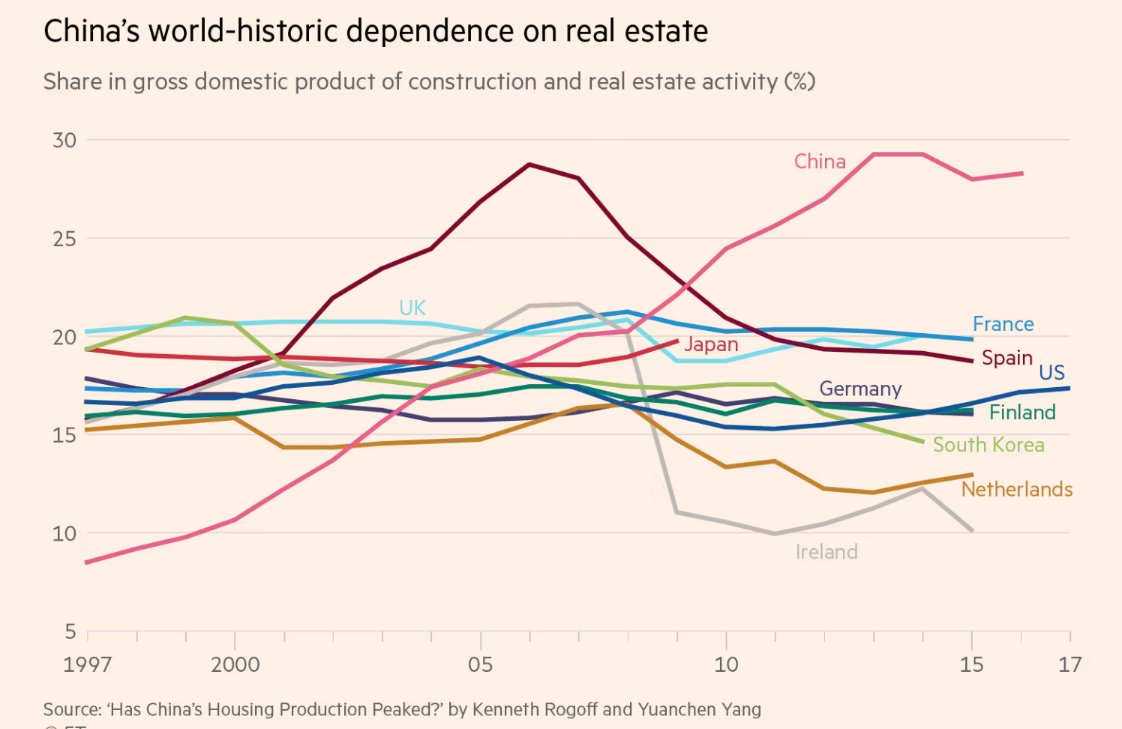

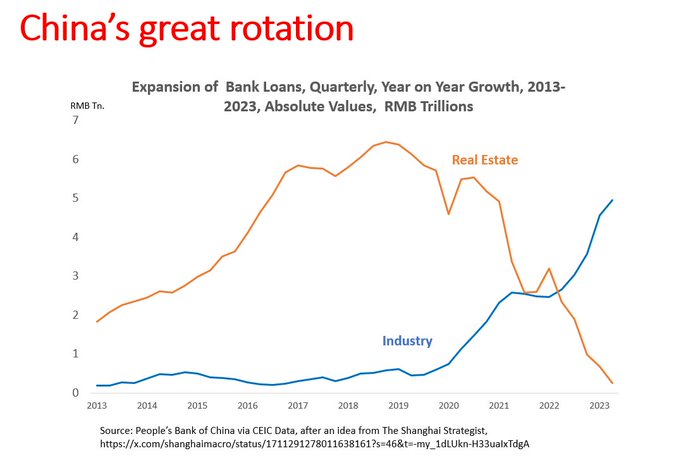

The second play was the housing driven internal capitalization market to make people at home feel good and fund local governments. Local governments (who control about 70% of the Chinese budget, far higher than any other major nation) oversaw massive development deals. Housing values rose, the governments made lots of money as they kept rising for decades. Similar to how for a long time now betting on rising real-estate prices in the US or Canada or the UK was a sure thing.

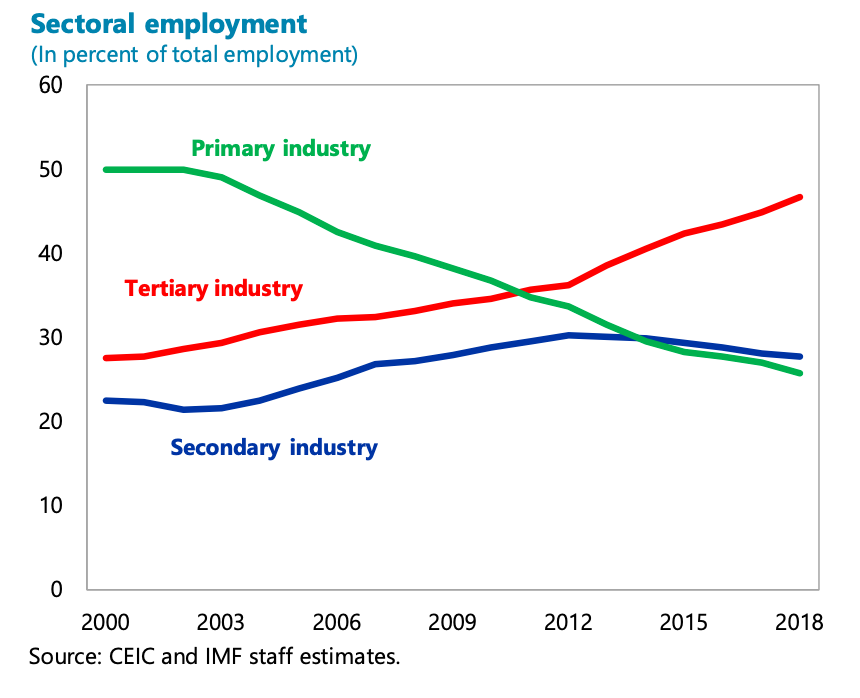

This synergized with moving peasants off the land and into factory and service jobs, which allowed for large commercial farms, seen as far more effective than small farms, let alone collectivized farms. (No one has been able to make collectivized farms work so far.)

This is standard, again, to industrialize you need a labor pool, and peasants tied to the land and ancestral villages aren’t free labor.

One problem with this play is that it is a “virtuous” or self-reinforcing cycle and it can get completely out of control (see above.) The second is that it makes local governments very dependent: they don’t want it to end, even though it leads to massive inequality and mal-distribution of resources.

But that chart shouldn’t be seen as entirely a bad thing: note that US housing prices are ludicrously high by restriction of supply. The Chinese ARE and did supply a lot of new housing. The problem is it now isn’t getting to people who need it.

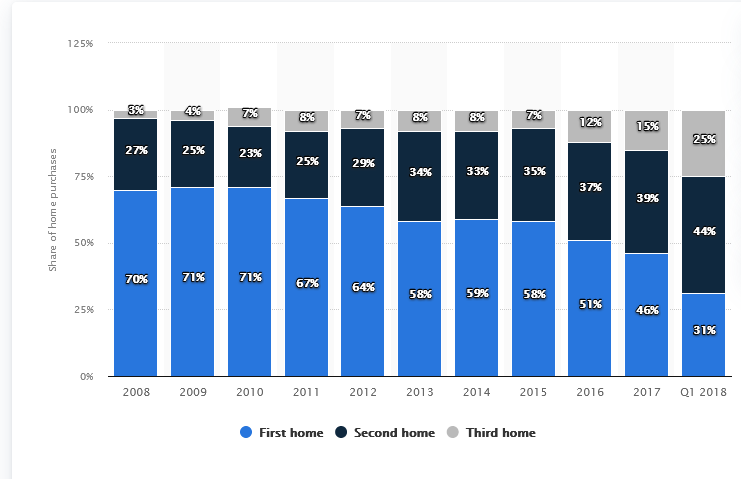

The above chart is pathological, and notice that it only goes to 2018. Anecdotally, young people in China, like in the US or Canada or the UK just can’t afford to buy a home unless their parents pay.

The second play, by the way, is often used independently. Turkey, for example, got about a decade and a half of prosperity out of it, but without the underlying “real” economy to support it, all it lead to in the end was inflation and economic weakness, because gains are always very unevenly distributed.

The problem with these two plays is that they are time bounded and lead to the middle income trap. They don’t develop a consumer economy, and income stagnates: far above undeveloped, but much lower than high income nations like the US, Japan and so on.

Likewise, these plays lead to extreme levels of inequality, as they did in the US during the gilded Age.

So, China had/has problems: high inequality; a gilded Age; housing which isn’t getting to those who need it. The social contract of “if you work and get a degree and so on, you’ll do well, is on the edge of breaking.”

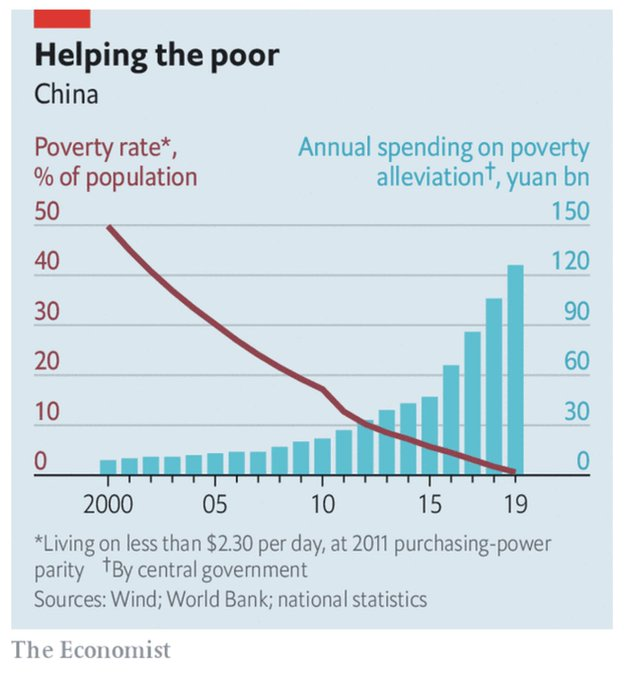

But they’re working on it. Some parts they’ve already somewhat solved.

Solutions

The first is poverty. The extreme poverty metric is garbage, but the chart still indicates that there’s a hell of a lot less poverty than there was even twenty years ago.

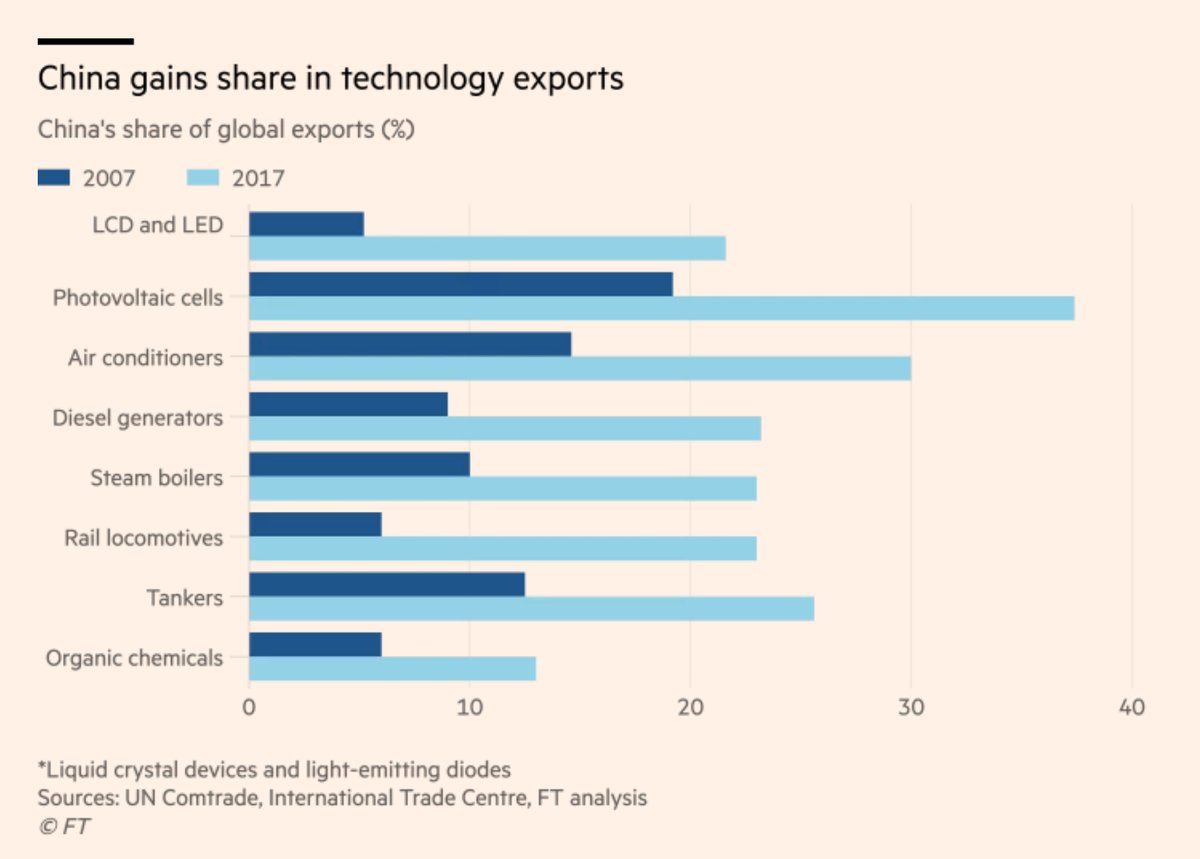

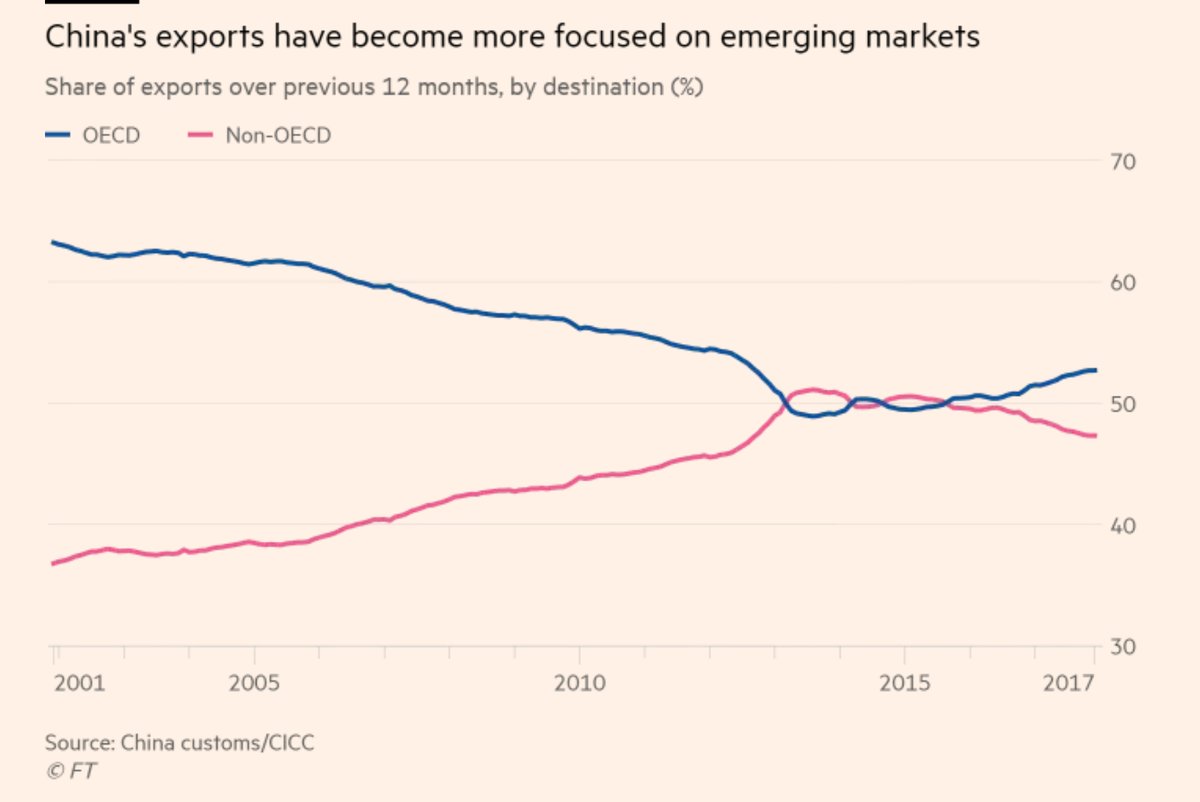

The second is what is called “moving up the value chain.” Countries which industrialize tend to recapitulate history, starting with textiles (the first industrialized goods.) But if you want to become a high income nation, you need to produce the highest value-add goods. China now does, and has even deliberately been moving out low value industry to other countries.

For a long time, if you wanted to buy advanced goods you had to go to the West, Japan, South Korea and Taiwan. That was it, and all of those are firm members of the “rules based order” or, really, of the US. Now you don’t, and China is absolutely eating the West’s lunch. France’s exports to its ex-African colonies, to name just one, have absolutely collapsed. China offers better deals with less political and military interference, and now that those nations don’t “need” France, they’re kicking France out.

But if the rest of the world doesn’t need to buy from the West, in the medium to long term, they aren’t going to sell to us, because we have so little they want. This where we move into Western collapse mode and is a large part of why, ex-climate change and environmental collapse, China would have already one, except perhaps for some shooting along the way. (Much like America’s ascendence was already baked in by 1900.)

Moving to a high income, goes in two phases: first you increase manufacturing, then you increase services. (Manufacturing is secondary industry, services are tertiary, and primary is resource extraction in the chart below.) Again, you can see China is making this transition, and blazingly fast, too.

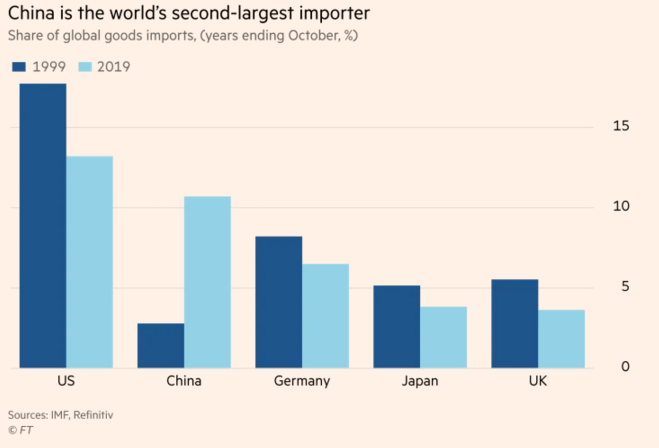

Key to being a high income nation is a consumer economy. While you want to create as much of the goods and services as you can domestically, there is always a transition from “living with what you have” and “spending almost all your foreign money on capital goods” to “we can now import stuff.” China is well on its way.

But China’s main issue now is the real-estate market. Prices are too high; it’s an investment and speculation vehicle; the people who need housing aren’t able to afford it, and since China has enough housing now, further investment is a mis-allocation of resources.

Which leads us to—

Boom. China is crashing the real-estate market. In the western press this is viewed as bad, an economic crisis, but it is necessary. Housing needs to become a commodity good, so that everyone can afford it and so that resources go to more needed areas.

And while making it to high income includes a lot of consumption, China has challenges which can only be met thru manufacturing, engineer and science. It needs to leap past the final western barriers in industries like semiconductors, biotech and aircraft. It has to transition to a clean electrified economy and prepare for climate change. (Really, to avoid a collapse, they have to build a massive sea wall along the northern coast, otherwise the northern breadbasket will wind up under water.)

From where I sit, China is doing most of its major economic policy correctly. Transitions are painful, and it is possible they’ll botch their transition, but these changes are necessary. Indeed, if the West is serious about re-industrializing, we need to do the same thing, with certain differences. We need to build more housing and collapse pricing, where they need to build less housing and collapse prices.

There’s more to write on China, in particular about climate change, demographics, Covid, Chinese dependencies and so on, and we’ll return. But for now, this is the big picture.

About two-thirds of these charts are from Albert Pinto’s twitter account. Worth following.

https://twitter.com/70sBachchan

Donors and subscribers make it possible for me to write, so if you value my writing, please DONATE or SUBSCRIBE

StewartM

Ian, this post was awesome, and a much needed-correction to the smug Western “China is in crises!!” lamestream media reports. Yes, an economy that is ‘investing’ in flipping houses isn’t investing in anything that is truly economically worthwhile.

I’ve always thought we should redefine “investment” not to mean “putting resources into something that makes me as an individual short-term profit” but rather “putting resources into something that will create more goods and services and value”. The stock market was supposed to be the latter model (lending a company money to invent and create more); however once you started to allow stock buybacks and acquisitions it ceased to be that.

The impulse just to buy and sell assets to make profit, actions that do not create value, any decent economy should ruthlessly suppress by either taxation or banning it outright.

KT Chong

There was another huge problem with out-of-control housing prices in China.

In Chinese culture: for a woman and her family to accept a man’s marriage proposal, he has to have a house. When a man does not own a house, then he can’t afford to get married and have a wife. Often, Chinese women would refuse to date a man who does not have a house; (unless you are a foreigner or white man, then you are exempted from the rule.)

So, when the prices of houses are out-of-control, it becomes a societal problem in China: young men (who have not yet establish themselves) are unable to afford to buy and put a down payment on a house — and, therefore, unable to afford to marry a woman. Which leads to the bigger problem of people not having children.

Ironically, I first heard about that rationale from Kyle Bass, (who HATES China.) It explained why Xi Jinping might have deliberately crash the real estate market because demographics is a bigger problem than real estate in China.

Link: https://www.youtube.com/watch?v=Q9WGsY1VvZE

Jan Wiklund

Just a small correction: there are few economies of scale in agriculture. There are too many local soils and local climates, and monocultures aren’t very sustainable. So just as big units as a family can manage seems to be the most economical. But of course the family has to know what it is doing, and they must have the resources to do it.

See for example USDA Census of Agriculture 2002 (quoted by the source I have). Small and medium-sized farms yield more per area, both in money and output – and they are also more likely to use environment-friendly methods.

Purple Library Guy

@Jan Wiklund That isn’t really a correction. You can stipulate all that, and if your objective is to kickstart industrial development, still want to move to large farms because they are less labour-intensive and so will stimulate an exodus to the cities, creating the industrial workforce you want.

Incidentally, another side note on farms: Nobody has been able to make collectivized farms work well so far. But people HAVE been able to make COMMUNAL farms work well (and are still doing so). The major difference being that the former is imposed from the top down, generally by people who know jack about farming, while the latter is generally built democratically from the bottom up, by the farmers themselves. The results and objective of collectivized farms tends to be large-farm monoculture only less efficient, while the results and objective of communal farms tends to look like small farming, with a lot of organic techniques and diversified crops/livestock, but with pooled resources to accomplish things that are hard for individual small farmers to do.

Jorge

The budgeting is, as you note, very decentralized. I find it helps to understand China by reversing the joke: “Africa is a country”. China is in many ways its own continent/planet. It has centuries-old playbook for running a very large and diverse empire.

It has many things not found in other countries. Example: armed standoffs among security arms of different governmental entities. Imagine the state fish&game wardens in an armed standoff with rural county cops. I don’t think anybody gets shot, but these do have to be mediated/talked down.

Joan

Question from a clueless person: let’s say you own a townhouse that you mortgaged for $200k. But then more housing is built which is definitely good for your community. However, if it were to get extreme and now your townhouse is only worth $100k but you’re still on the hook for a $200k mortgage, wouldn’t this just make a lot of people go bankrupt? (I’m asking this in good faith, just to be clear.)

Jan Wiklund

@Purple Library Guy: There is also a bottom line of the size of a farm. I realize that there were too many people in the Chinese countryside in the 20th century, and that all of them were not needed there to produce the necessary food.

But family farms are still more efficient, per area, per hour and per dollar, than big industrial farms worked with wage labour.

JohnnyGL

@Joan – Historically, the least painful way to transition out of this sort of thing is to inflate away the debt. If you let inflation run a 4% (with wages matching or exceeding inflation) while house prices stagnate or barely rise at all (falling in nominal terms causes more problems, or at least indicates the existence of bigger problems) then you are slowly moving things in the right direction.

This isn’t without costs, but it’s usually the least painful combination. To be clear, it takes years to work through.

Justine

My thoughts and prayers are with all the human beings forced to become wage slaves in China, just as previously happened in Britain, the US, etc. This “enclosure” of the ability for regular people to simply live their lives is appalling no matter when or where it occurs.

And of course it only benefits the elite of whatever country it’s happening in.

different clue

@Joan,

As a fellow clueless person, my best guess is that . . . if you still had the same job as before and still made as much money as before and could still afford the same payments as before on the townhouse you mortgaged at $200k and nothing changed in your ability to keep making those payments, then you would just keep making them even if the townhouse was now “worth” only $100k. If you were still able to keep making the monthly payments till you paid off your mortgage, you would still end up owning the townhouse which would still be just as good a place to live at $100k as it would have been at 200k.

You wouldn’t have made “money” on the “deal”, but you would still own the same just-as-good a place to live in.

Justine

I should add, as well as becoming wage slaves, they are being forced into China’s surveillance state, perhaps the creepiest in the world. And that’s saying something.

On the other hand, China’s fossil fuel, mining and coal use are through the roof, so that’s good, right? I mean, for their industrial growth and strength anyway.

Ian, I don’t understand how you can be so concerned with global warming and ecological overshoot and still root for massive industrial growth in China – or anywhere.

Or are you not “rooting” but simply reporting? But if that’s the rejoinder, then I would counter that you are not simply reporting when it comes to other countries (primarily in “the west”).

I understand how abominable “the west” is. I am not here to defend it. I just think that with all the meditation you do, and all the grand insights you offer on life…it just seems entirely out of place. Frankly, it’s often hard to believe you. You seem so genuinely principled when it comes to life sometimes, and then other times it’s as if I’m reading an entirely different person.

Am I missing something?

Ian Welsh

I’m analyzing, not cheerleading and every article doesn’t cover everything. In the past I’ve written about enclosure in China, noting that people who stay in the villages are happier than those who leave.

Willy

I don’t mind government elites who try to be competent on behalf of the people. Try to maintain a ground that’s almost as fertile for their citizen mob as it is for their own greedy selves. But when they peddle that greed is good, just because that’s the only thing that works for themselves emotionally, I think they’ve crossed a line.

And we all know what’s on the other side of that line. Environmental collapse. Meth hollers and tarp towns. Endless drug commercials depicting young beautifuls living American dreams doing stuff no real American does anymore because they’re all indoors playing video games and binge watching Hulu, alone.

I’d go on about how greed starts out being good but greedy intentions always pave roads to hell (or some other bad aphorism), but we already know all that.

Which of course brings me to anacyclosis. The USA is just further down the hellish part of that road than China is. Maybe someday, they’ll have their own demagogue spouting gibberish about making China great again to crowds of Bonhoeffer cult zombies, while the smaller nations nervously chuckle to themselves.

Me, I try to consume less. Recycle and repurpose anything I can. It’s not so bad. There’s a personal fulfillment in that, although your consumerist nieces and nephews might think you mad. But they’ll be learning soon enough. I also try to remind people of the good stuff China did have before Nixon visited, now being lost on their own travels down the consumerist fury road.

StewartM

Joan

Question from a clueless person: let’s say you own a townhouse that you mortgaged for $200k. But then more housing is built which is definitely good for your community. However, if it were to get extreme and now your townhouse is only worth $100k but you’re still on the hook for a $200k mortgage, wouldn’t this just make a lot of people go bankrupt?

Why would that result in you “going bankrupt”?

The whole idea Ian is pushing, and I agree with, is that you should view housing as more of a commodity expenditure more than an investment (it ultimately saves you money in the long run, even in the situation you describe, as eventually you’ll have no housing payment. We don’t say you “go bankrupt” just because your car and other things nearly ALWAYS depreciate, so why is it a problem if your house sometimes depreciates? (Unless you’re foolishly basing your retirement on your home’s value).

In fact, many people who have paid off their house do NOT want them to gain value, as their property taxes will go up. That was the big incentive behind California’s Prop 13 in the late 70s, as people who had bought houses and paid them off saw their housing value skyrocket due to surrounding development so much they could no longer afford to live in the house anymore. These people certainly weren’t happy about their $50,000 home suddenly being worth $500,000.

One solution to this, I’ve been told, in some states is not to collect these property taxes until after the death of the home occupants. This to me is still unsatisfactory, as the children or heirs will likely not be able to pay the taxes either, and thus will be forced to sell the home to pay the back-taxes. A much better solution to me is to base the property tax value of any home solely on its worth as a structure, and not be influenced by its location at all (in our case, that $50,000 home will thus only grown in value due to inflation, and stay $50,000 inflation-adjusted.) Of course, if the that $50,000 home is sold later for its market value (influenced by neighborhood) of $500,000, then the state can step in and recoup its taxes on the sale. But the point is that its current occupants or their heirs are never forced to sell and move out due to changes in the market value of their home.

I prefer my method as I feel the first method drives neighborhoods to become segregated by income (i.e., all the non-rich people are forced out) whereas my solution allows people of more modest means to live in ‘rich’ neighborhoods. I count that as a plus.

Tallifer

Amen to @Willy!

Zapster

Some of the above is suffering from a lack of understanding of China’s political system. The analysis is mostly right on, but I can some misunderstandings there, and also in the comments. I suggest listening to this podcast (or reading the transcript, down the page) from a man who has lived in China for a long time and studied how it actually works. https://chinarising.puntopress.com/2023/10/25/regis-tremblay-asks-jeff-j-brown-who-is-in-china-is-it-free-capitalist-democratic-china-rising-radio-sinoland-231025/

Richard

As the person who brought Giovanni Arrighi’s work into both the law and American management literatures, I can safely say that Ian’s analysis fits his predictions perfectly. I assume you’ve read him?

Carborundum

Family farm is not the same as small farm. Yes, most small farms are family farms – but so are most large and very large farms. Family farms can be 10s of thousands of acres. I personally know three family operations in excess of 30 thousand acres and another in excess of 40 thousand and the number of them has increased markedly over the past 15 years. Yes, they are significantly more efficient than non-family farms of equivalent size, but they are every bit as industrialized.

Two dirty little secrets with the productivity of small and very small family farms are that the increased productivity doesn’t add up to much in the aggregate (i.e., it isn’t going to feed the world) and it tends to be over-indexed in areas that don’t matter much ( e.g., meat production, non-staple crops, etc.).

Ian Welsh

I have not, perhaps I should take a look.

Most of it’s just based on a lot of reading in what actually happened in historical developed societies to get there.

Ian Welsh

I’ve experienced involuntary hunger, but fortunately never been without power/water/heat/shelter for any length of time.

Joan

Thanks to the people who responded to my question on home value, I understand. I think in the case of my example, it would be fine if the hypothetical person were planning to stay put. But it would be a problem if they had to move cities for a job or anything else. I definitely agree that putting your retirement aspirations on a home sale is foolish, but if a person needs to move cities and their $200k mortgage is on a house that is now worth less than that, then they’d be on the hook for the remainder while not even living there anymore and trying to find housing in a new place. I don’t need to make a profit, but I at least need to break even so I can then find a home in my new city, right?

anon y'mouse

after building thousands of coal plants, destroying waterways with dams and still needing to import mass amounts of food far into the future, China will “go green” how exactly?

it’s odd to see environmentalists tout the ultimate industrial state, that on the way up cared just as little for their environment as ours did when it grew, just because they claim they are “addressing their problems” with greenwash (same as all, no worse but also no better).

and no, exporting tons of solar panels doesn’t tip that balance to “net zero”.

StewartM

Joan,

but if a person needs to move cities and their $200k mortgage is on a house that is now worth less than that, then they’d be on the hook for the remainder

That’s true, especially true in the case of a large downsizing (a big industry in a small town has a mass layoff, and then most homes will be less than their market value. That was one reason why I chose to pay rent for almost 20 years instead of buying (of course, there was some housing inflation then, but nothing like today).

The only advice I can give you is the contrarian advice to buy cheap, as ‘starter homes’ depreciate less in value and are easiest to sell. I do know some professionals who stupidly bought $500,000 homes (expensive for Appalachia!) then decided to leave the company and the last time I heard that home still wasn’t sold. Apparently they’re still paying for it, and the taxes on it.

Richard

Arrighi’s best book (co-authored with Beverly Silver) is Chaos and Governance in the Modern World System. Cliff Notes version: there have been four hegemonic waves of global capitalism since Columbus: Hapsburg/Genoa, Netherlands, UK, US. Each waves ends with about a generation of financial hypertrophy and heightened degree of war, and a new hegemon emerges from the rubble, with a new set of comparative advantages.

Ian Welsh

Sweet Lord Jesus give me patience.

China is not a green state. China has been increasing coal (may do an article on that soonish.)

I wear a few hats here. One of them is doing proper macro-historical and macro-economic analysis. That’s what this is. To say that they are handling the normal issues of developing to a high income state does not mean I approve of the environmental damage they’re doing.

I’ve written multiple articles trying to explain this issue but simply put someone (including some state) can do things that are good and things that are bad, and sometimes something that is good can have terrible knock-off effects. So China lifting hundreds of millions out of poverty was done in ways that cause climate change (though if the industry had stayed in the US and Europe, it’d still pollute. But richer people pollute more, so yeah, getting people out of poverty in the standard way has issues.)

Carborundum

It’s worth noting that China anticipates commissioning 6 – 8 reactors per annum for the next 5 years at least. It will take considerable time – and technological advances – for their buildout to account for a significant proportion of power generation, but they are moving in the right direction. I expect a significant dimension of the nuclear renaissance will be Chinese.

anon y'mouse

i would love it if you opened up the topic that way. but then again, that’s my overall interest.

there is a clear dichotomy or perhaps even paradox inherent in technological development. and i don’t necessarily believe in “rising tides lifting all boats” nor in expanding the pie to have more pie for everyone. our society has proven that isn’t the way it goes, necessarily.

if one wants both to live at a high technological level (thus “footprint” of some kind–area of necessary renewable and non-renewable resource usage to sustain that level of consumption), then basic math seems to indicate that one should be more rare upon the earth than the great white sharks or the giant whale species.

this is why i don’t necessarily trust the “multipolarity” diatribes we’ve been subjected to. would it be nice to share the wealth? yes, but even so we would then ALL land (as an entire species) into the problem of using a great deal of non-renewable resources to maintain those standards.

in many ways, mud huts and tree bark fiber clothing really is the most sustainable living. the problem is, no one wants to do it (nor would most of us, myself included, know how).

i wasn’t accusing you. i was just saying that it’s always interesting to me to see it. in numerous places you get this “China is doing this really great thing–amazing to watch and if true and not hype, can help the world” and all can think is—help them into the same boat that the highly developed countries have already started sinking in?

like, why is China encouraging car ownership? is it because in order to promote domestic consumption and have certain tech development within their country to use for other purposes, they need a domestic car industry? how will the stupidity of suburbanism, driving everywhere for a quart of milk, and so on be discouraged? the U.S. has just spent my entire lifetime building crappy developments on the farmland that was traditionally used to feed the cities (thus avoiding the 3k mile salad bar issue), just so people could afford to drive 3 hours to sleep in a crapshack with stucco on the outside and some sad lawn rolls placed over the dirt.

and really, that is the best we could do. because living in a huge Tokyo-esque landscape is not ideal for everyone (i grew up in an inner city ghetto, although of the single and double story kind and it had benefits but lots of drawbacks). perhaps it’s only ideal for a few, and we were not able to maintain such spaces in that kind of condition (barring perhaps NYC, and even that has become something else). i don’t see China wanting what comes with a domestic consumer society. and yet they seem to try to figure out how to replicate what we Westerners have already proven doesn’t lead to significant satisfaction (hey, i personally do sleep better in a suburb than ever in a ghetto–fewer bullets to dodge, for one. but there’s crap all to do out there except flip meats on the bbq and mow the lawn).

instead of 50 pairs of shoes, i would much rather somewhere interesting to go in the 5 pair i should rationally own, and something interesting to do while there. meanwhile, they have gotten rich by indulging our sweet tooth while trying not to let it catch on at home. i just don’t see how they’re going to work that angle. especially since the people they have now are supposedly “lying flat” because they see little reward for the efforts they have made same as our millenial/post millenials.

why would or should they replicate our idiocy, and how can they avoid it having taken a similar path to “development”. i congratulate them on their high speed trains, but if their solution to say, domestic food production is going to be something like “vertical farming” then they are going down the same dead end–trying to end-run biological systems through tech means you are basically controlling all condtions, inputs and outputs and that requires a lot of materials and energy.

sorry, i’m rambling. i wasn’t meaning to accuse you. but it did elicit a fruitful response from you. i just see way too much uncritical China boosterism around due to this PR effort.

if a true multipolar world is possible of non-exploitation and dominance heirarchy, then i’m all for it but all i see is them trying to corral by charm offensive the same resources we took pretty much by force and fraud for their own development and call that “win-win” (we all know—the powerful always win and the less powerful might get subsistence if lucky, or shiny baubles if less lucky). the world is only capable of so much surplus, after all and it’s time the rest of the world had a crack at exploiting it. i just really pray that they don’t do the same stupid shit with it we seem to have done when that seems to be nearly the same road they’re going down. and convincing the rest of the world to do that, too. we don’t have enough worlds for this at present population levels, nor even perhaps half our present population levels.

anon y'mouse

Joan—

ideally, people would buy homes for the security of a place to live where the landlord can’t arbitrarily torture you, and as a secure buffer for your old age as well as a place to raise a family in. but of course, since a lot of the wealth of individuals and families ends up going there, it becomes a store of such and then like any other “investment”.

there are two paths i can see if you just can’t keep living there at that price for some reason–jingle mail, or what i proposed the last time we had our crash and that no one wanted to engage in because it would disadvantage the advantaged and run against the “it’s your moral, perhaps biblical, obligation to pay every penny you owe”—-everyone takes a haircut.

so, the way i thought this should work is that the bank essentially created the money you paid for your mortgage out of thin air, that money is now gone and so is the “investment” that was made with it. the house still stands, you get advantage by living in it and the bank gets advantage if they don’t have to deal with jingle mail and sell it on the market at a sure loss, and they get advantage if they keep collecting interest from you.

so everyone takes a haircut proportionally to the “new” value and the banks write it off their taxes. if you, at present, “own” 50% of the equity and the bank still owns the rest, you both take a haircut of equal value down to the present value, and you go on living there and paying them until you own the 100% of the new equity. bankers would complain, but they complain about everything anyway and the last thing they need (unless they are all invested on the opposing side of the fall in those REITs which hope to capitalize on people jingle-mailing, which is a real possibility) is a bunch of houses to offload at half the price in a falling market. granted, this in no way addresses stuff like mortgage backed securities and all of that duplication of “insurance” on those investments, which is what became an insoluble nightmare the last time around for us. hopefully they don’t have those in China, because hopefully they are slightly less insane than we are but if not, all of those followers on from real assets should LOSE THEIR ASSES. that’s what investments are—a thing that carries risk. the riskier, the more you may gain and lose. but we all know that couldn’t happen to us here last time around because those people that own those particular assets, own this entire country and nearly everyone in it.

as far as my limited understanding of Chinese finance goes, this would be even MORE possible to carry on in their system, since the finance derives essentially from the government and not solely under the purview of private banking empires. they can just write it off, write it down, and carry on.

we would have been in much better shape last time if we had done something like that to allow homeowners to stay housed and inflated values to be wound down in a tolerable manner without substantial compounding issues. but i am sure some smart financial people will be along immediately to tell me that my solution was and is utterly impossible forevermore because investor money and their complex pieces of paper saying they “own” something and are due endless lifetime payments from the rest of us just to live and eat is sacrosanct, or somesuch.

Itsmeagain

Good article but please explain in slide 2: how there can be more second homes 40%+ than first homes 30%+. By definition the number of second homes must always be less than the first home, right?

Adding a source would make the chart useful.

Thank you.

Ian Welsh

The chart is of new purchases of homes.

Speak Not

“living in a huge Tokyo-esque landscape is not ideal for everyone”

Tokyo is 1000% more livable than any city in America. Green space, small neighborhoods (even within huge neighborhoods, just off the main roads), walkable and public transit heavy.

anon y'mouse

even so, some of us can’t handle that much stimulation.

our nervous systems had enough already.

a “walkable”, nice city would be nice. but it’s not pleasant to be surrounded by buildings that block out that much sun.

SF was more than enough for me, back in the day. Portland was then “just about right” but already too mobbed with people. and no, neither for all of their being touted as paradise for some was all that great, but they did have transit. you still had to spend half your life on it to get anywhere, and still very likely had to drive for a gallon of milk or more than a few emergency rolls of toilet paper.

people mock those who order online for such trivial things, but in those places it can be a godsend. not having to try to arrange transit, or pay taxis or lug that stuff back was very helpful. not having to spend all of that time was also great.

the most livable neighborhood i ever occupied was a “main street” thoroughfare that was nearby to an area with multimillion dollar homes. you could get nearly everything you needed on that street (albeit, prices were inflated). there was even a local grocery. of course, the millionaires would drive but I could walk and do everything i needed to do along that one strip including hit the pharmacy and the post office, and my hospital was right at the end, a block over. of course, rent around that area was insane even 30 years ago because most of the buildings were offices for hairdressers and therapists and other professionals.

they are never going to offer such areas in the U.S. at any price that a non-credentialed professional can afford. so despite that this paradise “exists” in Tokyo it does no one here much good.