Every once in a while it’s important to do a policy piece, to show how society could work if we wanted to do the right things. Not because I think anyone in the West will implement enough good policy to matter, but to show that it is possible.

Every once in a while it’s important to do a policy piece, to show how society could work if we wanted to do the right things. Not because I think anyone in the West will implement enough good policy to matter, but to show that it is possible.

Back at my last corporate job I did a major workflow redesign. In the notes to management, along with the technical details were two highlighted lists. I noted that in order to receive the benefits of the change:

- Do these things, and;

- Don’t do these things.

Management appears to have reversed the lists. I left not long thereafter, and I was one of only two people who understood the entire workflow of the department. (I accept plenty of the blame, I didn’t play politics well or understand the sheer cupidity of management. I should have understood the second at least.)

The point is that policy often requires a number of actions to be taken, and that opposing action not be taken. You can’t just pick and choose: policy actions must support each other.

Big Picture On The European Economy

Europe is in decline.

- Energy costs are too high for their heavy industry and many modern internet and computer technologies.

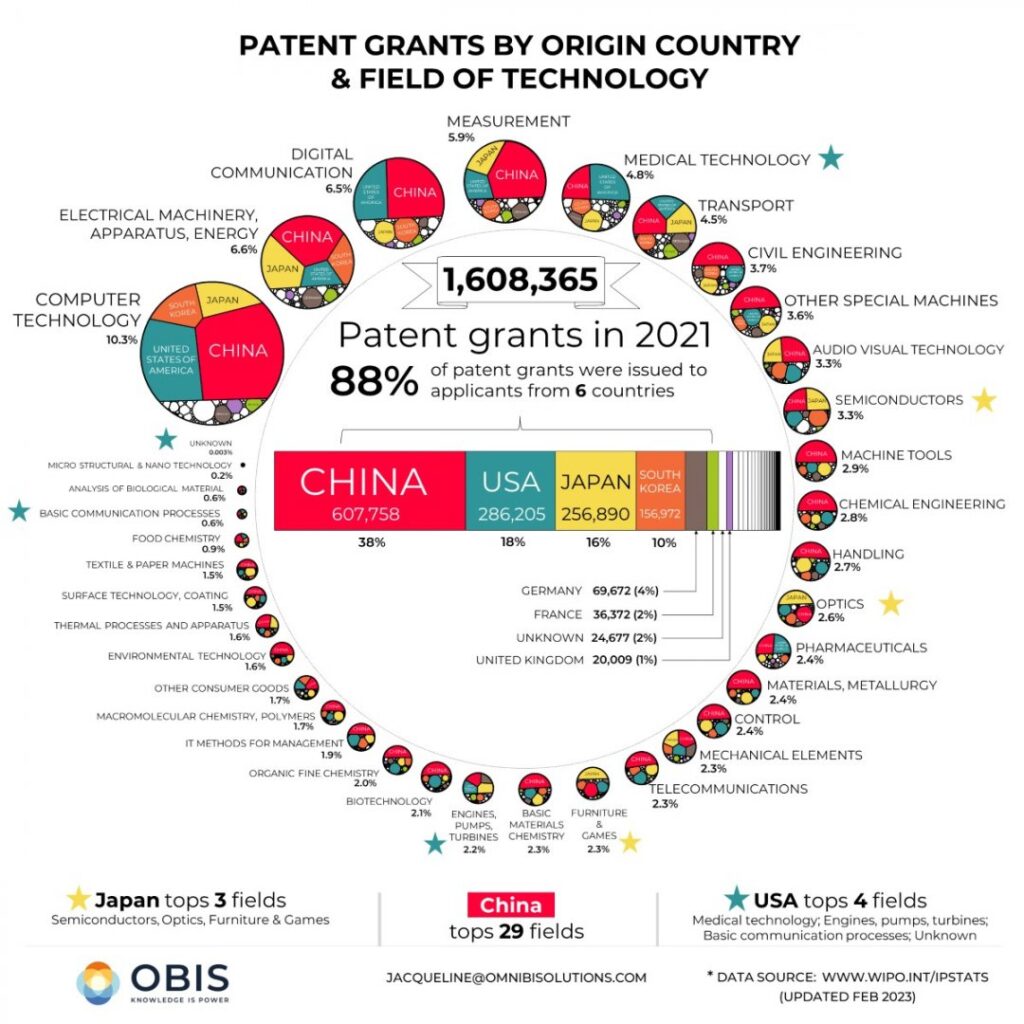

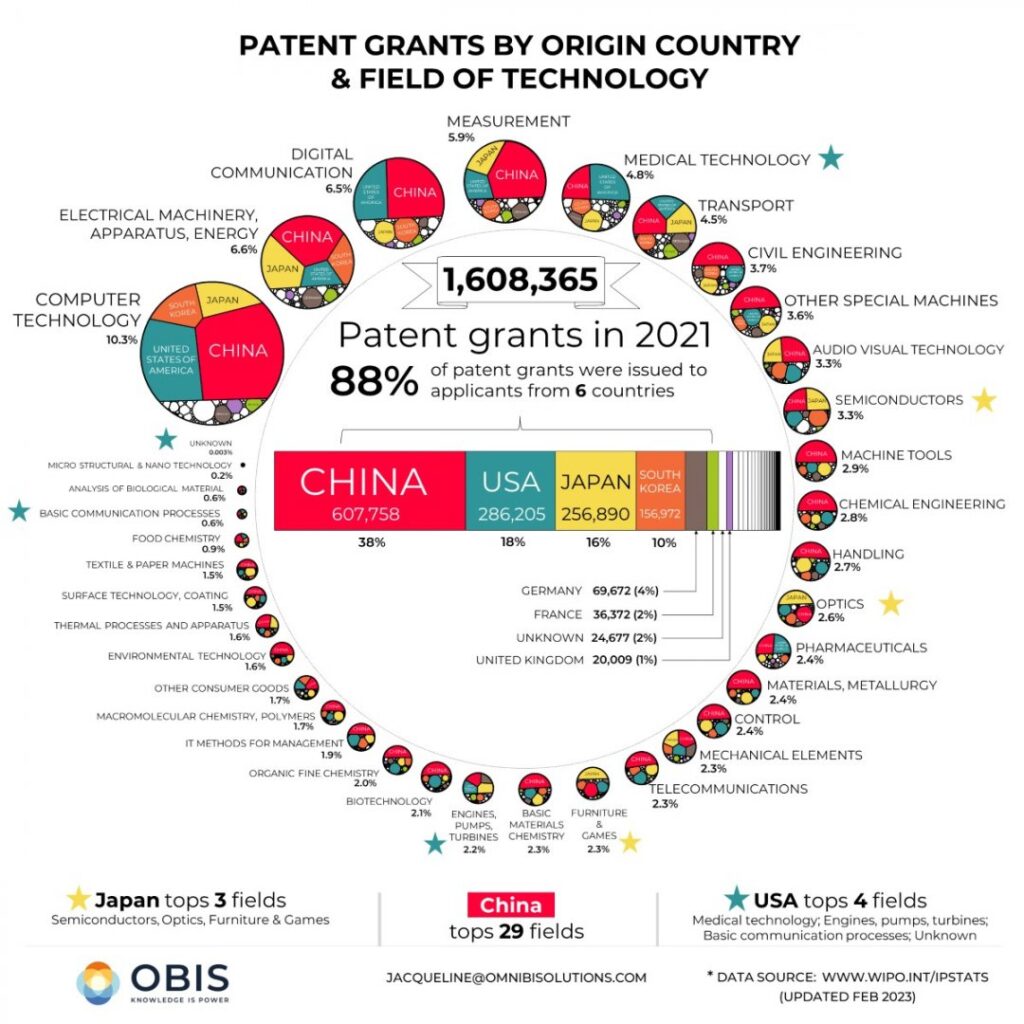

- They are not in play when it comes to scientific and technical research.

- They don’t produce significant raw or refined resources compared to other regions, with the single exception of basic agricultural crops, and the end of AMOC will smash European agriculture, probably sometime between 2025 to 2075;

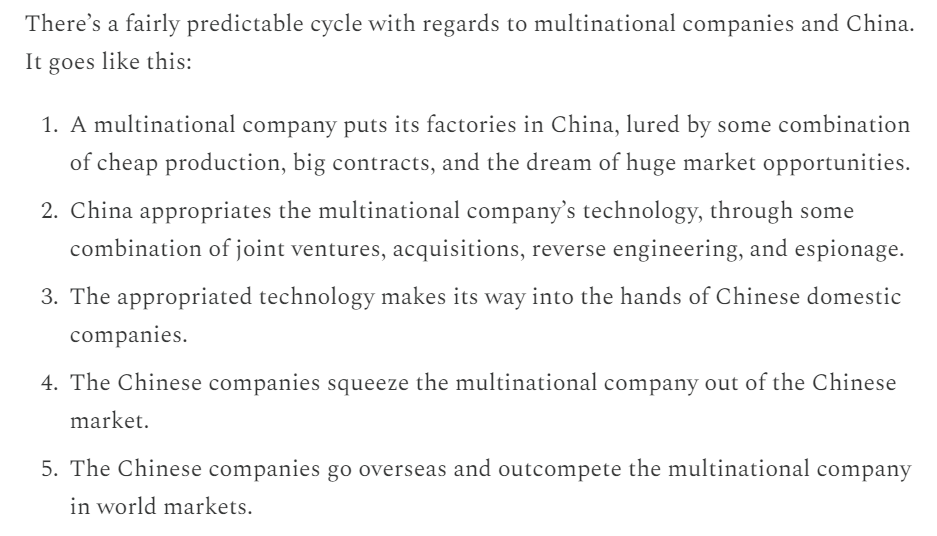

- The Chinese are pulling ahead in major export fields, like automobiles;

- They import much of what they need, and pay for it with exports;

- They aren’t creating a lot of new companies with new products and are, generally, falling behind in old technology;

- Much of their industrial base is moving out of Europe (Germany, mainly). Much of that to the US.

- Their cost structure is too high,

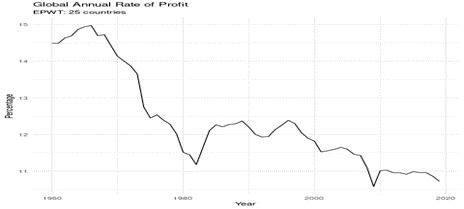

European prosperity was based on being able to sell advanced tech to less-developed country. Until recently, if you wanted that tech you could get it from Europe, the US, or other Western allies like Japan, Taiwan and South Korea. But now that tech can be bought from China, who almost never sanction, don’t lecture and sell and finance for less while not telling less-developed countries how to run their internal economy.

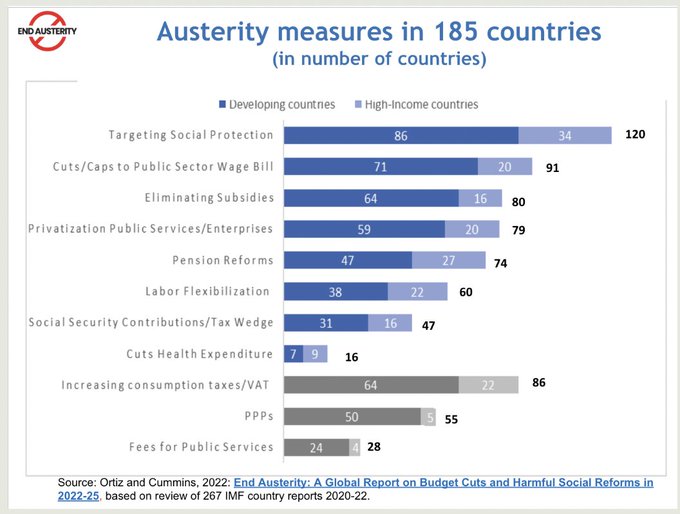

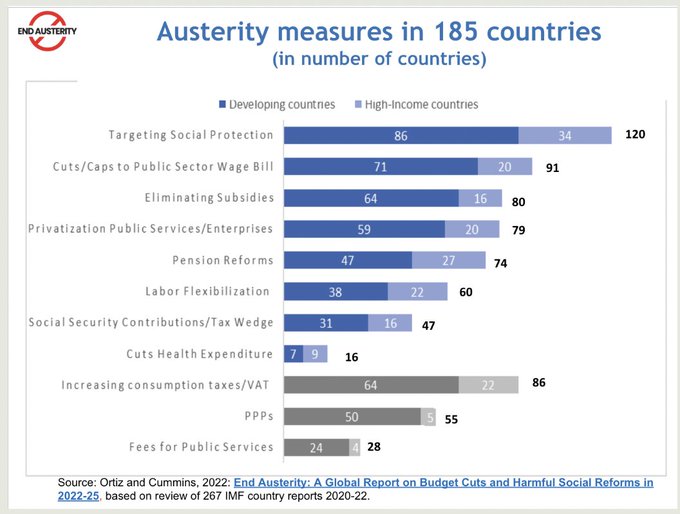

The IMF was the main economic enforcer in Western hegemony. These austerity policies in developing countries were generally a direct result of IMF requirements, or undertaken due to general financial pressure:

But this ability to force the third world into selling cheap resources to the West in exchange for Western tech and finance is coming to an end. Burkini Faso recently declined an IMF loan which was contingent on austerity measures, for example.

So Europe is in serious decline, and the structure of the world economy is moving from one designed to support it to one that no longer needs it. To put it in market terms, they’re actually going to have to compete again, and can’t keep coasting on advantages created generations ago.

Like this lists I produced for my ex-bosses, the policies which follow are intended to work in concert. Each of them is required, not optional. It will be obvious that his wish list is politically impossible, which is part of why European decline will continue.

End Austerity

Europe still has a fair bit of room to maneuver. They produce plenty of food and they still have a fair bit of industry left. Austerity needs to end. Government needs to spend. What it should do is arrange that spending to be used mostly on internal goods: if you give money to people for food, you want them to buy what Europe produces. Domestic production must be ramped up for what people and companies need and the necessary tariffs, barriers and subsidies put in place so that government spending mostly creates European demand. (Many further policies are based around making this happen.)

End Neoliberal Taxation

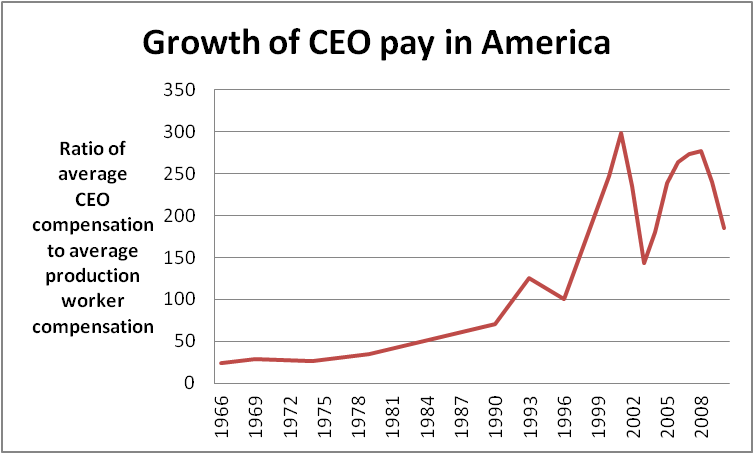

This means high marginal tax rates on income, including corporate income. High estate taxes. High corporate taxes on profit not reinvested. End all stock buybacks and stock options and end the doctrine of shareholder supremacy.

Institute excess profit taxes on all old products, probably basing profit levels on 2019. New products will be allowed to make higher profits, perhaps as much as 30%, with the amount of time dependent on how new they are. A product which is only a minor upgrade or alteration will not qualify.

Understand that government’s job is to create positive externalities. Government can fund actions, like good education and health and industrial subsidies because it doesn’t care who makes money from them. But this is only true if it recaptures that money from whoever is making lots of money. You let ordinary people keep most of their income but you take most of the money back from winners, then plow that money into further policies which create positive externalities.

So high marginal tax rates are necessary to run good industrial and social policy.

You also need to ensure that companies are using their profits to reinvest into the business, especially with reference to creating new products.

While you’re at it, you must put an end to moving money offshore to avoid taxation. No significant amounts of money moves outside of Europe without being taxed first. Criminal sanctions for anyone who tries and anyone who makes it possible.

End Sanctions and Sanctimony

Unilaterally end all sanctions against China and other countries, including Russia. You need their cooperation to fix your economy. Stop lecturing other countries on human rights, unless they reach severe heights like genocide.

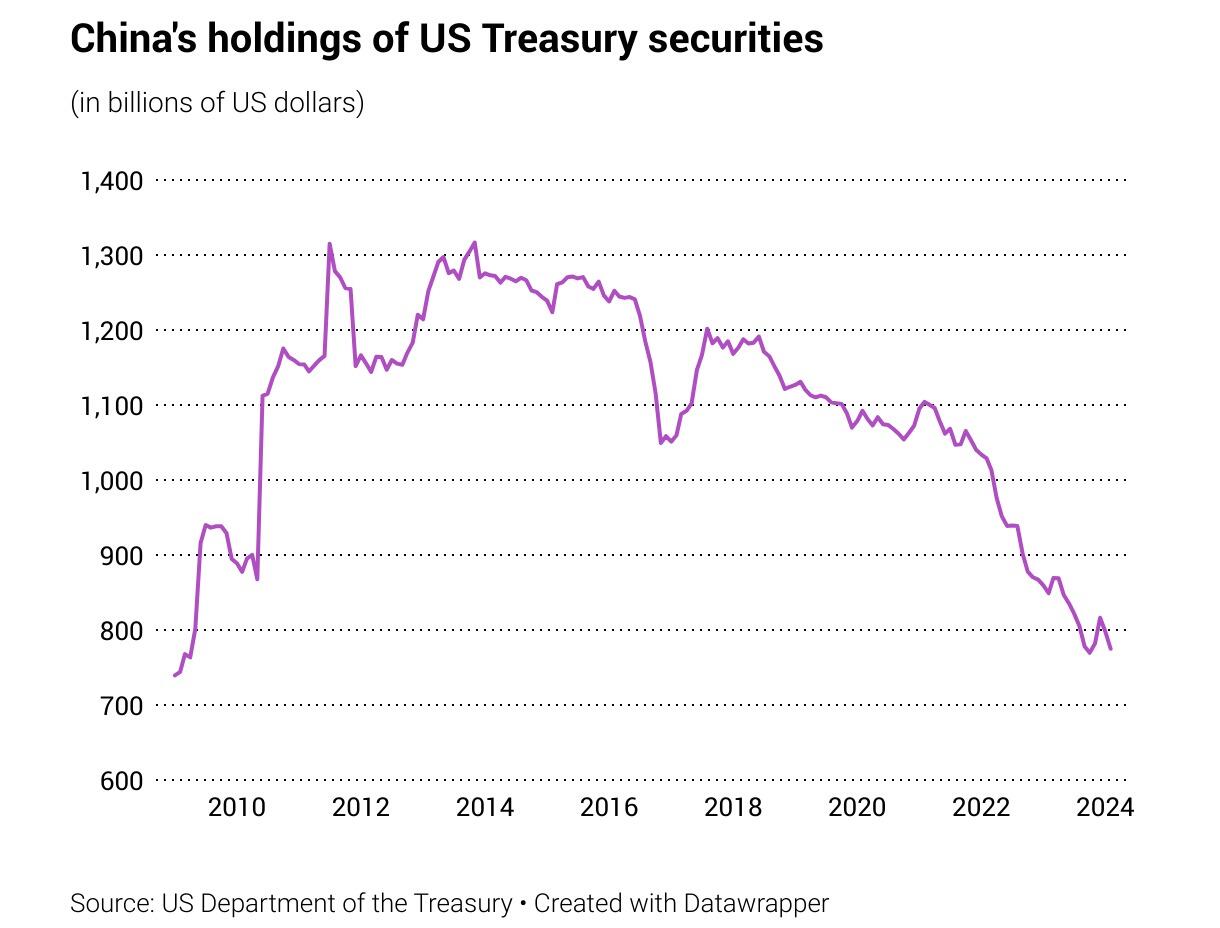

Cut deals with China and Russia

From Russia you need cheap resources. Force the Ukraine war to an end, fix the pipelines and be good business partners.

China’s a harder nut: China is now ahead of Europe. What Europe needs is deals to allow it to keep some of its advanced areas. To get these deals they’re going to need to let China into the European market in other areas. Where Europe is behind, but wants to catch back up (electric vehicles, for example) they should bargain for branch plants in exchange for market access.

End Imposed Third World Austerity and Forgive Debt

Since the ability to coerce the third world is ending relationships will have to fairer. Forgive most of their debt, get rid of the IMF as it now exists and reform the World Bank. Cut deals for needed resources without requiring control over internal politics. Europe now has to compete with China to buy what it needs from the third world and thus will need to offer actual good deals. An end to third world austerity will also lead to better markets for any European goods.

Reform World Trade Laws and Learn How to Tariff and Subsidy

Europe will need to produce what it can domestically because it isn’t going to be able to buy much of what it needs from foreign countries. To make European goods competitive will require tariffs and subsidies. This will have to be negotiated with other countries and if Europe wants to do it, they have to allow others to do it as well. The idea that “foreign made” is cheaper is only true if you have enough money to buy foreign made and remember that they have to want your currency. The Euro is going to be worth less and less until or if Europe creates enough tech that others must have and can’t get cheaper elsewhere.

If you can’t reform the WTO and so on, then leave and make a new organization or bilateral treaties, especially with China.

And get rid of almost all ability for private companies to sue countries for domestic laws. Countries need to have policy freedom and other than branch plants and so on Europe will require that most business is domestic.

Reduce the Cost Structure

Economic rent must be hunted down and killed. Landlords should make a decent living but not get rich. Housing should be turned into a utility: relatively cheap and easy to afford. (Some European countries are close to this already, some aren’t.) High returns on financial games must be ended: move to public (postal) banking. End high returns on financial companies. Break up the big financial firms, and make the new smaller banks and finance companies loan to new businesses. End stock market bubbles and enforce 50s style financial regulation.

Where utilities, roads, trains and so on have moved into the private sector, nationalize them.

As a general rule no one gets wealthy without creating new products for export or creating products which reduce the need to import, and billionaires become a thing of a past.

Kill Admin Bloat

Pull out your favorite admin bloat chart, look at what the administrative percentage was back in the 60s, and aim for that. The teeth to tail ratio needs to become much higher. If you aren’t doing the actual work of an organization, what you do to support it must be actually necessary. In general to receive subsidies you must reduce this bloat or your funding is cut off. There are a lot of subsidies already and in such a regime there will be much more.

We don’t want to be paying for useless jobs.

Reform tax codes to make them far simpler. Go thru the extensive regulations Eurocrats love to much and change most of them to ends, not means, then hire lots of inspectors and auditors. “We don’t care how you achieve the following environmental or workplace safety metrics, but we will check to see if you do and if you don’t we’ll fine you first (actual decision makers, not the companies), then put you out of business and if you hurt people, put you in prison.”

End Corporate/University Research Partnerships

University researchers should be government funded. Corporations who want product research should pay for it themselves, and generous subsidies should exist.

Fix Universities and Colleges

A lot of this comes ending admin bloat. Start there. Faculty should teach, some should research as well as teach and faculty must be forced to take control of universities again, with significant power for students. Administrators must have no significant policy power.

Academic publishing as it exists now must end. All academic publishing must be free and online.

All patents that are a product of government funded research are free for domestic use and available for foreigners with a fee.

Academics must no longer be judged based on volume of research. Their work must actually be read, those who hire or promote them must sit in their classes and witness their teaching. Replication of results must be emphasized and funded.

Research funds must be spread around far more, with fewer and weaker “principal researchers.”

Ties with advanced universities in foreign countries must be emphasized and student exchanges encouraged. Yes, this means China, which has most of the world’s best universities for science and technology now.

Kick NATO out and Form a European military

If you want to avoid further forced centralization form it from national units. Europe needs to make policy America isn’t going to like, it can’t do that while occupied.

Force the US to reduce embassy staffs by 90% and remove all US NGOs and similar organizations.

Same reasons. As the joke runs, “why doesn’t America have coups? Because it doesn’t have an American embassy.” America has too much influence in Europe. Reduce it.

Vastly reduce lobbying

Entrenched interests can’t be allowed to control government

Allow national subsidies to Mitigate the Effects of the Euro

For some countries the Euro is too high, and that makes their industry uncompetitive. For others it is too low and this gives industry a subsidy. Allow countries to subsidize industry to make up the difference if necessary and perhaps tax countries which are benefiting.

Make Creating New Companies Easy

Easy business loans, easy registration and removal of barriers of industry are key here. The policy of regulation by results will also help, since it reduces the massive burden of endless regulation with a simple “make sure you’re meeting our regulatory goals.” Subsidize chosen industries and make those subsidies easy to get, but audit for results and cut off those who aren’t making it.

Subsidize new companies, reduce their subsidies over time.

Make bankruptcy easy, frequent and painless. If a company fails, it fails. You keep your home and enough money to get by on for a couple years.

Final Remarks

We could go on, or each point could have its own full article, in many cases an article many thousands of words long. There’s little point in doing all that work now, since implementation is impossible. But it’s important to lay down the marker that good policy is possible and to show, generally speaking, what it would look like.

By the time Europe is willing to consider good policy its position will be far worse and digging out of the hole (when in a hole, stop digging) will be far harder. The most likely outcome is that Europe returns to being what it has been for most of history: a backwards peninsula on the edge of Eurasia, largely meaningless to anyone but themselves.

The world is changing, in huge ways, bigger than any changes since the industrial revolution, most likely even bigger than those. Europe is no longer the world’s leader, nor is it any longer the favored vassal of a super-power. It can adapt or see an end to the European garden.

So for it is choosing to see an end to the “garden.”

So be it.

My writing happens because readers donate or subscribe. If you value that writing, and you can afford to, please support it.

Every once in a while it’s important to do a policy piece, to show how society could work if we wanted to do the right things. Not because I think anyone in the West will implement enough good policy to matter, but to show that it is possible.

Every once in a while it’s important to do a policy piece, to show how society could work if we wanted to do the right things. Not because I think anyone in the West will implement enough good policy to matter, but to show that it is possible.