One of the greatest powers of the United States, one which was hardly used before Clinton, is the ability to freeze people out of the payments system. When Argentina had its previous debt crisis, it cut a deal with investors: They took a haircut, and the government agreed to pay them the haircut. Some investors refused.

Later, that deal was effectively destroyed, because Argentina lost in a US court. As a result, they could not pay the investors who had taken the haircut–a US judge was able to cut a sovereign state off from paying its debtors. Argentina could only have access if it paid both those who took the haircut and those who didn’t.

Over the last 20 years, in particular, the US has enforced financial sanctions against a bewildering number of people and states. Right now, it is disallowing Venezuela from buying many foreign goods. (When “socialism” doesn’t collapse fast enough, the US is always on hand to give it a shove.)

During the Iran sanctions period, before the Iran nuclear deal, the US and the EU cut Iran off from the payments system, virtually wholesale. SWIFT, the electronic payments system headquartered in Brussels refused to cooperate, saying that it should not be used as a tool of politics.

But the EU threatened the board and senior SWIFT executives with criminal charges, and SWIFT folded.

Lots of Iranians died and suffered under those sanctions, just like Iraqis did under the sanctions in the 90s.

When the Iran deal was cut, the sanctions were eased.

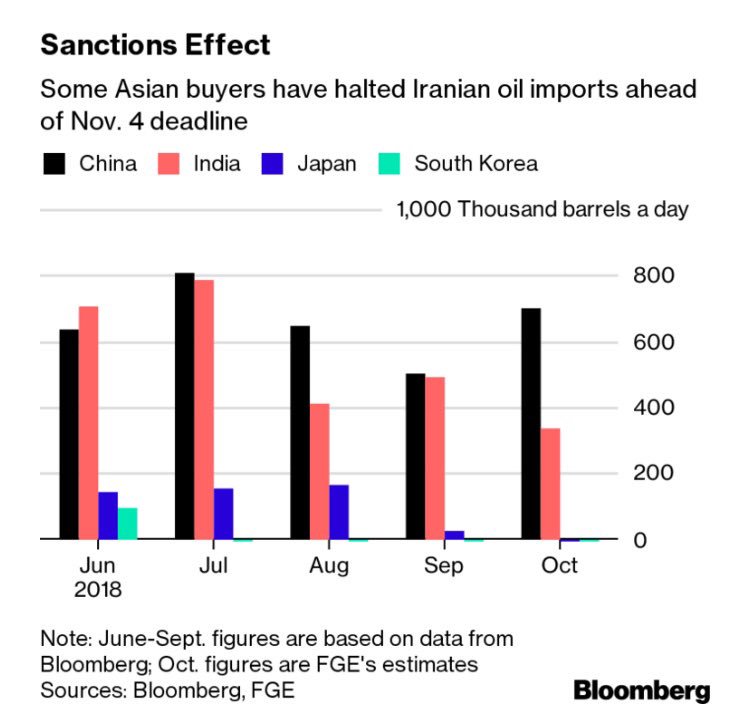

But Trump, when he tore up the Iran deal, re-imposed sanctions. The EU disagreed, but many EU companies are obeying the American order because America has said that it will sanction both companies and individuals who disobey.

And even if SWIFT doesn’t cooperate as a body, the problem is that most payments at some point touch American banks. The moment they do, America jurisdiction cuts in. (This is how FIFA got hit for corruption by US law enforcement. None of the bribes had anything to do with the US, but payments went thru US banks.)

So Europe is considering creating a payments system which does not ever touch US jurisdiction:

Germany’s foreign minister has called for the creation of a new payments system independent of the US as a means of rescuing the nuclear deal between Iran and the west that Donald Trump withdrew from in May…

…“For that reason it’s essential that we strengthen European autonomy by establishing payment channels that are independent of the US, creating a European Monetary Fund and building up an independent Swift system,” he wrote.

This adds Europe to a group which includes Russia and China, along with virtually every nation who has been subject to US sanctions.

The thing is that such sanctions used to be fairly rare. But Clinton weaponized them against Iraq and every President since them has used them as a bludgeon. They are a way, like drones to punish countries and individuals and to ignore sovereign rights.

The MMT types go on and on about being sovereign in one’s currency, but the fact is that you aren’t sovereign if another country can cut you out of the payments system. And right now the only countries in the world that are sovereign in that sense are America, the EU and China. And the EU and China are only somewhat sovereign.

These punishments are extra-territorial, they are an imposition of US law on non US countries and citizens. They are possible only because the US is the world hegemonic power, and sits at the center of the world payments system. Venezuela can sanction, but no one cares unless they have assets actually in Venezuela.

This power has been abused, repeatedly, to interfere in business that is none of America’s business. One can say that it might have been used acceptably when the entire UN security council agreed (I disagree), but when it doesn’t, the US has acted anyway.

And so, now, every great power in the world, with the possible exception of Japan, wants to take that power away from the US.

About time, but it will take time. It isn’t just about virtual links, it is about physical links: it must be done over continental cables and thru satellites which are not American. The way current software acts doesn’t take that in account, and physical infrastructure as well as software needs to be built.

But I hope that Europe is serious, because combined with China and Russia this is something which can be done, and done fairly fast (within a decade, I’d guess.) The only problem is that the EU, too, likes having this power. Are they really willing to give it up? Because the best way to do this would be to create a system which cannot be sanctioned without the agreement of all the powers who create: a system which cannot be sanctioned unilaterally. Everyone involved should have a veto.

Time will tell if Europe and, indeed, other nations, truly want a system that none of them can use to punish others.

The results of the work I do, like this article, are free, but food isn’t, so if you value my work, please DONATE or SUBSCRIBE.