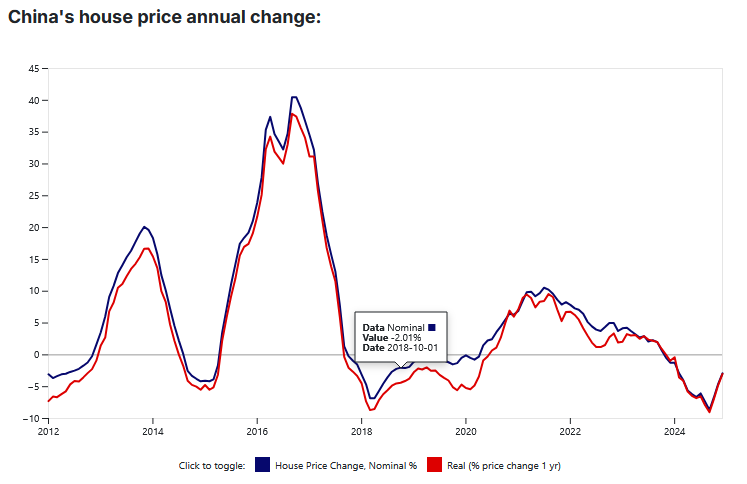

In 2016, Xi said that houses were for living in, not for speculating. The Chinese government took steps to reduce prices, those steps took time to bear fruit.

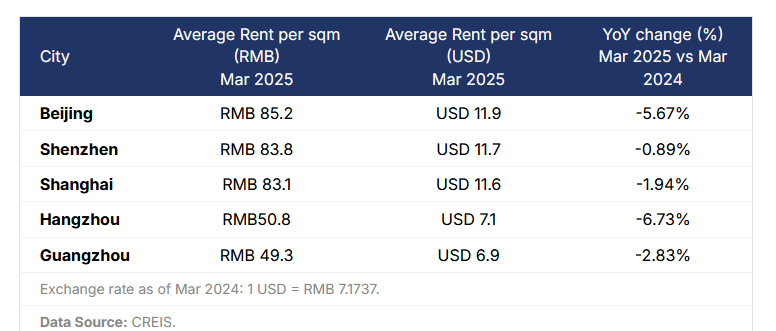

Likewise, rent prices have been dropping recently:

And yes, this is a result of government policy:

While, according to the PBOC, in the pre-pandemic decade, the annual rental inflation in China exceeded 1.2%, it slowed significantly in recent years and has been in the negative in the last twelve months. In March 2025, the rent of the rental housing component of the consumer price index (CPI) showed a 0.1% year-on-year decline, trending upwards, however, from -0.4% and -0.3% annual change rates previously registered in September 2024 and December 2024, respectively.

“In recent years, rents have declined due to lower income expectations and the increase in government-subsidized housing supply. This has provided tenants with more options and increased bargaining power, making lease renewals a key challenge for leasing companies,” noted Savills in their 2025 Chinese Real Estate Market Outlook.

Now you might think “this means the Chinese economy or citizen is in trouble!” No.

In stark contrast to the slowdown across housing and industry, however, Chinese consumers appear motivated to open their wallets and spend on goods. Retail sales grew 6.4% in May, topping expectations and sharply accelerating from April’s 5.1% rise.

Now, standard Western economists think that the real-estate market slumping is bad, and retail trade going up is good, but they’re both good and they’re both a result of government policy. China wants relatively cheap real-estate and to increase the size of its domestic consumer market so its industry is less reliant on exports. (Trump has kindly demonstrated the problem with over-reliance on trade partners.)

The thing is that if real-estate had kept going up in price the way it did in the past, the CCP would be in danger: their legitimacy rests on the idea that people’s lives keep betting better. For many years I kept reading young people in China saying they couldn’t afford to own a home. That was (and still is, to some extent) a problem. Xi acted on it.

Further high real-estate prices increase the costs of every single business, since they increase the costs of employees. China wants to stay an industrial power, not become worthless rentiers and financiers, and as such real-estate can’t be allowed to increase too much.

Now for a long time real-estate is how city government financed themselves. It was an engine which allowed growth. But when it started becoming a financial game, with people owning multiple condos or houses; prices increasing faster than wages and people locked out of ownership Beijing acted.

You can’t be an industrial power if rentiers: people who expect to make money thru time arbitrage and managed scarcity, are in charge of your society.

It is also true that if you aren’t a major manufacturing power you can’t become or remain a major military power. (Britain says “Hi!” America says, “uhhhhh….”)

Anyway, China needs to keep housing and rental prices down. At the very least they need to increase less than wage increases and for many years.

All signs are, that as is most often the case, the CCP is succeeding at the policy goals it set out for itself.

If you’ve read this far, and you read a lot of my articles, you might wish to Subscribe or donate. I’ve written over 3,500 posts, and the site, and Ian, take money to run.

Alan Sutton

That link explaining the Chinese Govt. actions to bring property prices down seems to be behind a paywall.

What were the actions the Govt. took to bring this about? Can’t just be high interest rates. Did they tax property harder in some way?

Would be interested to hear how it was done although down here in Aus there is absolutely no chance of anything like that happening. In fact official policy is to keep housing prices going through the roof for as long as they keep it happening.

Like & Subscribe

What about slumping demand? Doesn’t that account for some of the price decline? I would think so.

Also, what about build quality? Has that improved? Affordable housing is great but if the structure disintegrates in 20-30 years, it kind of offsets the initial price savings, wouldn’t you say?

Joan

We desperately need this in the states. I hope at least with the Boomers retiring and perhaps downsizing or moving into retirement communities that some housing will open up for Millennials, but it’s bad out here.

I don’t care if US cities end up looking a bit crazy like Vancouver with single family homes next to sky scrapers of condos, but something has to be done. I’m in a city where a lot of homeless people bus in for the summer for the cooler temperatures. People don’t need enormous mansions, we just need good apartments/condos with sound proofing, no mold, high enough ceilings so we don’t feel like we’re living in a box, etc.

I actually didn’t know about the generational angst between Boomers and Millennials until I moved to a city where this was particularly bad and my fellow young people explained it to me. We were working the jobs that actually kept the city running, but our rent was 50-75% of our income just to live within the city in a small place with roommates. Boomers who bought single-family homes right in town for $20k in the 70s were now millionaires and fought any push for more housing. Then you’d be biking into work and more Boomers in their fancy vehicles would get aggressive with you on the road.

bruce wilder

So much of China’s enormous accumulation of household savings is parked in the fairly illiquid ownership of housing units that managing rent and asset prices is a genuine challenge for economic monetary policy. This is one aspect of the consequences of decades of managing the renminbi foreign exchange value to support rapid development while failing to develop properly other institutional vehicles that could carry pensions and savings for a highly developed money economy. China’s monetary problems are the mirror image of America’s, because they share a common origin in the financial basis for China’s rapid industrial development and America’s rapid industrial dismantlement.

I don’t have the language skills to judge how well China is managing the transition. I do follow Michael Pettis, who has a long history of following the macroeconomics well in outline. My instinct says that the China runs a risk of plunging suddenly into deflation. Deflation is very, very hazardous to levels of economic activity and employment. A couple of months of deflation triggered the 2007-8 GFC. Thirty months of deflation caused the Great Depression.

Politically, the elite competency crisis would seem to preclude any possibility of the U.S. managing its corresponding monetary problems well, but for the moment it may be a “bear in the woods” problem, with the Euro running slower from the bear than the dollar.

cc

A telling graph showing US vs China house prices to 2024Q2:

https://cdn.voronoiapp.com/public/images/fc8036bb-ad78-4b2c-9b24-17bc650bb021.webp

And a telling graph showing Canada vs US house prices to 2022:

https://awealthofcommonsense.com/wp-content/uploads/2023/09/Screenshot-2023-09-07-131527-2-1024×746.png

(from https://awealthofcommonsense.com/2023/09/the-u-s-housing-market-vs-the-canadian-housing-market/)

I have the feeling that beyond political posturing the Canadian government and establishment media are not actually serious about making housing affordable here …

–

p.s. small aside:

“CPP” is a deliberate misdesignation used by those with an anti-China agenda (clearly not the case here or from the rest of what I’ve read of Ian.)

ex. https://www.reddit.com/r/TheDeprogram/comments/1jlavco/ccp_or_cpc/

The actual name and acronym for the “Communist Party of China” is “CPC”.

It would be like deliberately always calling the “Conservative Party of Canada” (CPC) the “Canadian Conservative Party” (CPP) just to spite and annoy them.

If we insist on calling the genocidal Israeli military by their official self-designated name, the “IDF” (with the constant built-in reinforcement of their absurd “self-defense” propaganda,) then it seems only fair to try to use the official self-designated name of the CPC as well.

Feral Finster

Or is that evidence of deflation?

That is an honest question.