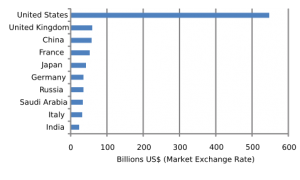

Top 10 Countries by Military Spending 2007

Joshua D Foster explains how fear and statistical illiteracy inflate America’s security budgets in Psychology Today:

Consider, for example, that the 2009 budget for homeland security (the folks that protect us from terrorists) will likely be about $50 billion. Don’t get us wrong, we like the fact that people are trying to prevent terrorism, but even at its absolute worst, terrorists killed about 3,000 Americans in a single year. And less than 100 Americans are killed by terrorists in most years. By contrast, the budget for the National Highway Traffic Safety Administration (the folks who protect us on the road) is about $1 billion, even though more than 40,000 people will die this year on the nation’s roads. In terms of dollars spent per fatality, we fund terrorism prevention at about $17,000,000/fatality (i.e., $50 billion/3,000 fatalities) and accident prevention at about $25,000/fatality (i.e., $1 billion/40,000 fatalities).

People fear things that are highly unlikely to kill them, such as flying on an airplane, much more than things that are much more likely to, such as crossing the street or driving a car. As a result they make irrational decisions about how to spend both time and effort. This is why basic statistics should be taught in every school and no one should be allowed to graduate before they pass.

Disproportionate fear is particularly the case when it comes to security and military spending in the US. The US spends almost half the world’s military spending and too many Americans seem to think that it needs to spend more, not less. Heck, the US intelligence budget alone is over $43 billion while China spends $70 billion on its entire military.

Delusional is too kind a word for it, and I’m not sure insane even covers it, so lets go for understatement and call it “counterproductive” and “a waste of good money”. Slash the military budget in half and the US will still spend more money on its military than any possible combination of attackers. Do the same to homeland “security” spending and the intelligence services, and you’d have all the money you need for refitting the country for energy independence, which would make the country far more secure than lots of jet fighters meant to fight the USSR and airport screeners with rubber gloves.