Top Tax Rates

—And thus, inability to run the state.

In the modern world this causes a great deal of confusion. I guarantee some MMT follower is gleefully planning a comment saying “a state’s ability to spend is not based on taxation.”

Technically true, practically false. A state which uses its own currency can always, in theory, print money.

But taxation is best understood more primaly than “the people send us money, we spend it.” Rather it is the amount of the economy which the government can control.

Every country has an economy. The economy is what the people of the nation actually do. Dig stuff up, refine stuff, grow stuff, manufacture, stuff, take money from idiots as consultants, waste everyone’s time with advertisements, destroy the digital commons, and so on.

Near adjacent to the economy is what it could do if we wanted it to, because we know how to do whatever it is and we can easily get the resources: so we could easily build more homes, for example, or train more doctors or nurses, or hire more Professors or build out more solar power and so on.

The final part of the economy is what you can get from other nations. Call this the external economy. Does someone else make it, will they sell it to you, can you afford it? Most of the time countries won’t sell other countries nukes, for example, and for much of history countries tried not to sell other countries the knowledge required to make advanced techs. When they didn’t prevent this, they paid big time: Britain was de-facto subjugated by America and America is now losing its Empire.

The final part of the economy is what you can get from other nations. Call this the external economy. Does someone else make it, will they sell it to you, can you afford it? Most of the time countries won’t sell other countries nukes, for example, and for much of history countries tried not to sell other countries the knowledge required to make advanced techs. When they didn’t prevent this, they paid big time: Britain was de-facto subjugated by America and America is now losing its Empire.

This is why being the richest King in Africa in 1850, even if you had been richer than England, would have done you very little good. You could not buy what you needed: industry, and even if you could buy a few weapons and machines you couldn’t maintain and repair them.

Taxation is the ability to command the resources of other people. That is all it is.

Now, in the US and the West generally, since some point in the sixties, the state has been increasingly losing the ability to tax the rich. The rich insist on controlling more of the nation’s wealth and economic activity and every decade they have increased that control. Every time something is privatized, that’s the state losing power to tax—to control a piece of the economy. Every tax decrease on the rich is, obviously, a reduction in ability to tax the rich.

The amount of control the State has has been reduced, and amount of control the rich have has been increased. This is an effective loss of the ability to tax.

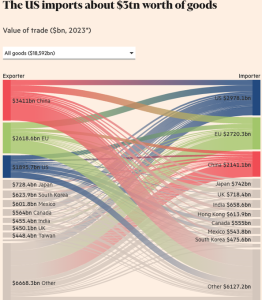

What is happening right now is that the US is losing the ability to tax the rest of the world. Dollar privilege was “we’ll take American money and make what Americans want for them.” It was the ability of America to direct other people’s economies to do what America wanted. The vast power this implies is mind-boggling.

It is that ability to control other nations’ economies which made the US an Empire, even if it directly militarily occupied few countries. It didn’t need to. It could still tell them what to do.

Since the US didn’t need to make and dig everything, it didn’t: it just made everyone else do that. This was, in many ways a bad idea, but it did mean that the US got the benefits of industry without a lot of the downsides.

So, since JFK and especially since Carter/Reagan, the US has been losing its ability to tax the rich. It has increasingly chosen to tax the rest of the world, moving industry, in particular, to other countries. Those countries made what the US needed, and sold it to them in US dollars, of which they were willing to accept nearly infinite amounts even though, in most cases, they didn’t need nearly as much from the US as the US did from them. (What they did need, in the early and middle years, was capital goods and knowledge, almost infinitely precious, though. Now with China leading in 80% of fields, well, not so much.)

Right now a huge tax cut for the rich is being paid for by cutting 800 billion from Medicaid, even as DOGE savagely cuts a federal civil service which has not grown in nominal numbers in sixty years, and thus has really already been contracting. State capacity is being savaged and services and jobs are being removed from the lower and middle classes.

Now let’s bring this back to the original topic: revolutions happen when states can’t command enough of the internal or external economy. It does not matter how much you can print or tax in nominal terms. In the Weimar Republic people would take a wheelbarrow full of cash to the store: all that matters is what you can actually command/buy with the money. For a long time the US dollar could buy pretty much anything.

But what happens when it doesn’t? What happens when you give it to cops and bureaucrats and soldiers and brown shirts like ICE and it doesn’t buy what they need, or even what they want?

different clue

People were “moderated” right off of Naked Capitalism for not worshipping the MMT

(Magical Monetary Thinking) Cargo Cult worshipfully enough. Or, even worse, for making fun or even just seeming to make fun of some of its most revered High Priests.

Magical Progressives believe that if they can just get their hands on the magical MMT money-issuance-and-spending machine, that they can magically MMT their way into the Progressive Society.

different clue

A thought suddenly hit me . . . what if Trump is a secret Manchurian Marxist? What if he has been for decades?

What if he has decided that the State will never wither away the way Marx said it would at the Dialectical Materialistian End Times? What if Trump has decided to MAKE the State wither away Right G@dDamn Now? By Burning it the F@ck Down!?

bj

@different clue

Imagine that the founding myth for your theory on money was that taxation drives your money’s value (MMT) and people so misunderstand your theory as to say things like taxation doesn’t matter. Ian writes an almost MMT treatise besides the opening paragraph from how developing economies need dollars to the power of taxation to drive the productive capacity of the economy. NakedCapitalism convinced me of MMT and when people tell me they don’t want to pay tax, I reply, “Oh you want your money to be worthless?”. In fact, MMT academics have been screaming that the US has so much outstanding debt that raising interest rates will drive inflation, so apparently even debt matters.

Joan

(Pointing out the obvious, sorry.) We are at a dangerous point right now because the president can order the enforcers (cops, ICE, the military) to do what he wants, whether it’s legal or not, and it seems right now the enforcers are happy to obey.

Ahmed Fares

“I guarantee some MMT follower is gleefully planning a comment saying “a state’s ability to spend is not based on taxation.””

Hi, I be that MMTer. However, I’ll spare you the MMT speech and say something even more profound:

It is impossible to tax rich people.

The function of taxes is to release resources, not money. After all, the issuer of a fiat currency has no need for money. Given that rich people have a low marginal propensity to consume, which is to say they won’t cut back on spending when taxed, the money you get from them when spent will cause inflation. This will cause the central bank to respond by raising interest rates, the so-called “monetary offset”, which will increase the flow rate of debt service payments to the very rich people you just finished taking money away from. In essence, the money you take from the rich boomerangs right back to them.

Monetary policy is a stealth tax on the poor. Fiscal policy sends money from the rich to the poor, monetary policy sends it right back in the other direction. Increase one, and you increase the other in the same amount. Like a blood circulatory system.

If you want to help the poor, what you require is a broad-based consumption tax, because that is what releases resources. This from Matt Yglesias:

“I do see the view, from a standpoint of abstract cosmic justice, that it’s annoying to see someone like Elon Musk or Jeff Bezos get so rich without contributing more to the Treasury. So there is a case for taxing wealth or unrealized capital gains or at a minimum changing the stepped-up basis rule. But fundamentally, I do think there are profound reasons why things like VAT and payroll taxes are the workhorses of European welfare states. Musk is not employing 10,000 butlers who can be taxed away and turned into preschool teachers. Inducing him to liquidate financial assets and fork over the proceeds does not generate any real resources that are available for new use. What a Nordic-style tax system does is broadly constrain consumption in order to free up resources for more extensive consumption of health, education, and other social goods.”

It’s all about resources.

Ian Welsh

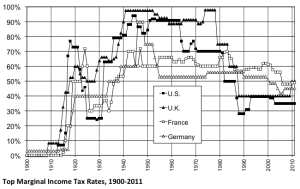

Ah yes, the period when the West taxed rich people at over 90% marginal tax rates also had inflation higher than wage increases.

No.

And please never, ever, quote Yglesias except to mock him. I come out of the same circles as Matt, and he’s a dishonest careerist whose brand of intelligence is primarily oriented around knowing who to kneepad. (He’s a world leader in that type of intelligence, to be fair.)

Soredemos

@different clue

MMT is an objectively accurate description of how the accounting flows of how a fiat currency issued by a central bank works, woth a particular focus on the US.

If you’re run out of an economics blog for now honestly engaging with it, I would suggest that would be a bit like being run off a site related to geology because you refuse to accept plate tectonics. Some things just have such a preponderance of evidence that they simply are, beyond any reasonable doubt, true. And if you claim they aren’t, you damn well better bring receipts to back up your position.

MMT is even more clear cut a case because it’s about any entirely man made system. It’s not about some natural mystery. And if all you do is poke fun at the ‘High Priests’ that tells me you’re not actually arguing with any of the concepts or facts.

About MMT and taxes though, I’ve never seen a single major advocate claim taxes don’t matter. Enthusiastic amateurs, maybe (MMT has plenty of those). But the Moslers, Keltons, Keens, etc, have always been very clear that a reasonably functioning tax revenue systems matters to a floating fiat currency for a variety of reasons. Just raising revenue for the central government isn’t one of them.

The money is ultimately simply invented on a ledger somewhere. That’s a fact. The theory part is what can then be done with this fact. It’s honestly frustrating to see someone dismiss this all as if it’s some sort of vague ‘they just want to ride the magical money train to a progressive society’ as if specific, detailed policy proposals haven’t been written that literally fill entire books. A key insight of MMT is that real resources and their distribution matter, not money. To pretend this isn’t the case feels extremely disingenuous and bad faith.

Adam Eran

The best explanation I’ve seen of the limitations of MMT:

https://youtu.be/C33RWFYec3A

Political economist Mark Blythe explains why an independent Scotland has a problem, even if it’s a monetary sovereign.

mago

Just to jump on the dog pile, back in the halcyon days of the blogosphere, circa 2010 or so I used to read Yglesias and considered him a seer of sorts.

It didn’t take long to see him and the promising blog world transform into a pile of steaming shit.

Yglesias and his ilk aside, glad to see some torchbearers endure.

A bow to our kind host.

different clue

@Joan,

I suspect you are correct about most-at-least of the nation’s 18,000 police departments. I am sure you are correct about the ICEnazi magastapo.

I am not so sure about the military, or at least all parts of it. I have read that there are some unhappy campers in uniform, given how they would know they would be treated for blowing opsec the way the Hegseth gang has blown it, two times in a row now.

https://www.reddit.com/r/technology/comments/1k4os8q/white_house_plagued_by_signal_controversy_as/

And I think Hegseth himself had his doubts about automatic military obedience, as revealed by his very early firing of all leading JAGs.

https://www.newsmax.com/newsfront/hegseth-jag-fired/2025/02/24/id/1200325/

So Hegseth felt he had to take steps to make sure that the Armed Forces would indeed be Trump’s Christianazi Armed Forces when called upon. Can Hegseth be sure? Can he be sure that he can be sure? I don’t know. I would not want to be anywhere relevant if/when Hegseth gives the order, but still . . . can TrumpenHegseth be sure?

GregL

You’re distorting the MMT position. MMT just points out that the spending comes first and the taxation comes afterward. MMT does indeed say that if the state can’t tax effectively, ie, exactly the failed state you predict, inflation-to-hyperinflation will result.

Trump’s gutting of the IRS might get us there!

Warren Mosler, for his part, recommends eliminating payroll and incomes taxes and implementing a property tax to avoid the loopholes which the wealthy can easily exploit. (Of course our political system will never allow such a change, so it’s all moot).

There is definitely criticism of US policy to be made about the way that the US exercised its “exorbitant privilege” post-Bretton Woods. MMT would say that they (all US political leaders since 1944 until present day) have no idea how the machine they are operating actually works….and thus the results have been increasingly piss poor.

I think the answer to your wrap up question is: we become Great Britain.

Jeff Wegerson

MMT is stupid simple. You can’t tax till you have printed. You must tax some so people have a reason to want your money. If you want to use money to advance a moneyless economy you must not tax it all back.

Ian Welsh

MMT is about accounting principles. Taxation has occurred in many places and times where the government did not issue money. Entire wars have been fought over the right to not pay taxes in “money.”

Everything important MMT says is covered by Keynes in one sentence, everything else in it is just unfolding logical principles. “We can afford anything we can do.”

MMT is a curse on discourse, since the moment one mentions tax or money, its disciples are unable to learn anything new.

The interesting stuff in this article are things like America’s ability to tax the rest of the world, which it is losing and the question of control over resources and the real ability to tax, which is constrained by the strength of different power factions.

Not to mention what taxation really is, which isn’t the ability get money from people.

But it’s my own fault. I will never again so much as print “MMT” unless I want to deal with it specifically.

different clue

@Soredemos,

In theory you are correct. In practice ( as I have seen it) you are not. Naked Capitalism’s blog masters keep claiming over and over again that ” taxes do not fund spending”. That the government can just “issue the money” and then “spend it” because it is the sovereign money-issuing power. The two principal bloggers over there always tried to leave taxation as the unmentioned part of the equation. One had to tax enough already-existing money back out of the system to allow the government to spend newly issued money into the system for what government wants to see bought with the money.

Some commenters would note that the so-called “distinction” between taxing to first raise the money and taxing to soak back up the excess money in order to allow the issuance and spending of new money was a distinction without a difference. Taxing back some of the priorly-issued money was necessary to permit the issuance of new money to proceed without distorting or destroying the value of the money in the eyes, hearts and minds of the people using that money. The Head NaCappers In Charge did not want to engage with that.

So Federal Taxing is necessary to permit Federal Spending by creating and maintaining the head-room for the new money to function in. Or am I wrong?

You are correct in that I haven’t read the WHOLE BOOKS which have been written on the subject. Any intellectual can write a book. Marx once wrote a book.

So many books, so little time. The trick is deciding which books cannot be done without.

GregL

Setting MMT aside, you’re getting at the Trump project to do away with the BrettonWoods/post-BrettonWoods system.

Stephen Miran blames BrettonWoods for the hollowing out of US manufacturing…and he’s not completely wrong…but it really took GATT to accelerate the fall by bringing 1 billlion Chinese workers into the mix. (Sir James Goldsmith foresaw this with some clarity. See his book The Trap, circa 1994).

The losers were US manufacturing especially at the lowest/brute end; the winners were: a. the rest of the US consumers (40 years of cheap clothing, furniture, electronics, etc) and b. (especially) corporate governance/shareholders whose profit margins widened to the point where they spent more money buying back shares than doing R&D. The rich got a lot richer and a couple generations of working class people got even more precarious lives.

The US state (both parties!) bought into the “rising tide lifts all boats” fantasy of it…went more and more neoliberal with gov. policies and from that narrow coastal elite POV, it was all working.

I don’t think it had much to do with taxation except that Main Street kept seeing Wall Street misbehave and get rewarded/bailed out (Gordon Gekko of the 80’s; DotCom in the 90’s & Housing in the 00’s). Meanwhile MainStreet were forced to shop at DollarStores, work dead-end service jobs with unpredictable hours and risk bankruptcy if their health failed due to the precarity stress, fast food and self-medicating intoxicants.

The Tea Party was the start of the rebellion and Trump is the dying gasp of that movement where it devolves from tragedy into farce (apologies to Marx).

The problem with the Tea Party and with Trump is that they can see the problems clearly, but their solutions are 180 degrees wrong based on their (traditional) inverted misread of the US monetary system.

Revelo

MMT describes the reality of how fiat money systems work, and since most people, including the elite, do not understand that reality, MMT is extremely important. MMT is not complicated, which raises the question: why don’t people understand it? Because not understanding MMT makes it plausible to insist on policies that benefit the wealthy (austerity) or the banks (focus on monetary rather than fiscal/taxation policy to control inflation). Because of this, we will not see MMT discussed until such time as the wealthy and banks suffer badly. Rather, we will continue to be hear that USA is in danger of bankruptcy, so we need to run a budget surplus to pay off the massive government debt, and that, once we pay off the debt, we should continue running a surplus, to pile up dollars in the Federal Reserve vaults. Ordinary non-MMT economists know this is madness, because ordinary economic theory is simply a very confused restatement of MMT. To reiterate, this confusion is intentional, because ordinary economists serve the elite and banks.

Purple Library Guy

MMT is doubtless true but not very important. And as far as I can make out, the more accurately you understand it, the less important it becomes because its policy implications become smaller. But the thing about MMT is that it’s a theory about one economic thing which is, OK, a kind of important economic thing . . . but still just one. It’s not a general economic theory, it says almost nothing about how economies work overall. It doesn’t tell you whether markets are efficient, whether unions are a good idea, how unemployment works, how public goods or externalities work, et cetera.

Anyway, as to what the article was generally about–I agree. A country, the social system it presides over, has to on balance for most people provide more than it takes away. Modern states are supposed to provide a whole lot of things which collectively allow people to make a living, fairly safely and fairly well. Infrastructure, education, safety, if there’s capitalism a fairly solid, predictable work/business environment. Culture, even–museums and all that. To do that, it takes a portion of economic output. Trump is breaking the deal. Partly he’s breaking the deal because plutocrats, none of whom apparently understand what a “collective action problem” is, have decided that a lot of the things that make the society work are in the way of them individually making money.

So for instance, they don’t want food safety rules because unsafe food is more profitable, they don’t want effective fraud enforcement because fraud is a huge profit source, they don’t want pollution rules, occupational safety, labour laws and the list goes on–all these things that benefit everyone they’ve decided they don’t want there, and it’s not even a matter of them having to pay for it with taxes, they actively don’t want the state making people’s lives better. Even aside from the cases where they draw direct lines from state actions to crimps on profit, they’ve generalized to an overall idea that ANYTHING the state does to help ordinary people MUST be bad for them SOMEHOW. So, no beneficial rules should be allowed to stand.

And they don’t want the state to do positive actions either, because anything the state does is in theory something a plutocrat could be doing instead and extracting a profit for. So they’re cutting that.

And they don’t want the state doing services that learn or measure things, because they know they’re screwing everyone and they don’t want that to be known. So they cut research and agencies that measure the economy, or the weather, or whatever, in case they find out things that make it clear the plutocrats are fucking everything up. But that also means all the useful knowledge the government gathers can no longer be used. So there goes that.

So by the time they’re finished, what is the state still doing that makes the fact of being in the nation-state’s social/political/economic network a thing worth having? Dick all.

On top of that, what taxes are still collected are increasingly going to be redirected to corporate subsidies and other linings for plutocrats’ pockets. And in Trump’s specific case, then you add in just being a moronic wrecking ball who creates chaos. At which point the whole state thing becomes a negative–the social network is actually taking more than it gives back.

Arguably the United States is already in that situation on a current basis, and is mostly coasting on the continued existence of a gradually-depleting stock of useful infrastructure built in the past (roads, universities etc). As that stock reduces and the imbalances get worse, people’s rational choice becomes leave, secede internally somehow, or join a revolution to return to a situation where the state does useful things again.

UphillBend

The state gradually losing control over its elites – especially in its ability to tax them, the emptying of state coffers, various schemes to make up for the situation the burden of which ended up falling upon the populace, and on and on until rebellion or invasion from the outside of a weakened nation is a consistently recurring formula for all the major Chinese dynasties. Here is the historian Morris Rossabi describing the state of the Southern Song on the eve of the Mongol conquest.

Khubilai Khan: His Life and Times, pg 80

“Serious evidences of decay resulted from the economic and political dislocations in the Sung system. The government confronted some of the same difficulties that had engulfed earlier Chinese dynasties. Like the Han and T’ang dynasties in various periods in their history, the Sung government was faced with severe financial problems. Large landowners had accumulated vast estates, whether through chicanery, oppression of the peasantry, or good management. Many of these landlords either were officials themselves or else had close relatives in the bureaucracy. In any case, they achieved a tax-exempt status through their official connections. As more and more land was removed from the tax rolls, the government’s fiscal crisis worsened.

The court could not meet its rapidly rising military expenditures. By 1260, when Khubilai ascended the throne in the North, the abuses of the landlords and officials in the South imperiled the dynasty. The evasion of taxes had to be restricted if the Southern Sung was to survive. Again in the same pattern as earlier Chinese dynasties, the Southern Sung suffered from excesses and hunger for power among the court retinue. Though eunuchs were not as politically dominant as they had been in the Later Han and T’ang dynasties, they were present at court and potential challengers for political power. Similarly, the relatives of each succeeding empress and the members of the imperial clan sought high offices on the basis of their connection to the throne. All of these assorted groups needed to be restrained if the Sung was to weather challenges from the Mongols.”

Eclair

Reading the comments on MMT reminds me of the blind men feeling up parts of the elephant and basing their description of the beast on the one part (foot, trunk, tail, etc., ) that they could touch. Well, here goes another blind person trying to comprehend MMT:

I began reading a lot about MMT a few years ago, and one important thing that stood out: Modern Monetary Theory, the name, is unfortunate, because MMT is NOT a theory, it is a description of how the current US monetary system actually works.

Second, the US government can, and does, ‘create’ money out of nothing, based on the fact that the Dollar is the World’s reserve currency, i.e., other countries trust that the Dollar will hold its value when all else withers on the vine. But …. and this is a big one ….. it can continue to do so as long as the money creation is backed up by ‘resources.’ And, I understand ‘resources’ to be: land (amount, climate, water, soil fertility, minerals, fossil fuels, etc.); people (healthy, educated, content, etc., ); the political system (the less said about this the better, at this point.). Obviously, the US may be facing some problems in the resource area in the near future.

Thirdly, taxes are not necessary to fund the Federal Government programs. But, taxation is necessary in order to prevent a small group of more aggressive, psychopathic, brilliant (your choice) people from getting their hands on most of the money, thereby immiserating a large portion of the population.

And, fourth, borrowing money to ‘balance’ the Federal Budget, is NOT necessary. It is both a holdover from the days when the money supply was constrained by the Dollar being linked to the actual physical gold supply and governments or kings had to run around persuading money lenders to send them actual bags of gold coins, usually at usurious rates (these money men later started credit card companies 🙂 !) and …. a stick to beat the populace (already on the road to immiseration due to the machinations, and low to non-existent taxation rates, of the Oligarchs) into accepting the ruse that the Government is a “Household” that has overspent its budget and we must all tighten our belts (except that the belts of the populace are around our necks) and embrace Austerity.

I admit that I have not been able to completely wrap my mind (or what’s left of it) around the ‘issuance of debt’ is not necessary trope. I do believe it is also intertwined with the fact that the US is a net consumer of goods in the global market, i.e., we buy more than we sell, all this commerce is conducted in dollars, and other countries, e.g., China, Japan, South Korea, are left with tons of dollars because of this trade imbalance, and the US Treasury sidles up to them with a deal they can’t refuse: put those dollars into our notes and bonds and we will pay you interest!

I am open to additions, corrections, further understanding of my take on MMT. Or, as I prefer to term it: MMnT (Modern Monetary not a Theory.)

Daniel A Lynch

2 points. 1) where is it written that revolutions are caused by an inability to tax? My observation is that revolutions are preceded by a lack of food, or soaring food prices. The rules go out the window when people are hungery.

2) I am not an MMT’er and will not defend it, but I am a chartalist, and chartalists believe taxation and government defined legal tender are necessary to give fiat money value. To put it another way, taxation creates “fiscal space” for government spending. Reducing taxes on the rich reduces fiscal space, all other things equal, and in practice that reduced fiscal space will result in fewer government services that benefit ordinary people.

The Elon Musks of the world don’t care about government services, except for the police which are necessary to protect Elon and his wealth from the workers. So Elon’s plan is, increase the police, cut most other government services, and cut taxes on the rich. Yes, that will shitify society and may eventually lead to revolution, but shitty societies have been known to endure for hundreds of years, so don’t hold your breath waiting for a revolution. The U.S. has an old, thoroughly brainwashed population, and Grandma and Grandpa are not going to storm the Bastille.

Mel

“Issuing debt” is a piece of jargon that screws me up every time. I think it means “borrowing.”

But I can imagine me, as a lender, granting you the obligation to pay me back money in the future. Wouldn’t that fit the words?

But no, no. I don’t think they use it like that. It’s got to mean borrowing.

Mark Pontin

Ian W; “But it’s my own fault. I will never again so much as print “MMT” unless I want to deal with it specifically.”

Why in fact bang your head against the wall? The MMT debate has become so polluted and useless, that instead I just mention Keynes’s remark and describe Chartalism, which back in 1905 essentially made the same analysis and reached the same conclusion as MMT —

https://en.wikipedia.org/wiki/Chartalism

marku52

Sorry to see that not many have come to grips with what I think is the really interesting point of Ian’s piece–That when the government loses the ability to tax, it correspondingly loses the capability to govern.

This seems pretty clear, and true. Next question, does this lead to revolution? Or just a failed state?

Was the French revolution preceded by decreasing tax revenue? In the Roman case it seems that fiscal failure just lead to a failed state. In the case of the American revolution, it was an attempt to increase taxation that lead to the uprising, at least in part.

We should dig in to this farther….In the US case, I’m seeing failed state.

Fe4ral Finster

My preferred analogy is the USSR, around 1983 or so.

Everyone knows that K. U. Chenenko is a senile alcoholic. Everyone knows that drastic reforms have to be made, and soon, but that entrenched interests make any real reform impossible. The Uniparty still appears unified in public, but the knives are out and factions are frantically maneuvering behind the scenes. The old slogans, freedom, democracy, all that are still trotted out and people still mouth along to the old songs, but nobody believes a word of any of it any more, and there is no attempt to implement any of it. The security services are still there, and they still have fearsome powers of repression, which are largely used for political purposes. The idea of a world without the Soviet Union is still pretty much unthinkable (when A. A. Amalrik published “Will The Soviet Union Survive Until 1984?”, he was written off as a nutcase).

A few years later is when the open looting of everything not nailed down starts.

You get the picture.

The other historical analogy is that we are at the end of the Roman Republic and the beginning of the Roman Empire.

marku52

Another key moment was when Nixon’s “Guns and Butter” started inflation, and France began repatriating gold from the US at the controlled $36/Oz level

Under a gold standard of banking (which is terrible for all sorts of reasons, like baked in deflation etc) this should have lead to a devaluation of the USD, and a return to balanced trade until the USD hit a level to enforce that.

Instead, Nixon “closed the gold window” and unlinked the USD to gold, making it a true fiat currency. And also, oddly, enabled the trade deficits that demolished US manufacturing through an overvalued USD, amongst other things, like incompetent US managers and financialization of thinking.

Gold just breached $3500/oz, about 50 years later…… Hmmm. USD has lost a lot of value.

EGrise

I agree with marku52, the more interesting implication of Ian’s post is the fate of the government and the thing it governs.

The power to tax is indeed the power to destroy, which also means the power to control. Without the power to control, what exactly is a government good for? Without the power to control, people will (eventually) start ignoring that government – no matter how many brown shirts it has (which will decrease anyway) – and find something else that works.

The outcome could be revolution but I doubt it, mostly because the only people set up to enact any sort of a revolution are allied to the people causing the problems. Failed state is much more likely, and that could go in a number of interesting directions.

Right now I think we’ll have some sort of Great Depression 2 (hopefully not quite that bad, but bad enough) but unlike the 1930s we won’t have a government able to ramp up and deal with the situation because we will have let a bunch of grifters and Nazis destroy it.

But people will still need food, shelter, education for their kids, etc. They won’t just shrug and say, “Well, what’re you gonna do?” at least not for long. Instead I can see caudillos taking control of portions of the country and either federating them into a smaller version of the US (The United States of New England) or seceding entirely (Cascadia, essentially the combined states of CA, OR and WA, perhaps as a protectorate of the PRC) in order to regain stability and “normalcy.”

I imagine the federal government will resist it (how can it not?) and there’s where the fireworks kick off. But the feds will never have enough people to occupy the country, and they will have given up many of the non-violent means of control (little or no tax money being returned to states, whether in the form of grants, Medicaid spending, etc.). Rich people (who should have known better) will be in serious trouble, not in guillotine terms but in terms of expropriation: taking away a billionaire’s money is to them a fate worse than death.

Hope we can pull back from the brink but I wouldn’t bet money on it. Anyway, thanks for reading my doomer fanfic.

Soredemos

You say it was a mistake to mention MMT and will never do it again. But that you need effective taxation for reasons other than raising revenue is a core point of MMT. Entire articles have been written about how real resourcesand control matter.

That’s not a ‘technicality’. ‘Oh it’s only technically true you can just print the money, but the naive charatalists don’t understand real resources.’ Not a single actual MMT proponent I know of thinks ‘money printer goes brrrrt and all our problems are solved’.

Tallifer

History supports the assertion that efficient taxation is necessary to avoid revolution or stagnation. For example, the English Civil War and French Revolution happened because the king ran out of money.

different clue

@Eclair,

Your mention of the tale of the blind men and the elephant reminded me of a Sam Gross cartoon about the blind men and the elephant I once saw in National Lampoon magazine. I found a copy of the image of it but it doesn’t seem possible to isolate it and offer a link to just that one image. So the best I can do is offer a link to the bunch of collected images and note that it only takes a few seconds of scanning through them till you find what you will recognize as Sam Gross’s ” the blind men and the elephant” cartoon. Here is the link.

https://images.search.yahoo.com/search/images;_ylt=AwrhcZeT_AdoXIkQdyeJzbkF;_ylu=c2VjA3NlYXJjaARzbGsDYnV0dG9u;_ylc=X1MDOTYwNjI4NTcEX3IDMgRmcgNzZnAEZnIyA3A6cyx2OmksbTpzYi10b3AEZ3ByaWQDR25abUNPUDJUMk9feUdMUThvanoyQQRuX3JzbHQDMARuX3N1Z2cDMARvcmlnaW4DaW1hZ2VzLnNlYXJjaC55YWhvby5jb20EcG9zAzAEcHFzdHIDBHBxc3RybAMwBHFzdHJsAzUzBHF1ZXJ5A3NhbSUyMGdyb3NzJTIwY2FydG9vbiUyMGFuJTIwZWxlcGhhbnQlMjBpcyUyMHNvZnQlMjBhbmQlMjBtdXNoeSUyMGltYWdlBHRfc3RtcAMxNzQ1MzUzOTY2?p=sam+gross+cartoon+an+elephant+is+soft+and+mushy+image&fr=sfp&fr2=p%3As%2Cv%3Ai%2Cm%3Asb-top&ei=UTF-8&x=wrt#id=53&iurl=https%3A%2F%2Fimage.slideserve.com%2F371076%2Fslide2-l.jpg&action=click

Mark Pontin

marku52: “Sorry to see that not many have come to grips with … the really interesting point of Ian’s piece … when the government loses the ability to tax, it correspondingly loses the capability to govern.”

Ian’s point is so obviously true — and the US has been so obviously heading down — that it’s hard to think of anything useful to add to it. Beyond the question of where in the “gradually, then suddenly” timeline the US is currently at.

bruce wilder

ah, the French Revolution! I remember it well.

thank you, marku52 for bringing it up. In many ways, it is the prime historical example of state failure related to fiscal failure (the inability to tax the rich in particular) leading to revolution (and subsequently to the unleashing of state capacity in Napoleonic empire building)

Ancien Regime France at the end of the 18th century had an underdeveloped financial sector, was overpopulated relative to its agricultural productivity, had lost a big chunk of its colonial empire and despite the theoretical advantages of its 17th century legacy of centralizing absolutism, was a litigious society of particularism, privilege, and resentment.

The crisis when it came found many fissures in the fiscal firmament of the state. The privileged often enjoyed exemptions from certain taxes, sometimes purchased with office by some ancestor. The collection of certain taxes was in private hands. At the time of the revolution, an extensive wall around Paris was being built by a consortium of private “tax farmers” expecting to grow rich on the power of the state to collect such taxes thru private hands.

The expedients of a paper money and a central bank had been tainted fatally by Law and the Mississippi Bubble. The Paris financial sector was entirely in the hands of Swiss and Dutch bankers and speculators. One of these, Necker, followed in the tradition of Colbert, and was quite popular in part because he created a system of State pawn shops, which relieved some of the inconvenience.

The political parallels and contrasts with the UK were stark. The UK had used its fiscal capacity and central bank to outspend France in the Seven Years’ War, subsidizing its continental allies. The UK had had its own South Sea Bubble at the same time as the Mississippi Bubble, but in the UK, the South Seas Company was folded into the Bank of England and the national debt was serviced ever after at a “risk-free” rate, a floor for other rates.

The inability of the UK to tax their 13 American colonies to finance the war debt caused the American Revolution before the French Revolution. And the example taught the French.

The UK had experienced an agricultural revolution of sorts in the early 18th century as Smith’s “improving landlords” began very fine calculations on the advantages of turnips and forage in crop rotation and the profit from further enclosing the commons, a process underway since the Tudors. The gains in land and labor productivity were small but significant and fed a growing urban population.

France was not so fortunate. French agriculture was notoriously backward and resisted the promotional efforts of royal reformers and intendants. Feudal dues were collected in large areas by the church or impoverished nobles with no power to manage or improve the properties.

The nascent “business cycle” of 18th century France was an agrarian cycle of boom and famine: a good harvest could feed an expansion of mercantile and artisanal sectors. A famine would drive France into a business depression. The Physiocrats observed the pattern and made a theory out of it. And, from the Physiocrats came the liberalism of Turgot.

The same Dutch and Swiss bankers took liberalism and fashioned an argument for a laissez faire response to famine.

Failing to control the price of bread or the distribution of grain stores had a profound effect on the course of the Revolution.

Ian Welsh

Bruce,

I’d like to elevate that comment (with a small amount of editing.) You OK with that?

Ian

ella

EGrise wrote “But the feds will never have enough people to occupy the country, and they will have given up many of the non-violent means of control (little or no tax money being returned to states, whether in the form of grants, Medicaid spending, etc.). …”

Indeed, its already happening. An example of the feds denying monetary help to Arkansas in its time of need.

https://governor.arkansas.gov/news_post/governor-sanders-appeals-denial-of-arkansas-major-disaster-declaration-relief-request/

Must have come as a surprise to Huckabee as she and her gang are all in on the dominant party’s agenda, but I guess she thought her red state satrapy would have a turn at the teat.

I live in a part of Texas that gets hit by hurricanes every 3-5 years, big time. I live in a city that the governor and his goons hate because it keeps on not voting Republican. Will Abbott stand up for this part of Texas after the next inevitable natural disaster? If so, will his grandstanding make a bit of difference with the administration that is willing to let other red state supporters suffer? I’m afraid we are going to find out.

mago

Apropos of nothing and everything, as Hunter S. Thompson once observed, the US is a nation of used car salesmen, so you can take your economic acronyms and shove em where the sun don’t shine.

Not gonna make a good goddam to a starving dog howling in the wilderness.

That’s where we are and where it’s at. Yo hillbilly

GrimJim

Frankly, anything the Austrian School despises can’t be all that bad.

From “The End of the Ancient World and the Beginning of the Middle Ages,” by Ferdinand Lot:

“FROM the Early Empire onwards, we see the development of large landed property. Every large estate kept its boundaries, individuality and name. In France, many villages (Juilly, Vitry, Savigny, L6zigny) preserve today names of ancient Gallo-Roman landlords (Julius, Victor, Sabinus, Licinius). In Africa and Asia they are even more common than in Gaul and Italy.

The decay of industry and commerce, since the third century, contributed further to raise the exceptional position of the large landed proprietors. Henceforth landed property was the only source of wealth. The monetary chaos, which from this time onwards exhausted the Roman world, affected comparatively little the large landowners who went from estate to estate, consuming the product of their land on the spot. The wealthiest belonged to the Senate which was feared and hated by the Emperors of the third century.

We have seen that from the middle of the same century this social class was debarred from the command of the army. There remained to it the functions of civil life. Lastly and chiefly there remained its economic power, which tended more and more to become unlimited.

i. the large landowner versus the state

His estate was administratively outside the City territory. His autonomy was marked by boundary stones on the land.

I. The large landowner turned an estate into an asylum. He received in it : (1) Runaway slaves. An oratio of Marcus Aurelius was required to oblige the potentior to allow his estate to be visited and searched. (2) The curiales who wanted to escape from, the burdens of the fiscus: these, having taken refuge on the land of the vir potens, were protected from the laws. 1 The constitutions of Julian and Majorian against these abuses remained useless. (3) The traders who refused to pay the coratio, or license as we should say. (Theodosius, 386.)

II. He defrauded the fiscus. This he did in several ways:

(1) by engaging in commercial transactions and refusing to pay the license (364, Valens and Valentinian). In 408-9 Honorius and Theodosius II were forced to adopt a radical measure: the potentiores were forbidden mercimonium exercere.

(2) They or their agents impudently refused to pay the land tax, knowing that the Cities would not dare to prosecute them. Hence, in 383, Theodosius adopted a series of measures: the task of recovering the capitation was to be entrusted to the officiates (servants) of the governor of the province. Similarly, it was the governor who was to have a survey made of these large estates {masses, fundi, potestates). Thus, in every civitas, while the decurion had the task of levying the tribute from the curiales, and the defensor civilatis from the minores personas, it was upon the rector of the province that fell the difficult task of making the darissimi pay. But the position of some landowners was such that the governor himself could do nothing, the rich taxpayer refusing to appear before him. Already in 328, Constantine admitted that certain personages were in fact amenable only to the Praetorian Prefect and the Emperor.

III. By force or fraud, he got assigned to himself fundi limitrophi which served to maintain the frontier armies (Constitution of Valentinian, Theodosius, and Arcadius, in 386).”

bruce wilder

The temptation to say something about the shortcomings of MMT is too much for me, too.

What a central bank does is manage the national debt. By handling the servicing of the national debt and thus making interest payments and redemptions certain and by making the national debt marketable and thus a source of liquidity even in a crisis, the central bank stabilizes the financial system, creating in the national debt a “risk-free” reference and hedge instrument for all other lending and credit creation.

MMT neglects the critical importance of marketable debt instruments with a range of planned maturities in creating the superstructure of a money and a stable unit of account. The MMT proponents I have read often focus entirely on the currency as representative of “money” which is misleading. A central bank makes managing the demand for coin and currency into a technical operation with only trivial implications for aggregate rates of economic activity. This is a good thing, that business is never impeded by a shortage of coin or currency, but it is not the be-all and end-all of what money is, or is for.

Money is fundamentally a means of making deals with the future. Ian asked recently, what is “capital” and gave an answer that focused attention on the ability of money to mobilize resources for production, which is fine as far as it goes, but leaves a bit murky the relation of money and money finance to capital. Well, here it is: capital is a private form for mobilizing resources by making credible conditional and unconditional promises in the face of uncertainty.

Credible promises. That is the main trick that money pulls off to create the power of private capital to mobilize resources into sunk cost investments. It is not the only trick. Custom and property rights have to be available as tools of business strategy to create a means of extracting economic rents from the use of those sunk cost investments, too. The latter is about political power and law, not money per se. It should be noted that society as a whole is often better off in the long run if public power is used to mobilize resources into sunk cost investments and taxes used to recover a return. But, the reverse is also proven true: private capital can be better at the task of resolving uncertainty into business innovation in some cases.

Investment in future productive capability is so routine in modern, developed economies that we can overlook how miraculous a task of social organization it is, as well as the exact roles institutions of money and money finance play in pulling it off. Money enables calculation, for example. And, hedging.

Anyway, I think MMT sadly neglects the importance of public debt in stabilizing the unit of account and interest rates over time.

It leaves MMT unable to say much that is enlightening about the present crisis, which centers on flows into vast pools of public and private debt demanding service that may not be possible to fund, but which flows are relied on to support routine rates of business trade and activity.

marku52

GrimJim, thanks for the info on late Rome. I had thought that inability to tax the elites was a major problem.

Creigh Gordon

Inability to effectively tax the rich is definitely a problem if the rich control all the resources.