This has been coming for a long time. I grew up in BC, used to work as deckhand for an uncle on his salmon troller occasionally. Even back in the 80s it was obvious stocks were in massive decline. Friend of another Uncle is a marine biologist, in his 60s, he says he expects to see the effective end of BC salmon in his lifetime.

A MYSTERIOUS decline in the numbers of spawning salmon has become one of the rites of autumn in British Columbia, bringing worries of financial and job losses, threats of extinction and a perplexing lack of answers. This season only 1.7m of the 10.4m sockeye salmon that were forecast to return to the Fraser river in fact made it—a 50-year low

The response? Another inquiry…

That prompted Stephen Harper, Canada’s prime minister, to ask Bruce Cohen, a justice of British Columbia’s Supreme Court, to hold an inquiry into the causes of the sockeye’s decline. Applause was muted. Four other federal inquiries held over the past three decades have failed to halt the decline.

The economist then goes on to suggest overfishing, destruction of spawning habitat, “first nation” overfishing, parasites from farm fish, and climate change. The answer, of course, is probably “all of the above”.

I remember the period prior to the collapse and essential extinction of the cod fishery off the east coast of Canada, the Grand Banks. Commission after commission, study after study, and nothing was done. In large part because in order to stop it would have required unilaterally extending territorial waters and stopping both Canadians and Europeans from overfishing (ideally Americans too, but that wouldn’t be possible due to disparity of armed forces). The Feds weren’t willing to do that, since it would have caused a huge diplomatic snafu and might have even caused a war and they were willing to trade away the fish stocks for good relations with Europe and America.

Same thing will happen out West. No one will do what is necessary, and the fishery will be destroyed. And the same thing will happen to all major commercial fishing stocks in the world, as we continue to overfish all of them and destroy the habitat of all of them. The only solution would be to create an armed navy whose job is to enforce internationally declared fishing limits, and enforce various environmental laws, such as not allowing dragnet ships which pick up everything on the sea bottom, destroying the ecosystem. Ships found engaging in such activities would be impounded.

But, of course, that’s not going to happen. So enjoy fish while you can. Within most of our lifetimes the only fish most of us will be able to eat will be parasite ridden farm fish. The rest will be gone, and the seas will be dead.

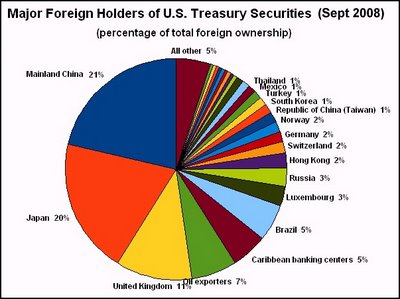

Barack Obama came back from China and immediately announced that he was worried that about high deficits causing a double dip recession. Notice the chronology. Trip to China: announcement that deficits are a problem. In other words, the Chinese told him to get the US deficit under control, or else, and he responded.

Barack Obama came back from China and immediately announced that he was worried that about high deficits causing a double dip recession. Notice the chronology. Trip to China: announcement that deficits are a problem. In other words, the Chinese told him to get the US deficit under control, or else, and he responded.