So, Janet Yellen has been replaced as Fed chair.

Her reign was meaningless, she just kept the trends moving as they were, and was essentially no help to ordinary Americans. Yes, she kept interest rates low, but that meant little; all that money flooded into corporate bank accounts.

I don’t want to slam Yellen particularly hard. The person who was in place at the time when a real change could have easily been made was Bernanke, and he decided to bail out rich people and let ordinary people sink. He is responsible, with Bush, Obama, and Geithner, for the continued decline and stagnation of the US economy, and for the damage to much of the world’s economy.

If Bernanke had done nothing but allow banks to go bankrupt and the government to take them over, with appropriate support, we would be in far better shape now, though the couple years after the financial crisis would have been worse.

Yellen? Yellen is a drone. She had no idea what to do, so she froze for years in the headlights.

The results of the work I do, like this article, are free, but food isn’t, so if you value my work, please DONATE or SUBSCRIBE.

Cirze

Ian,

Thanks for all you do for us.

I continue to grieve at your lack of a Twitter link.

Adams

Geithner. By either spelling a true scumbag and worthy successor to Paulson. He went on The News Hour for a softball interview with Lehrer in 2009 and said that everything they were doing was to help and support Main Street, not Wall Street. Made my skin crawl.

No fan of Yellen either, but you’re being a bit hard on her. She resisted recurrent, vociferous calls for rate hikes based on the continuous (but always wrong) drumbeat warning of incipient inflation. In other words, doing nothing wasn’t necessarily easy.

Stirling Newberry

She did minors things… but not majors things. On the plus side, we now know what would happen in John Nance Gardner rather the FDR had been elected president… the Depression would have been slower.

Notorious P.A.T.

Ah yes, Tim “Foam the Runways” Geithner.

http://wallstreetonparade.com/2012/08/how-treasury-secretary-geithner-foamed-the-runways-with-childrens-shattered-lives/

realitychecker

Drones don’t freeze in the headlights, Ian. Deer do.

Personally, I always found her to be more like an owl.

But it was reassuring to have a Fed head that reliably started every sentence with “So, . . .” 🙂

Ten Bears

Owls can be pretty vicious creatures. Like cats, they play with their food.

Hugh

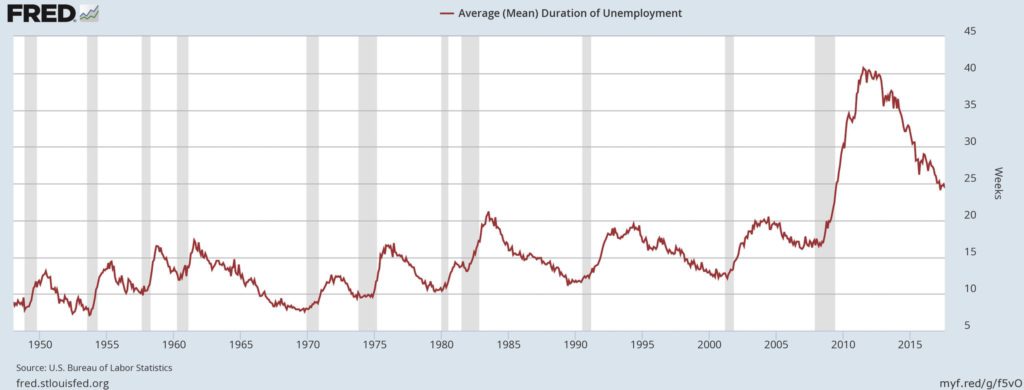

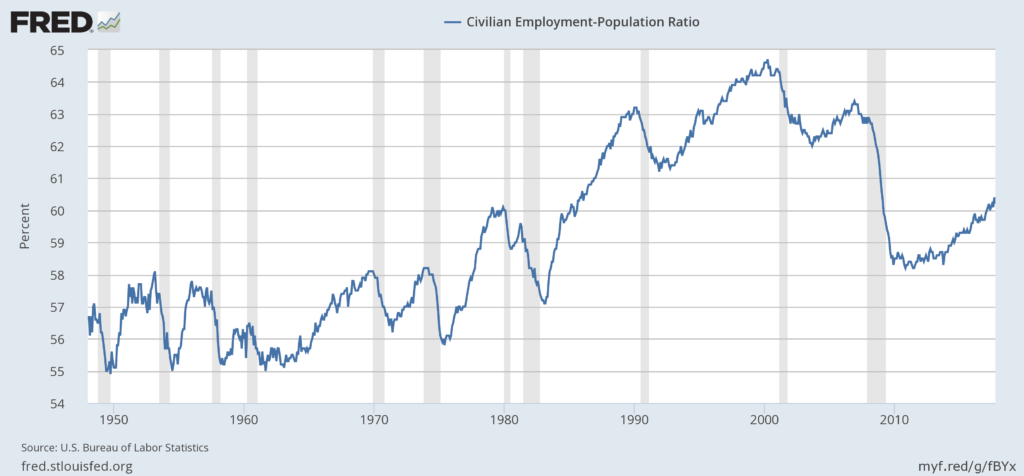

The jobs report for October is out from the BLS. Interestingly, Yellen became Fed chair in 2014, and 2014 is also the post-meltdown year I use as a benchmark because it was the last year where we saw halfway decent job creation in the private sector.

For those interested, the economy produced 603,000 jobs last month seasonally unadjusted. This is actually a good number and may represent a rebound from last month’s hurricane-influenced figures. It means year to date 4.168 million jobs have been created in the private sector. However, as I said last month, the Trump bounce is gone, and this new post-hurricane bounce is still below the 4.204 million jobs created last year to this point and almost 600,000 fewer than the 4.750 million of 2014.

There is a similar story when we look at total nonfarm jobs, i.e. both public and private jobs together. 1.042 million in October, a good number historically, but year to date (Jan.-Oct.), 2017’s 4.733 million is 150,000 fewer than 2016 (4.881 million), and 600,000 fewer than 2014 (5.378 million).

And as I always point out, the unemployment rate, which comes from a different, and smaller, survey than the above is largely meaningless. It is based on a job seeker model and not the common sense one of without a job but would work if decent jobs were available.

One final note, retail continues to suck. This is important going into the big Christmas holiday season. October’s 136,700 is somewhat anemic, but year to date the economy actually lost 7,300 retail jobs, where in other years we might have expected an increase to this point of 250,000-300,000 jobs.

Back to Yellen, as I recall, the Fed continues to carry some $4 trillion in mortgage backed securities, and at Yellen’s current trim rate of $4 billion a month, it would take more than 80 years to eliminate it. This along with maintaining low lending rates has kept the bubble in stock markets juiced. Well, that and the expectation of big Trump tax cuts for the rich and corporations.

wendy davis

heh, yes. ‘too big to fail’ may have been the propaganda meme of the time.

also, i know it’s off-topic, but this disappointed me as much as it seems to have disappointed yves smith, as i’d considered dayen the go-to guy on mortgage issues, including the sub-prime fukkery. i thought folks here might want to know, read, even decide for themselves, although it’s very, very long.

“Yves here. We regret the need to publish a detailed analysis of a pair of articles appearing in the current issue of The Nation. They are so fundamentally wrongheaded as to require retraction or a major rewrite, not just in their details but in their thesis: that small-scale mortgage vulture, Larry Schneider, is a hero for taking on JP Morgan Chase (Chase) over some mortgages that Chase forgave.

Yes, you have that right. The Nation and its author, David Dayen, attack Chase for tearing up mortgages and try to depict a hedge fund manager as a saint for fighting the write-offs so he could milk more money from deeply distressed borrowers.

Michael Olenick, the author of the article below, is an expert on mortgages who has done extensive work on foreclosure abuses. Olenick wrote The Nation twice, urging them to retract or do a fundamental rewrite of both pieces. The Nation did not at once respond. It instead forwarded Olenick’s email immediately to Dayen, whose response to Olenick arrived within hours. Olenick and we reviewed Dayen’s comments which in our opinion only strengthen the case for a retraction.”

https://www.nakedcapitalism.com/2017/11/nation-depicts-mortgage-vulture-foreclosed-homeowners-fdr-like-hero-demonize-chase-actually-helping-homeowners.html

Billikin

Yeah, the Fed could have taken the tack of Herbert Hoover’s Treasury Secretary, Andrew Mellon, to “liquidate labor, liquidate stocks, liquidate farmers, liquidate real estate… it will purge the rottenness out of the system.” That would have helped, bigly.

The main culprit of our lesser depression is Congress, which controls the purse strings. It was Congress that bailed out Big Finance and Wall Street and screwed Main Street. I expect that Obama could have gotten a sufficient stimulus through Congress in 2009. He certainly had the political wind at his back. But, for unknown reasons, he embraced austerity. Without Congressional action, the Fed could do little of a positive nature. It may have been able to crash the system, but who had the stomach for that?

Hugh

The Fed had more than $24 trillion flow through its emergency programs. We don’t know how much went through the regular ones. No audit was ever done of them. Pretty much all of this went to bailout the rich. All this dwarfs what Congress did by a couple orders of magnitude.

Peter

@Hugh

Weren’t these funds loaned through the Fed discount window to create liquidity and then repaid by everyone but AIG? The money was loaned to the institutions here and abroad not given to the rich people who work there.

Some collectivists still seem to believe it would have been a good idea and example to allow these banks to collapse so the FDIC could pick up the rubbish left behind. If you are going to nationalize banks it would probably be wise to target prosperous institutions not failed bankrupt skeletons.

Billikin

@Hugh

How much money could the Fed have lent to poor people, the unemployed, or small businesses? AFAICT, they legally could have bought municipal bonds, but otherwise there was nothing that they were authorized to do. The Fed is only quasi-independent. Congress is in control.

Stirling Newberry

I spoke with some economist the other day – they really want me to apply for a Ph.D. , not going to happen, but that is not relevant – but one paper that they were showing me gave me an idea.

the paper was on the subject of opioid addiction, and it pointed out that drastic Opioid restrictions did not help. but what is interesting is that the option of legalizing marijuana was not on the table – even though this option has been tried in a few states. The reason is that legalization of marijuana will not happen, and cannot be introduced in many states.

Which made me go back and work on an idea that this suggests: this is a world where the profits are vacuumed upwards to the rich – this actually is an economic idea, and I have worked out how – but one of the cardinal principles is to make it illegal some contrapositive solutions – such as legalizing marijuana. not because of the solution, But if one looks at the whole structure, one sees that these contrapositive solutions cannot be allowed to happen until such time as they are benefiting the uber-program of making people work for someone else’s profit.

Why this is important, is because such contrapositive solutions mean that the cycle is broken – and we cannot have that. That it is in the numbers themselves speaks volumes. we are living in a world where we have to make people unhappy to continue to make the wrong people rich. Many people instinctively feel this, but they do not have the proof.

Ten Bears

We have to stop doing what we are doing. It isn’t working.

bob mcmanus

The best indicator of the Yellen regime is that Trump had to be talked out of reappointing her.

Willy

I’ve been trying to get the idea out to partisans that those with a rent-seeking mindset will use politicians from either party for self-serving mandates or lack of enforcement, knowing the angsty partisan citizen will mindlessly keep its focus the other team, instead of on the disease itself.

realitychecker

@ Peter

“Some collectivists still seem to believe it would have been a good idea and example to allow these banks to collapse so the FDIC could pick up the rubbish left behind.”

It’s not really a “collectivist” idea that under capitalism the failures should fail.

How many basic tenets should we ignore before we stop calling it “capitalism,” in your opinion?

Peter

@RC

I don’t think you are one of the commies I was addressing but possibly a social justice capitalist, a defendable position. I’ve never seen a capitalist manifesto or good capitalist rulebook that states any such basic tenent about manditory hands-off failure.

The Fed did seem to take that position from 1930 to 1933 and allowed thousands of banks to fail which helped send the US and the world into a great depression. The TBTF banks we have now are a much bigger component of our economy than those banks were at that time. There are good reasons to think that our great recession could have been much worse without intervention, it was bad enough with this intervention.

The vampire squid personalities are certainly not attractive but they did get the financial intermediation that was needed back on track supplying the funds for new mortgages, bond sales and all the other nasty business they handle.

highrpm

jeff bezos for president, 2020. the money supply chain can’t be anymore complex than the amazon products supply chain.

BlizzardOfOz

So Trump nominated the first goy Fed chairman in over three decades. For those looking for a smoking gun of Trump’s anti-Semitism, you have it.

Hugh

Bagehot came up with the principle that in downturns credit should be made available but at high rates to punish and discourage the bad behavior which created the downturn. The Greenspan and Bernanke puts essentially negated Bagehot’s principle. Keeping interest rates low in the regular programs, allowing investment banks like Goldman and Morgan Stanley access to the discount window like regular commercial banks, and the emergency Fed programs all allowed the rich and corps to both liquidate their bad positions at very low costs to them and to support the prices of the underlying assets. All this cost the rest of us three to four times what it would have cost to directly bail out the $5 trillion or so owed by homeowners. And in return, the Fed which is the primary regulator of banks gave the whole financial industry a pass. What this amounted to was a vast transfer in wealth. Ordinary Americans were allowed to lose their shirts, their homes, their 401ks, etc., the rich, the corps, the banks were made whole, and more, pumping trillions into an ongoing stock bubble.

As for the scope of the Fed’s powers, the AIG bailout was completely outside its purview, and Bernanke did it without a blink. Ditto, the declaration that Goldman and MS were “commercial” banks. The Fed had a whole slew of huge emergency programs. If the Fed had wanted to, it could have provided funds to banks on the condition they would be used to directly support homeowners. They didn’t.

Peter

@H

How can you help people who can’t pay their mortgage by offering them more debt? These people needed more income not more debt and any gift would be sending good money after bad debt. The HAMP did provide funds so that short sales could be made without the borrowers being liable for the difference between the short sale price and the loan amount. The lenders took a loss but a smaler loss with this assistance.

The other bailout idea of forgiving the old mortgages and writing new loans at the deflated value of these homes is unfair and possibly immoral when the person next door paid their mortgage and lived with an underwater mortgage for years and couldn’t qualify for help.

If some of these people had been helped with new smaller mortgages and payments with no liability and they lived in the areas where home prices have now recovered I think what’s called moral hazard might be apparent. These people would have a huge windfall increase in their equity while their unlucky neighbors would just be back to break even on their loans.

Billikin

“How can you help people who can’t pay their mortgage by offering them more debt?”

You buy their mortgage and renegotiate. Like local Savings and Loans used to do, since they would have been hard hit if their community had a lot of foreclosures. All it would have taken was legislation authorizing it.

Hugh

Re Billikin, exactly. This was done during the Depression with the HOLC via an act of Congress. Looking at the vast bailout programs the Fed ran after the 2008 meltdown, there is no reason to think it could not have set up something similar, if those there had wanted to.